Page 241 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 241

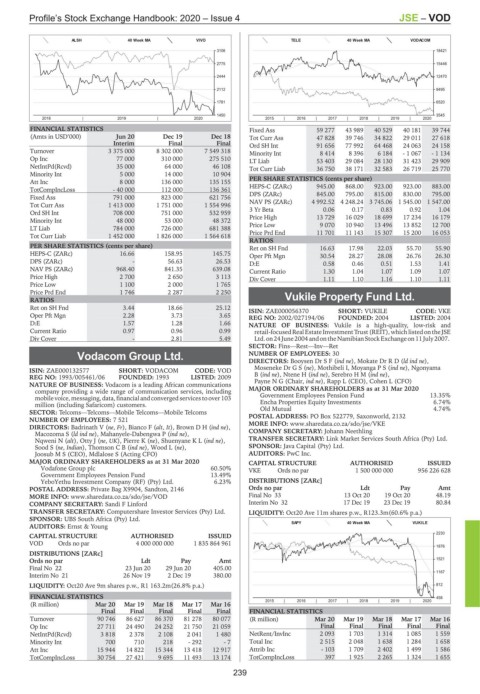

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – VOD

ALSH 40 Week MA VIVO TELE 40 Week MA VODACOM

3106 18421

2775 15446

2444 12470

2112 9495

1781 6520

1450 3545

2018 | 2019 | 2020 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS Fixed Ass 59 277 43 989 40 529 40 181 39 744

(Amts in USD’000) Jun 20 Dec 19 Dec 18 Tot Curr Ass 47 828 39 746 34 822 29 011 27 618

Interim Final Final Ord SH Int 91 656 77 992 64 468 24 063 24 158

Turnover 3 375 000 8 302 000 7 549 318 Minority Int 8 414 8 396 6 184 - 1 067 - 1 134

Op Inc 77 000 310 000 275 510 LT Liab 53 403 29 084 28 130 31 423 29 909

NetIntPd(Rcvd) 35 000 64 000 46 108 Tot Curr Liab 36 750 38 171 32 583 26 719 25 770

Minority Int 5 000 14 000 10 904 PER SHARE STATISTICS (cents per share)

Att Inc 8 000 136 000 135 155

TotCompIncLoss - 40 000 112 000 136 361 HEPS-C (ZARc) 945.00 868.00 923.00 923.00 883.00

Fixed Ass 791 000 823 000 621 756 DPS (ZARc) 845.00 795.00 815.00 830.00 795.00

Tot Curr Ass 1 413 000 1 751 000 1 554 996 NAV PS (ZARc) 4 992.52 4 248.24 3 745.06 1 545.00 1 547.00

0.17

0.92

1.04

0.83

0.06

Ord SH Int 708 000 751 000 532 959 3 Yr Beta 13 729 16 029 18 699 17 234 16 179

Price High

Minority Int 48 000 53 000 48 372

9 070

LT Liab 784 000 726 000 681 388 Price Low 11 701 10 940 13 496 13 852 12 700

Price Prd End

16 053

15 307

11 143

15 200

Tot Curr Liab 1 452 000 1 826 000 1 564 618

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 16.63 17.98 22.03 55.70 55.90

HEPS-C (ZARc) 16.66 158.95 145.75

Oper Pft Mgn 30.54 28.27 28.08 26.76 26.30

DPS (ZARc) - 56.63 26.53 D:E 0.58 0.46 0.51 1.53 1.41

NAV PS (ZARc) 968.40 841.35 639.08 Current Ratio 1.30 1.04 1.07 1.09 1.07

Price High 2 700 2 650 3 113 Div Cover 1.11 1.10 1.16 1.10 1.11

Price Low 1 100 2 000 1 765

Price Prd End 1 746 2 287 2 250

RATIOS Vukile Property Fund Ltd.

Ret on SH Fnd 3.44 18.66 25.12 ISIN: ZAE000056370 SHORT: VUKILE CODE: VKE

VUK

Oper Pft Mgn 2.28 3.73 3.65 REG NO: 2002/027194/06 FOUNDED: 2004 LISTED: 2004

D:E 1.57 1.28 1.66 NATURE OF BUSINESS: Vukile is a high-quality, low-risk and

Current Ratio 0.97 0.96 0.99 retail-focusedRealEstateInvestmentTrust(REIT),which listedonthe JSE

Div Cover - 2.81 5.49 Ltd.on24June2004 andontheNamibianStockExchangeon11July2007.

SECTOR: Fins—Rest—Inv—Ret

Vodacom Group Ltd. NUMBER OF EMPLOYEES: 30

DIRECTORS: Booysen DrSF(ind ne), Mokate DrRD(ld ind ne),

VOD Moseneke DrGS(ne), Mothibeli I, MoyangaPS(ind ne), Ngonyama

ISIN: ZAE000132577 SHORT: VODACOM CODE: VOD

REG NO: 1993/005461/06 FOUNDED: 1993 LISTED: 2009 B(ind ne), Ntene H (ind ne), SerebroHM(ind ne),

Payne N G (Chair, ind ne), Rapp L (CEO), Cohen L (CFO)

NATURE OF BUSINESS: Vodacom is a leading African communications MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

company providing a wide range of communication services, including

mobile voice, messaging, data,financialandconvergedservices toover103 Government Employees Pension Fund 13.35%

million (including Safaricom) customers. Encha Properties Equity Investments 6.74%

SECTOR: Telcoms—Telcoms—Mobile Telcoms—Mobile Telcoms Old Mutual 4.74%

NUMBER OF EMPLOYEES: 7 521 POSTAL ADDRESS: PO Box 522779, Saxonworld, 2132

DIRECTORS: Badrinath V (ne, Fr), Bianco F (alt, It), BrownDH(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/VKE

Macozoma S (ld ind ne), Mahanyele-Dabengwa P (ind ne), COMPANY SECRETARY: Johann Neethling

Nqweni N (alt), Otty J (ne, UK), Pierre K (ne), ShuenyaneKL(ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Sood S (ne, Indian), ThomsonCB(ind ne), Wood L (ne), SPONSOR: Java Capital (Pty) Ltd.

Joosub M S (CEO), Mdlalose S (Acting CFO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Vodafone Group plc 60.50% VKE Ords no par 1 500 000 000 956 226 628

Government Employees Pension Fund 13.49%

YeboYethu Investment Company (RF) (Pty) Ltd. 6.23% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: Private Bag X9904, Sandton, 2146 Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/VOD Final No 33 13 Oct 20 19 Oct 20 48.19

COMPANY SECRETARY: Sandi F Linford Interim No 32 17 Dec 19 23 Dec 19 80.84

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct20 Ave 11m shares p.w., R123.3m(60.6% p.a.)

SPONSOR: UBS South Africa (Pty) Ltd.

SAPY 40 Week MA VUKILE

AUDITORS: Ernst & Young

2230

CAPITAL STRUCTURE AUTHORISED ISSUED

VOD Ords no par 4 000 000 000 1 835 864 961

1876

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 1521

Final No 22 23 Jun 20 29 Jun 20 405.00

1167

Interim No 21 26 Nov 19 2 Dec 19 380.00

LIQUIDITY: Oct20 Ave 9m shares p.w., R1 163.2m(26.8% p.a.) 812

FINANCIAL STATISTICS 458

2015 | 2016 | 2017 | 2018 | 2019 | 2020

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final Final Final Final FINANCIAL STATISTICS

Turnover 90 746 86 627 86 370 81 278 80 077 (R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Op Inc 27 711 24 490 24 252 21 750 21 059 Final Final Final Final Final

NetIntPd(Rcvd) 3 818 2 378 2 108 2 041 1 480 NetRent/InvInc 2 093 1 703 1 314 1 085 1 559

Minority Int 700 710 218 - 292 - 7 Total Inc 2 515 2 048 1 638 1 284 1 658

Att Inc 15 944 14 822 15 344 13 418 12 917 Attrib Inc - 103 1 709 2 402 1 499 1 586

TotCompIncLoss 30 754 27 421 9 695 11 493 13 174 TotCompIncLoss 397 1 925 2 265 1 324 1 655

239