Page 233 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 233

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – TIS

NUMBER OF EMPLOYEES: 23 347

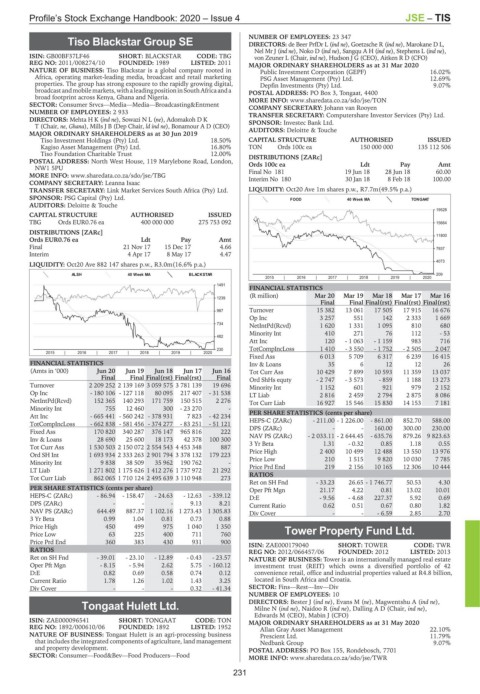

Tiso Blackstar Group SE DIRECTORS: de Beer PrfDr L (ind ne), Goetzsche R (ind ne), Marokane D L,

TIS Nel Mr J (ind ne), NokoD(ind ne), Sangqu A H (ind ne), Stephens L (ind ne),

ISIN: GB00BF37LF46 SHORT: BLACKSTAR CODE: TBG von Zeuner L (Chair, ind ne), Hudson J G (CEO), Aitken R D (CFO)

REG NO: 2011/008274/10 FOUNDED: 1989 LISTED: 2011 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

NATURE OF BUSINESS: Tiso Blackstar is a global company rooted in Public Investment Corporation (GEPF) 16.02%

Africa, operating market-leading media, broadcast and retail marketing PSG Asset Management (Pty) Ltd. 12.69%

properties. The group has strong exposure to the rapidly growing digital, Depfin Investments (Pty) Ltd. 9.07%

broadcastandmobile markets,withaleadingpositioninSouthAfricaanda POSTAL ADDRESS: PO Box 3, Tongaat, 4400

broad footprint across Kenya, Ghana and Nigeria. MORE INFO: www.sharedata.co.za/sdo/jse/TON

SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment COMPANY SECRETARY: Johann van Rooyen

NUMBER OF EMPLOYEES: 2 933 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Mehta H K (ind ne), Sowazi N L (ne), Adomakoh D K SPONSOR: Investec Bank Ltd.

T(Chair, ne, Ghana), Mills J B (Dep Chair, ld ind ne), Bonamour A D (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 AUDITORS: Deloitte & Touche

Tiso Investment Holdings (Pty) Ltd. 18.50% CAPITAL STRUCTURE AUTHORISED ISSUED

Kagiso Asset Management (Pty) Ltd. 16.80% TON Ords 100c ea 150 000 000 135 112 506

Tiso Foundation Charitable Trust 12.00% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: North West House, 119 Marylebone Road, London, Ords 100c ea Ldt Pay Amt

NW1 5PU

60.00

MORE INFO: www.sharedata.co.za/sdo/jse/TBG Final No 181 19 Jun 18 28 Jun 18 100.00

Interim No 180

8 Feb 18

30 Jan 18

COMPANY SECRETARY: Leanna Isaac

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. LIQUIDITY: Oct20 Ave 1m shares p.w., R7.7m(49.5% p.a.)

SPONSOR: PSG Capital (Pty) Ltd. FOOD 40 Week MA TONGAAT

AUDITORS: Deloitte & Touche

19528

CAPITAL STRUCTURE AUTHORISED ISSUED

TBG Ords EUR0.76 ea 400 000 000 275 753 092 15664

DISTRIBUTIONS [ZARc]

Ords EUR0.76 ea Ldt Pay Amt 11800

Final 21 Nov 17 15 Dec 17 4.66 7937

Interim 4 Apr 17 8 May 17 4.47

4073

LIQUIDITY: Oct20 Ave 882 147 shares p.w., R3.0m(16.6% p.a.)

ALSH 40 Week MA BLACKSTAR 209

2015 | 2016 | 2017 | 2018 | 2019 | 2020

1491

FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

1239

Final Final Final(rst) Final(rst) Final(rst)

987 Turnover 15 382 13 061 17 505 17 915 16 676

Op Inc 3 257 551 142 2 333 1 669

734 NetIntPd(Rcvd) 1 620 1 331 1 095 810 680

Minority Int 410 271 76 112 - 53

482

Att Inc 120 - 1 063 - 1 159 983 716

230 TotCompIncLoss 1 410 - 3 550 - 1 752 - 2 505 2 047

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Fixed Ass 6 013 5 709 6 317 6 239 16 415

FINANCIAL STATISTICS Inv & Loans 35 6 12 12 26

(Amts in ‘000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Tot Curr Ass 10 429 7 899 10 593 11 359 13 037

Final Final Final(rst) Final(rst) Final Ord ShHs equty - 2 747 - 3 573 - 859 1 188 13 273

Turnover 2 209 252 2 139 169 3 059 575 3 781 139 19 696 Minority Int 1 152 601 921 979 2 152

Op Inc - 180 106 - 127 118 80 095 217 407 - 31 538 LT Liab 2 816 2 459 2 794 2 875 8 086

NetIntPd(Rcvd) 152 365 140 293 171 759 150 515 2 276 Tot Curr Liab 16 927 15 546 15 830 14 153 7 181

Minority Int 755 12 460 300 - 23 270 - PER SHARE STATISTICS (cents per share)

Att Inc - 665 441 - 560 242 - 378 931 7 823 - 42 234

TotCompIncLoss - 662 838 - 581 456 - 374 277 - 83 251 - 51 121 HEPS-C (ZARc) - 211.00 - 1 226.00 - - 861.00 852.70 588.00

160.00

230.00

300.00

DPS (ZARc)

-

Fixed Ass 170 820 340 287 376 147 965 816 222

Inv & Loans 28 690 25 600 18 173 42 378 100 300 NAV PS (ZARc) - 2 033.11 - 2 644.45 - 635.76 879.26 9 823.63

0.85

1.18

0.55

1.31

3 Yr Beta

- 0.32

Tot Curr Ass 1 530 503 2 150 072 2 554 543 4 453 348 887

Price High 2 400 10 499 12 488 13 550 13 976

Ord SH Int 1 693 934 2 333 263 2 901 794 3 378 132 179 223

9 820

7 785

Minority Int 9 838 38 509 35 962 190 762 - Price Low 210 1 515 10 165 10 030 10 444

12 306

Price Prd End

2 156

219

LT Liab 1 271 802 1 175 626 1 412 276 1 737 972 21 292

Tot Curr Liab 862 065 1 710 124 2 495 639 3 110 948 273 RATIOS

Ret on SH Fnd - 33.23 26.65 - 1 746.77 50.53 4.30

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 21.17 4.22 0.81 13.02 10.01

HEPS-C (ZARc) - 86.94 - 158.47 - 24.63 - 12.63 - 339.12 D:E - 9.56 - 4.68 227.37 5.92 0.69

DPS (ZARc) - - - 9.13 8.21 Current Ratio 0.62 0.51 0.67 0.80 1.82

NAV PS (ZARc) 644.49 887.37 1 102.16 1 273.43 1 305.83 Div Cover - - - 6.59 2.85 2.70

3 Yr Beta 0.99 1.04 0.81 0.73 0.88

Price High 450 499 975 1 040 1 350

Price Low 63 225 400 711 760 Tower Property Fund Ltd.

Price Prd End 360 383 430 931 900 ISIN: ZAE000179040 SHORT: TOWER CODE: TWR

TOW

RATIOS REG NO: 2012/066457/06 FOUNDED: 2012 LISTED: 2013

Ret on SH Fnd - 39.01 - 23.10 - 12.89 - 0.43 - 23.57 NATURE OF BUSINESS: Tower is an internationally managed real estate

Oper Pft Mgn - 8.15 - 5.94 2.62 5.75 - 160.12 investment trust (REIT) which owns a diversified portfolio of 42

D:E 0.82 0.69 0.58 0.74 0.12 convenience retail, office and industrial properties valued at R4.8 billion,

Current Ratio 1.78 1.26 1.02 1.43 3.25 located in South Africa and Croatia.

Div Cover - - - 0.32 - 41.34 SECTOR: Fins—Rest—Inv—Div

NUMBER OF EMPLOYEES: 10

Tongaat Hulett Ltd. DIRECTORS: Bester J (ind ne), Evans M (ne), Magwentshu A (ind ne),

Milne N (ind ne), Naidoo R (ind ne), Dalling A D (Chair, ind ne),

TON Edwards M (CEO), Mabin J (CFO)

ISIN: ZAE000096541 SHORT: TONGAAT CODE: TON MAJOR ORDINARY SHAREHOLDERS as at 31 May 2020

REG NO: 1892/000610/06 FOUNDED: 1892 LISTED: 1952 Allan Gray Asset Management 22.10%

NATURE OF BUSINESS: Tongaat Hulett is an agri-processing business Prescient Ltd. 11.79%

that includes the integrated components of agriculture, land management Nedbank Group 9.07%

and property development. POSTAL ADDRESS: PO Box 155, Rondebosch, 7701

SECTOR: Consumer—Food&Bev—Food Producers—Food MORE INFO: www.sharedata.co.za/sdo/jse/TWR

231