Page 239 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 239

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – TSO

Tsogo Sun Hotels Ltd. Unicorn Capital Partners Ltd.

UNI

ISIN: ZAE000244745 SHORT: UNICORN CODE: UCP

TSO

REG NO: 1992/001973/06 FOUNDED: 1972 LISTED: 1993

NATURE OF BUSINESS: The Group is actively involved in the provision of

contracted opencast mining, overburden drilling and blasting, mobile

crane hire and exploration drilling services to the mining sector.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

NUMBER OF EMPLOYEES: 1 253

DIRECTORS: de Bruyn T (ne), Gama Dr M (ind ne), NaudéSP(ind ne),

Zihlangu D (ne), Patmore R B (Chair, ind ne), Badenhorst J (CEO),

Wolmarans C (Acting CFO)

ISIN: ZAE000272522 SHORT: THL CODE: TGO MAJOR ORDINARY SHAREHOLDERS as at 03 Dec 2019

REG NO: 2002/006356/06 FOUNDED: 1969 LISTED: 2019 JB Private Equity Investors Partner 37.38%

NATURE OF BUSINESS: Tsogo Sun Hotels is the leading hospitality Afrimat Ltd. 27.27%

company in southern Africa. Combining an established 50-year heritage Calibre Investment Holdings (Pty) Ltd. 6.39%

with a professional and energised approach, the group proudly

encompassesover 100 hotels offering 19 000 hotel rooms across all sectors POSTAL ADDRESS: PO Box 76, Woodmead, 2080

of the market – from Luxury to Budget hotels – in South Africa, Nigeria, MORE INFO: www.sharedata.co.za/sdo/jse/UCP

Tanzania, Zambia, Mozambique, the United Arab Emirates and the COMPANY SECRETARY: Light Consulting (Pty) Ltd.

Seychelles. With a vision to provide quality hospitality and leisure TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

experiences at every one of our hotels, the group operates a superb range of SPONSOR: Questco Corporate Advisory (Pty) Ltd.

restaurants and bars and conference and banqueting venues catering for

every possible eventing need. AUDITORS: BDO South Africa Inc.

Overthe lastfive decades,TsogoSunHotelshasplayedanimportantrolein CAPITAL STRUCTURE AUTHORISED ISSUED

shaping the landscape of hotels, gaming and entertainment in South Africa UCP Ords 1c ea 2 000 000 000 1 167 564 491

and further afield.

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Hotels DISTRIBUTIONS [ZARc]

NUMBER OF EMPLOYEES: 8 128 Ords 1c ea Ldt Pay Amt

DIRECTORS: AhmedMH(ld ind ne), GinaSC(ind ne), Final No 24 26 Sep 08 6 Oct 08 10.00

Molefi DrML(ind ne), NgcoboJG(ind ne), NicolellaJR(ne), Interim No 23 7 Dec 07 18 Dec 07 11.00

SeptemberCC(ind ne), Copelyn J A (Chair, ne),

von Aulock M N (CEO), McDonald L (CFO) LIQUIDITY: Oct20 Ave 10m shares p.w., R681 689.6(46.0% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 02 Sep 2020

TIHC Investments (RF) (Pty) Ltd. 39.20% METL 40 Week MA UNICORN

Allan Gray 16.24% 44

Hosken Consolidated Investments Ltd. 10.07%

POSTAL ADDRESS: Private Bag X200, Bryanston, 2021 36

WEBSITE: www.tsogosun.com

TELEPHONE: 011-510-7500

COMPANY SECRETARY: Southern Sun Secretarial Services (Pty) Ltd. 29

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 22

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc. 14

CAPITAL STRUCTURE AUTHORISED ISSUED

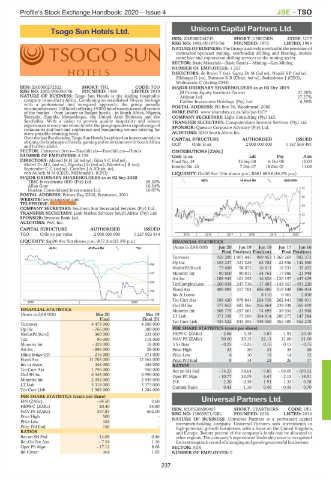

TGO Ords no par value 2 000 000 000 1 227 023 814 2015 | 2016 | 2017 | 2018 | 2019 | 2020 7

LIQUIDITY: Sep20 Ave 5m shares p.w., R17.3m(22.3% p.a.) FINANCIAL STATISTICS

ALSH 40 Week MA THL (Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final(rst) Final Final(rst)

Turnover 958 289 1 001 445 969 453 1 069 269 982 373

Op Inc - 103 237 321 325 62 702 - 22 936 - 142 550

386

NetIntPd(Rcvd) 73 680 58 075 16 811 18 533 35 652

323 Minority Int - 90 800 90 811 - 34 761 - 17 986 - 21 948

Att Inc - 108 943 161 292 16 826 - 120 197 - 447 429

259

TotCompIncLoss - 200 038 247 736 - 17 403 - 143 457 - 491 220

Fixed Ass 405 995 317 763 656 606 516 548 586 014

196

Inv & Loans - - 8 110 6 461 2 850

132 Tot Curr Ass 188 420 979 841 204 738 262 841 388 911

2019 | 2020

Ord SH Int 577 862 687 366 256 864 239 938 365 409

FINANCIAL STATISTICS Minority Int - 308 775 - 257 461 - 74 695 - 39 934 - 21 948

(Amts in ZAR’000) Mar 20 Mar 19 LT Liab 371 338 73 266 304 814 200 273 147 284

Final Final (P) Tot Curr Liab 435 522 843 395 448 058 455 389 552 218

Turnover 4 475 000 4 389 000

Op Inc - 766 000 380 000 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 360 000 231 000 HEPS-C (ZARc) - 2.86 - 3.18 3.87 - 1.93 - 20.10

Tax 96 000 118 000 NAV PS (ZARc) 50.00 59.15 22.11 21.00 31.00

Minority Int - 329 000 18 000 3 Yr Beta - 0.25 - 0.25 0.16 0.13 - 0.75

Att Inc - 896 000 28 000 Price High 23 30 34 35 26

Hline Erngs-CO 216 000 371 000 Price Low 4 10 18 14 12

Fixed Ass 11 703 000 12 565 000 Price Prd End 9 14 24 26 17

Inv in Assoc 446 000 488 000 RATIOS

Tot Curr Ass 1 796 000 950 000 Ret on SH Fnd - 74.23 58.64 - 9.85 - 69.09 - 109.33

Ord SH Int 6 343 000 6 990 000 Oper Pft Mgn - 10.77 32.09 6.47 - 2.15 - 14.51

Minority Int 2 352 000 2 939 000 D:E 2.20 0.38 1.91 1.33 0.78

LT Liab 5 318 000 3 373 000 Current Ratio 0.43 1.16 0.46 0.58 0.70

Tot Curr Liab 1 369 000 1 284 000

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 84.50 2.60 Universal Partners Ltd.

HEPS-C (ZARc) 20.40 34.80 ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL

UNI

NAV PS (ZARc) 597.83 662.00 REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016

Price High 500 - NATURE OF BUSINESS: Universal Partners is a permanent capital

Price Low 102 - investmentholding company. Universal Partners seek investments in

Price Prd End 158 - high-potential, growth businesses, with a focus on the United Kingdom,

RATIOS and Europe. Twenty percent of the company’s funds may be allocated to

Ret on SH Fnd - 14.09 0.46 other regions. The company’s experienced leadership team is recognised

Ret On Tot Ass - 7.54 1.16 foritsstrongtrackrecordofmanagingandgrowingsuccessfulbusinesses.

Oper Pft Mgn - 17.12 8.66 SECTOR: AltX

Int Cover n/a 1.65 NUMBER OF EMPLOYEES: 0

237