Page 155 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 155

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – KAP

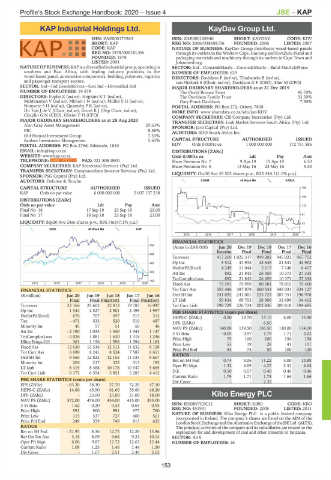

KAP Industrial Holdings Ltd. KayDav Group Ltd.

KAP KAY

ISIN: ZAE000171963 ISIN: ZAE000108940 SHORT: KAYDAV CODE: KDV

SHORT: KAP REG NO: 2006/038698/06 FOUNDED: 2006 LISTED: 2007

CODE: KAP NATURE OF BUSINESS: KayDav Group distributes wood-based panels

REG NO: 1978/000181/06 through its outlets in the Western Cape, Gauteng and KwaZulu-Natal and

FOUNDED: 1978 packaging materials and machinery through its outlets in Cape Town and

LISTED: 2004 Johannesburg.

NATUREOF BUSINESS:KAPisadiversified industrialgroup, operatingin SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs

southern and East Africa, with leading industry positions in the NUMBER OF EMPLOYEES: 629

wood-based panel, automotive components, bedding, polymers, logistics DIRECTORS: Davidson F (ind ne), Tlhabanelo B (ind ne),

and passenger transport sectors. van Niekerk S (Chair, ind ne), Davidson G F (CEO), Slier M (CFO)

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

NUMBER OF EMPLOYEES: 19 579 The David Brouze Trust 45.70%

DIRECTORS: Fuphe Z (ind ne), HopkinsKT(ind ne), The Davidson Family Trust 33.50%

McMenamin V (ind ne), MkhariIN(ind ne), MüllerSH(ind ne), Gary Frank Davidson 7.90%

NomveteSH(ind ne), QuarmbyPK(ind ne), POSTAL ADDRESS: PO Box 272, Ottery, 7808

Du Toit J de V (Chair, ind ne), Grové K J (Dep Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/KDV

Chaplin G N (CEO), Olivier F H (CFO) COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 28 Aug 2020 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Alan Gray Asset Management 29.63% SPONSOR: Java Capital (Pty) Ltd.

PIC 8.58% AUDITORS: BDO South Africa Inc.

Old Mutual Investment Group 7.53%

Sanlam Investment Management 5.63% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 2766, Edenvale, 1610 KDV Ords 0.0001c ea 1 000 000 000 172 751 585

EMAIL: info@kap.co.za DISTRIBUTIONS [ZARc]

WEBSITE: www.kap.co.za Ords 0.0001c ea Ldt Pay Amt

TELEPHONE: 021-808-0900 FAX: 021-808-0901 Share Premium No 7 9 Apr 19 15 Apr 19 6.50

COMPANY SECRETARY: KAP Secretarial Services (Pty) Ltd. Share Premium No 6 13 May 16 23 May 16 5.50

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct20 Ave 35 502 shares p.w., R25 344.1(1.1% p.a.)

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche CONM 40 Week MA KAYDA

CAPITAL STRUCTURE AUTHORISED ISSUED 190

KAP Ords no par value 6 000 000 000 2 607 137 238

156

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 122

Final No 18 17 Sep 19 23 Sep 19 23.00

Final No 17 18 Sep 18 25 Sep 18 23.00 87

LIQUIDITY: Sep20 Ave 24m shares p.w., R95.7m(47.1% p.a.) 53

GENI 40 Week MA KAP

19

2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

784

(Amts in ZAR’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final Final Final

626

Turnover 417 269 1 025 317 999 202 945 022 967 752

467 Op Inc 5 512 41 933 42 645 21 841 44 903

NetIntPd(Rcvd) 4 249 11 044 5 617 7 148 6 417

309 Att Inc 892 21 845 26 459 10 373 27 335

TotCompIncLoss 892 21 845 26 459 10 373 27 334

150

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Fixed Ass 73 591 75 959 80 381 78 015 75 460

FINANCIAL STATISTICS Tot Curr Ass 355 486 387 879 360 533 345 031 324 127

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Ord SH Int 241 892 241 001 235 729 207 351 196 978

Final Final Final(rst) Final Final(rst) LT Liab 59 834 69 703 28 906 32 696 34 402

Turnover 22 166 25 602 22 813 19 783 16 047 Tot Curr Liab 198 729 226 724 202 836 209 818 194 695

Op Inc 1 344 2 527 2 901 2 499 1 997 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 676 707 697 515 312 HEPS-C (ZARc) 0.50 12.70 15.10 6.00 15.90

Tax - 471 533 520 510 487 DPS (ZARc) - - 6.50 - -

Minority Int 45 57 51 50 46 NAV PS (ZARc) 140.00 139.50 136.50 120.00 114.00

Att Inc - 2 190 1 033 1 540 1 343 1 147 3 Yr Beta - 0.05 0.97 1.79 1.71 2.02

TotCompIncLoss - 2 026 1 081 1 630 1 318 1 246 Price High 75 100 100 150 158

Hline Erngs-CO 361 1 156 1 596 1 394 1 163 Price Low 53 19 28 41 101

Fixed Ass 12 630 12 536 12 513 11 832 8 128 Price Prd End 54 74 50 100 120

Tot Curr Ass 6 690 8 241 8 524 7 587 6 611

Ord SH Int 9 566 12 825 12 155 11 035 8 667 RATIOS

Minority Int 204 217 322 313 195 Ret on SH Fnd 0.74 9.06 11.22 5.00 13.88

LT Liab 8 419 8 468 10 176 10 347 5 665 Oper Pft Mgn 1.32 4.09 4.27 2.31 4.64

Tot Curr Liab 6 172 6 594 5 851 5 283 4 412 D:E 0.50 0.57 0.40 0.46 0.46

Current Ratio 1.79 1.71 1.78 1.64 1.66

PER SHARE STATISTICS (cents per share) Div Cover - - 2.35 - -

EPS (ZARc) - 83.30 38.30 57.70 52.20 47.10

HEPS-C (ZARc) 14.80 45.90 61.60 55.60 48.20

DPS (ZARc) - 23.00 23.00 21.00 18.00 Kibo Energy PLC

NAV PS (ZARc) 372.00 474.00 454.00 415.00 355.00 KIB

CODE: KBO

3 Yr Beta 1.62 - 0.20 0.53 0.64 0.95 ISIN: IE00B97C0C31 SHORT: KIBO LISTED: 2011

FOUNDED: 2008

REG NO: 451931

Price High 593 900 991 977 760

Price Low 115 537 727 600 501 NATURE OF BUSINESS: Kibo Energy PLC is a public limited company

incorporated in Ireland. The company’s shares are listed on the AIM of the

Price Prd End 249 559 749 813 625 London Stock Exchange and the Alternative Exchange of the JSE Ltd. (ALTX).

RATIOS The principal activities of the company and its subsidiaries are related to the

Ret on SH Fnd - 21.95 8.36 12.75 12.28 13.46 exploration for and development of coal and other minerals in Tanzania.

Ret On Tot Ass 3.18 8.09 9.64 9.24 10.14 SECTOR: AltX

Oper Pft Mgn 6.06 9.87 12.72 12.63 12.44 NUMBER OF EMPLOYEES: 16

Current Ratio 1.08 1.25 1.46 1.44 1.50

Div Cover - 1.67 2.51 2.49 2.62

153