Page 158 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 158

JSE – LEW Profile’s Stock Exchange Handbook: 2020 – Issue 4

NUMBER OF EMPLOYEES: 8 248

Lewis Group Ltd. DIRECTORS: Abrahams Prof F (ind ne),

LEW Bodasing A (ne), MotsepeDR(ind ne),

ISIN: ZAE000058236 NjikizanaTH(ind ne), Saven H (Chair, ind ne),

SHORT: LEWIS Westcott D (ind ne), Enslin J (CEO),

CODE: LEW Bestbier J (CFO)

REG NO: 2004/009817/06 POPULAR BRAND NAMES: Lewis, Best Home

FOUNDED: 1934 and Electric, Beares, UFO, Monarch Insurance

LISTED: 2004

POSTAL ADDRESS: PO Box 43, Woodstock, Cape

NATURE OF BUSINESS: Scan the QR code to Town, 7915

Lewis Group is a leading credit visit our website EMAIL: graeme@tier1ir.co.za

WEBSITE: www.lewisgroup.co.za

retailer of household furniture, TELEPHONE: 021-460-4400

electrical appliances and home FAX: 021-460-4662

electronics and has beenlisted on the JSE Ltd. since 2004 where it COMPANY SECRETARY: I N T Makomba

is classified under the General Retailers sector. TRANSFER SECRETARY: Computershare

Through the Lewis, Best Home and Electric, Beares and UFO Investor Services (Pty) Ltd.

brands, the group has a branch network of 794 stores. This SPONSOR: UBS South Africa (Pty) Ltd.

AUDITORS: PwC Inc.

includes stores across all major metropolitan areas as well as a BANKERS:AbsaBankLtd.,FirstNationalBankofAfricaLtd.,InvestecBank

strong presence in rural South Africa, with 125 stores in the Ltd., Nedbank Ltd., Standard Bank Ltd.

neighbouring southern African countries of Botswana,

Eswatini, Lesotho and Namibia. CALENDAR Expected Status

Lewis is the country’s largest furniture chain and one of the Annual General Meeting 23 Oct 2020 Unconfirmed

most recognisable brands in furniture retailing, focused Next Interim Results 25 Nov 2020 Unconfirmed

primarily on the growing middle to lower income market in Next Final Results May 2021 Unconfirmed

thelivingstandardsmeasurement(“LSM”)4to7categories. CAPITAL STRUCTURE AUTHORISED ISSUED

ThegrouphasexpandeditsofferingbeyondtheLewischainby LEW Ords 1c ea 150 000 000 79 212 225

developing the Best Home and Electric brand selling home ap- DISTRIBUTIONS [ZARc]

pliancesaswellasfurniturerangesintheLSM4to7category. Ords 1c ea Ldt Pay Amt

In 2014 the group embarked on a strategy of diversifying Final No 32 15 Sep 20 21 Sep 20 65.00

across income groups and market segments by acquiring the Interim No 31 21 Jan 20 27 Jan 20 120.00

long-establishedBeares brand. The Beares brand is focusedon Final No 30 16 Jul 19 22 Jul 19 129.00

the middle-income market in the LSM 7 to 9 category. Interim No 29 22 Jan 19 28 Jan 19 105.00

In 2018, the group acquired UFO as a continuation of the LIQUIDITY: Sep20 Ave 577 569 shares p.w., R14.5m(37.9% p.a.)

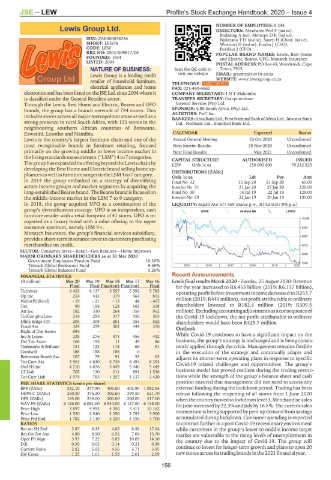

group’s diversification strategy. UFO is an independent, cash GERE 40 Week MA LEWIS

furniture retailer with a retail footprint of 41 stores. UFO is re-

10169

cognised as a luxury brand with a value offering to the upper

consumer spectrum, namely LSM 9+. 8383

Monarch Insurance, the group’s financial services subsidiary,

6597

provides short-term insurance cover to customers purchasing

merchandise on credit. 4812

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Home Improves

3026

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Government Employees Pension Fund 10.26%

Trimark Global Endeavour Fund 9.69% 2015 | 2016 | 2017 | 2018 | 2019 | 2020 1240

Trimark Global Balanced Fund 5.26%

FINANCIAL STATISTICS Recent Announcements

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 Lewis final results March 2020 - Tuesday, 25 August 2020: Revenue

Final Final Final(rst) Final(rst) Final for the year increased to R6.453 billion (2019: R6.137 billion),

Turnover 6 453 6 137 5 557 5 592 5 785 operating profit before investment income decreased to R253.7

Op Inc 254 443 379 564 815

NetIntPd(Rcvd) - 19 - 21 - 13 44 - 465 million (2019: R443 million), net profit attributable to ordinary

Tax 90 154 128 163 318 shareholders lowered to R182.4 million (2019: R309.5

Att Inc 182 310 264 358 962 million).Excludingaccountingadjustmentsasaconsequenceof

TotCompIncLoss 216 295 317 356 503 the Covid-19 lockdown, the net profit attributable to ordinary

Hline Erngs-CO 205 308 261 355 552 shareholders would have been R425.7 million

Fixed Ass 324 299 302 344 370 Outlook

Right of Use Assets 694 - - - -

Inv & Loans 228 276 471 456 432 While Covid-19 continues to have a significant impact on the

Def Tax Asset 166 195 11 49 86 business, the group’s strategy is unchanged and is being consis-

Trademarks&Software 121 122 118 66 61 tently applied through the crisis. Management remains flexible

Goodwill 188 188 188 6 - in the execution of the strategy and continually adapts and

Retirement Benefit Ass 107 79 91 55 63 adjusts its shorter-term operating plans in response to specific

Tot Curr Ass 5 561 4 630 5 736 6 494 8 393

Ord SH Int 4 710 4 876 5 449 5 440 5 449 Covid-19 related challenges and opportunities. The group’s

LT Liab 705 130 211 891 1 536 business model has proved resilient during the trading restric-

Tot Curr Liab 1 974 783 1 257 1 137 2 420 tions while the strength of the group’s balance sheet and cash

PER SHARE STATISTICS (cents per share) position ensured that management did not need to access any

EPS (ZARc) 232.10 377.50 306.80 402.90 1 082.64 external funding during the lockdown period. Trading has been

HEPS-C (ZARc) 260.20 376.20 302.60 399.50 621.70 robust following the reopening of all stores from 1 June 2020

DPS (ZARc) 185.00 234.00 200.00 200.00 517.00 when the country movedtolockdownlevel3. Merchandise sales

NAV PS (ZARc) 6 126.00 6 081.00 6 534.00 6 127.00 6 158.00 forJune increasedby 22.3% andJuly by 16.8%. The current sales

Price High 3 897 4 995 4 550 5 411 10 162

Price Low 1 520 2 540 2 250 2 795 3 900 momentum is being supported by pent up demand from savings

Price Prd End 1 782 3 110 4 220 4 150 4 700 accumulated during lockdown. Consumer spending is expected

RATIOS to contract further in a post Covid-19 recessionary environment

Ret on SH Fnd 3.87 6.35 4.85 6.58 17.64 while customers in the group’s lower to middle income target

Ret On Tot Ass 4.80 8.50 6.92 7.04 13.70 market are vulnerable to the rising levels of unemployment in

Oper Pft Mgn 3.93 7.22 6.83 10.09 14.10 the country due to the impact of Covid-19. The group will

D:E 0.35 0.03 0.14 0.21 0.39

Current Ratio 2.82 5.92 4.56 5.71 3.95 continue to invest for longer-term growth and plans to open 20

Div Cover 1.25 1.61 1.53 2.01 2.09 newstoresacrossitstradingbrandsinthe2021financialyear.

156