Page 242 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 242

JSE – VUN Profile’s Stock Exchange Handbook: 2020 – Issue 4

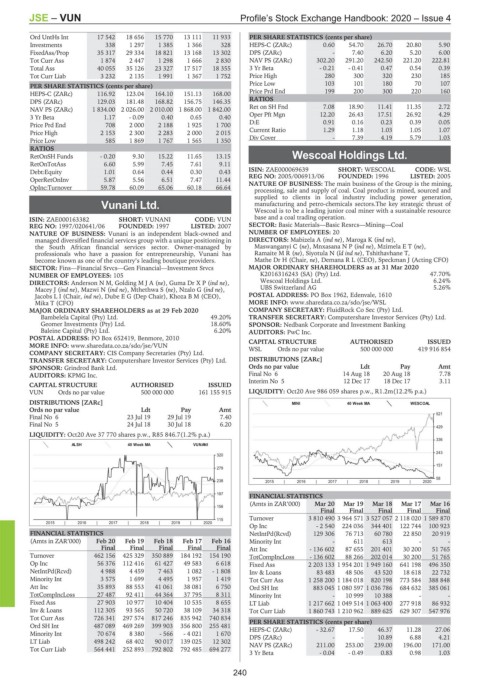

Ord UntHs Int 17 542 18 656 15 770 13 111 11 933 PER SHARE STATISTICS (cents per share)

Investments 338 1 297 1 385 1 366 328 HEPS-C (ZARc) 0.60 54.70 26.70 20.80 5.90

FixedAss/Prop 35 317 29 334 18 821 13 168 13 302 DPS (ZARc) - 7.40 6.20 5.20 6.00

Tot Curr Ass 1 874 2 447 1 298 1 666 2 830 NAV PS (ZARc) 302.20 291.20 242.50 221.20 222.81

Total Ass 40 055 35 126 23 327 17 517 18 355 3 Yr Beta - 0.21 - 0.41 0.47 0.54 0.39

Tot Curr Liab 3 232 2 135 1 991 1 367 1 752 Price High 280 300 320 230 185

PER SHARE STATISTICS (cents per share) Price Low 103 101 180 70 107

HEPS-C (ZARc) 116.92 123.04 164.10 151.13 168.00 Price Prd End 199 200 300 220 160

DPS (ZARc) 129.03 181.48 168.82 156.75 146.35 RATIOS

NAV PS (ZARc) 1 834.00 2 026.00 2 010.00 1 868.00 1 842.00 Ret on SH Fnd 7.08 18.90 11.41 11.35 2.72

3 Yr Beta 1.17 - 0.09 0.40 0.65 0.40 Oper Pft Mgn 12.20 26.43 17.51 26.92 4.29

Price Prd End 708 2 000 2 188 1 925 1 700 D:E 0.91 0.16 0.23 0.39 0.05

Price High 2 153 2 300 2 283 2 000 2 015 Current Ratio 1.29 1.18 1.03 1.05 1.07

Price Low 585 1 869 1 767 1 565 1 350 Div Cover - 7.39 4.19 5.79 1.03

RATIOS

RetOnSH Funds - 0.20 9.30 15.22 11.65 13.15 Wescoal Holdings Ltd.

RetOnTotAss 6.60 5.99 7.45 7.61 9.11 WES

Debt:Equity 1.01 0.64 0.44 0.30 0.43 ISIN: ZAE000069639 SHORT: WESCOAL CODE: WSL

OperRetOnInv 5.87 5.56 6.51 7.47 11.44 REG NO: 2005/006913/06 FOUNDED: 1996 LISTED: 2005

NATURE OF BUSINESS: The main business of the Group is the mining,

OpInc:Turnover 59.78 60.09 65.06 60.18 66.64 processing, sale and supply of coal. Coal product is mined, sourced and

supplied to clients in local industry including power generation,

Vunani Ltd. manufacturing and petro-chemicals sectors.The key strategic thrust of

Wescoal is to be a leading junior coal miner with a sustainable resource

VUN

ISIN: ZAE000163382 SHORT: VUNANI CODE: VUN base and a coal trading operation.

REG NO: 1997/020641/06 FOUNDED: 1997 LISTED: 2007 SECTOR: Basic Materials—Basic Resrcs—Mining—Coal

NATURE OF BUSINESS: Vunani is an independent black-owned and NUMBER OF EMPLOYEES: 20

managed diversified financial services group with a unique positioning in DIRECTORS: Mabizela A (ind ne), Maroga K (ind ne),

the South African financial services sector. Owner-managed by Maswanganyi C (ne), MnxasanaNP(ind ne), MzimelaET(ne),

professionals who have a passion for entrepreneurship, Vunani has RamaiteMR(ne), Siyotula N (ld ind ne), Tshithavhane T,

become known as one of the country’s leading boutique providers. Mathe Dr H (Chair, ne), Demana R L (CEO), Speckman J (Acting CFO)

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

NUMBER OF EMPLOYEES: 105 K2016316243 (SA) (Pty) Ltd. 47.70%

DIRECTORS: Anderson N M, GoldingMJA(ne), Guma DrXP(ind ne), Wescoal Holdings Ltd. 6.24%

Macey J (ind ne), Mazwi N (ind ne), Mthethwa S (ne), Nzalo G (ind ne), UBS Switzerland AG 5.26%

Jacobs L I (Chair, ind ne), Dube E G (Dep Chair), Khoza B M (CEO), POSTAL ADDRESS: PO Box 1962, Edenvale, 1610

Mika T (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/WSL

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

Bambelela Capital (Pty) Ltd. 49.20% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Geomer Investments (Pty) Ltd. 18.60% SPONSOR: Nedbank Corporate and Investment Banking

Baleine Capital (Pty) Ltd. 6.20% AUDITORS: PwC Inc.

POSTAL ADDRESS: PO Box 652419, Benmore, 2010 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/VUN WSL Ords no par value 500 000 000 419 916 854

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Grindrod Bank Ltd. Ords no par value Ldt Pay Amt

AUDITORS: KPMG Inc. Final No 6 14 Aug 18 20 Aug 18 7.78

Interim No 5 12 Dec 17 18 Dec 17 3.11

CAPITAL STRUCTURE AUTHORISED ISSUED

VUN Ords no par value 500 000 000 161 155 915 LIQUIDITY: Oct20 Ave 986 059 shares p.w., R1.2m(12.2% p.a.)

DISTRIBUTIONS [ZARc] MINI 40 Week MA WESCOAL

Ords no par value Ldt Pay Amt

Final No 6 23 Jul 19 29 Jul 19 7.40 521

Final No 5 24 Jul 18 30 Jul 18 6.20

429

LIQUIDITY: Oct20 Ave 37 770 shares p.w., R85 846.7(1.2% p.a.)

336

ALSH 40 Week MA VUNANI

243

320

151

279

58

238 2015 | 2016 | 2017 | 2018 | 2019 | 2020

197 FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

156

Final Final Final Final Final

115 Turnover 3 810 490 3 964 571 3 527 057 2 118 020 1 589 870

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Op Inc - 2 540 224 036 344 401 122 744 100 923

FINANCIAL STATISTICS NetIntPd(Rcvd) 129 306 76 713 60 780 22 850 20 919

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 Minority Int - 611 613 - -

Final Final Final Final Final Att Inc - 136 602 87 655 201 401 30 200 51 765

Turnover 462 156 425 329 350 889 184 192 154 190 TotCompIncLoss - 136 602 88 266 202 014 30 200 51 765

Op Inc 56 376 112 416 61 427 49 583 6 618 Fixed Ass 2 203 133 1 954 201 1 949 160 641 198 496 350

NetIntPd(Rcvd) 4 988 4 459 7 463 1 082 - 1 808 Inv & Loans 83 483 48 506 43 520 18 618 22 732

Minority Int 3 575 1 699 4 495 1 957 1 419 Tot Curr Ass 1 258 200 1 184 018 820 198 773 584 388 848

Att Inc 35 893 88 553 41 061 38 081 6 750 Ord SH Int 883 045 1 080 597 1 036 786 684 632 385 061

TotCompIncLoss 27 487 92 411 44 364 37 795 8 311 Minority Int - 10 999 10 388 - -

Fixed Ass 27 903 10 977 10 404 10 535 8 655 LT Liab 1 217 662 1 049 514 1 063 400 277 918 86 932

Inv & Loans 112 305 93 565 50 720 38 109 34 318 Tot Curr Liab 1 860 743 1 210 962 889 625 629 307 547 976

Tot Curr Ass 726 341 297 574 817 246 835 942 740 834 PER SHARE STATISTICS (cents per share)

Ord SH Int 487 089 469 269 399 903 356 800 255 481 HEPS-C (ZARc) - 32.67 17.50 46.37 11.28 27.06

Minority Int 70 674 8 380 - 566 - 4 021 1 670 DPS (ZARc) - - 10.89 6.88 4.21

LT Liab 498 242 68 402 90 017 139 025 12 302 NAV PS (ZARc) 211.00 253.00 239.00 196.00 171.00

Tot Curr Liab 564 441 252 893 792 802 792 485 694 277

3 Yr Beta - 0.04 - 0.49 0.83 0.98 1.03

240