Page 162 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 162

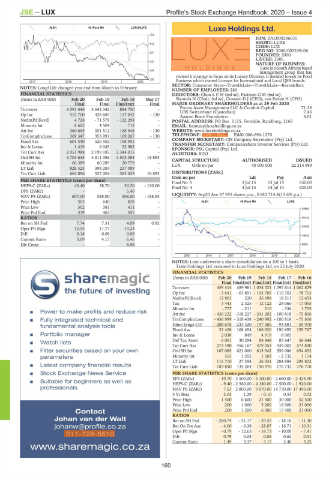

JSE – LUX Profile’s Stock Exchange Handbook: 2020 – Issue 4

Luxe Holdings Ltd.

ALSH 40 Week MA LONG4LIFE

702 LUX

ISIN: ZAE000286035

SHORT: LUXE

612

CODE: LUX

REG NO: 2000/002239/06

521

FOUNDED: 2000

LISTED: 2006

431

NATURE OF BUSINESS:

Luxe isa South Africanbased

340

management group that has

revised it strategy to focus on its Luxury Division. It decided to exit its Food

250 Business which owned licenses for International and Local QSR brands.

2017 | 2018 | 2019 | 2020

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Rests&Bars

NOTES: Long4Life changed year end from March to February.

NUMBER OF EMPLOYEES: 280

FINANCIAL STATISTICS DIRECTORS: ChouLCH(ind ne), PattisonGM(ind ne),

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Mar 17 Siyotula N (Chair, ind ne), Crosson D J (CEO), van Eeden H (CFO)

Final Final Final(rst) Final MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Turnover 4 091 446 3 642 342 884 750 - Protea Asset Management LLC & Conduit Capital 71.28

7.46

UBS Switzerland (Custodian)

Op Inc 512 700 428 685 117 042 - 130

Aaaron Beare Foundation 4.01

NetIntPd(Rcvd) 4 726 - 71 579 - 122 298 - POSTAL ADDRESS: PO Box 1125, Ferndale, Randburg, 2160

Minority Int 8 662 4 504 712 - EMAIL: hannes@luxeholdings.co.za

Att Inc 360 665 351 512 168 948 - 130 WEBSITE: www.luxeholdings.co.za

TotCompIncLoss 369 347 355 991 169 267 - 130 TELEPHONE: 011-608-1999 FAX: 086-696-1270

Fixed Ass 601 540 526 502 198 955 - COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

Inv & Loans 1 419 6 045 22 982 - TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd.

Tot Curr Ass 2 051 988 2 199 185 2 344 015 - AUDITORS: BDO

Ord SH Int 4 703 645 4 811 086 4 503 084 - 18 893 CAPITAL STRUCTURE AUTHORISED ISSUED

Minority Int 66 389 60 289 20 779 - LUX Ords no par 40 000 000 22 214 989

LT Liab 828 323 398 284 257 089 -

Tot Curr Liab 664 896 527 004 363 425 18 893 DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

PER SHARE STATISTICS (cents per share) Final No 5 3 Jul 15 13 Jul 15 650.00

HEPS-C (ZARc) 43.40 38.70 30.20 - 130.00 Final No 4 4 Jul 14 14 Jul 14 620.00

DPS (ZARc) - - 5.40 -

NAV PS (ZARc) 607.00 548.00 506.00 - 188.93 LIQUIDITY: Sep20 Ave 57 955 shares p.w., R180 714.4(13.6% p.a.)

Price High 505 640 838 - ALSH 40 Week MA LUXE

Price Low 302 381 411 - 48900

Price Prd End 319 463 555 -

RATIOS 39140

Ret on SH Fnd 7.74 7.31 4.09 0.92

29380

Oper Pft Mgn 12.53 11.77 13.23 -

D:E 0.18 0.09 0.09 - 19620

Current Ratio 3.09 4.17 6.45 -

Div Cover - - 5.56 - 9860

100

2015 | 2016 | 2017 | 2018 | 2019 | 2020

NOTES: Luxe underwent a share consolidation on a 100 to 1 basis.

Taste Holdings Ltd. renamed to Luxe Holdings Ltd. on 22 July 2020.

FINANCIAL STATISTICS

TM

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final(rst) Final(rst) Final(rst) Final(rst)

sharemagic

Turnover 459 414 489 981 1 034 321 1 097 614 1 062 829

Op Inc - 3 641 - 61 891 - 193 709 - 110 703 - 78 703

the future of investing

NetIntPd(Rcvd) 12 901 220 26 698 18 511 12 453

Tax 3 443 2 325 - 12 122 - 28 060 - 17 055

Minority Int - 777 - 211 210 - 336 1 705

Power to make profits and reduce risk

Att Inc - 436 222 - 318 227 - 241 202 - 100 818 - 75 806

Fully integrated technical and TotCompIncLoss - 436 999 - 318 438 - 240 992 - 100 818 - 75 806

fundamental analysis tools Hline Erngs-CO - 208 678 - 233 320 - 197 585 - 93 881 - 59 970

Fixed Ass 32 408 168 454 186 920 190 692 159 767

Portfolio manager Inv & Loans 2 038 849 4 919 8 905 -

Def Tax Asset 6 061 30 294 88 848 87 647 56 648

Watch lists

Tot Curr Ass 273 490 456 167 479 053 439 003 574 830

Filter securities based on your own Ord SH Int 167 085 621 000 813 942 559 086 654 652

parameters Minority Int 515 1 292 1 503 - 2 732 1 174

LT Liab 116 710 27 358 26 031 284 884 295 802

Latest company financial results Tot Curr Liab 183 850 135 264 150 976 176 732 176 778

Stock Exchange News Service PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 19.70 - 3 500.00 - 5 100.00 - 2 680.00 - 2 424.90

Suitable for beginners as well as

HEPS-C (ZARc) - 9.40 - 2 560.00 - 4 180.00 - 2 500.00 - 1 920.00

professionals NAV PS (ZARc) 7.53 2 800.00 9 070.00 14 770.00 17 490.00

3 Yr Beta 2.03 1.29 - 0.10 0.53 0.02

Price High 1 500 6 600 21 500 30 000 52 500

Price Low 200 1 000 5 200 16 000 21 000

Contact Price Prd End 200 1 200 6 000 17 900 21 000

RATIOS

Johan van der Walt Ret on SH Fnd - 260.74 - 51.17 - 29.55 - 18.18 - 11.30

johanw@profile.co.za Ret On Tot Ass - 4.00 - 9.38 - 28.07 - 16.71 - 10.31

Oper Pft Mgn - 0.79 - 12.63 - 18.73 - 10.09 - 7.41

011-728-5510

D:E 0.79 0.08 0.06 0.62 0.51

Current Ratio 1.49 3.37 3.17 2.48 3.25

www.sharemagic.co.za

160