Page 156 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 156

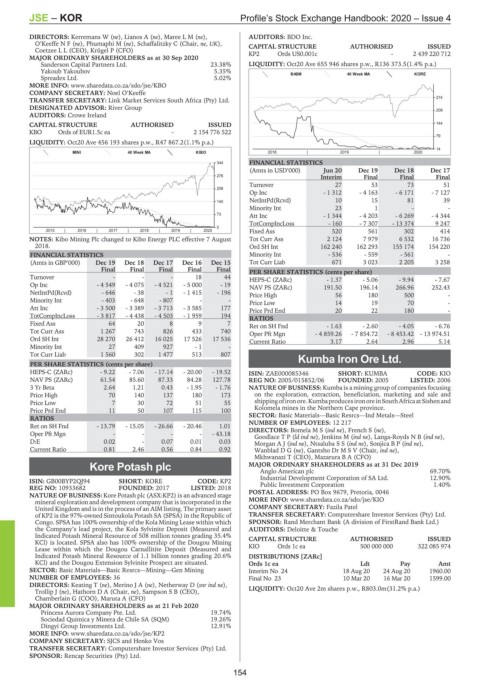

JSE – KOR Profile’s Stock Exchange Handbook: 2020 – Issue 4

DIRECTORS: Kerremans W (ne), Lianos A (ne), MareeLM(ne), AUDITORS: BDO Inc.

O’KeeffeNF(ne), Phumaphi M (ne), Schaffalitzky C (Chair, ne, UK), CAPITAL STRUCTURE AUTHORISED ISSUED

Coetzee L L (CEO), Krügel P (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 KP2 Ords US0.001c - 2 439 220 712

Sanderson Capital Partners Ltd. 23.38% LIQUIDITY: Oct20 Ave 655 946 shares p.w., R136 373.5(1.4% p.a.)

Yakoub Yakoubov 5.35%

BASM 40 Week MA KORE

Spreadex Ltd. 5.02%

MORE INFO: www.sharedata.co.za/sdo/jse/KBO

COMPANY SECRETARY: Noel O’Keeffe

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 274

DESIGNATED ADVISOR: River Group

209

AUDITORS: Crowe Ireland

CAPITAL STRUCTURE AUTHORISED ISSUED 144

KBO Ords of EUR1.5c ea - 2 154 776 522

79

LIQUIDITY: Oct20 Ave 456 193 shares p.w., R47 867.2(1.1% p.a.)

14

MINI 40 Week MA KIBO 2018 | 2019 | 2020

344 FINANCIAL STATISTICS

(Amts in USD’000) Jun 20 Dec 19 Dec 18 Dec 17

276 Interim Final Final Final

Turnover 27 53 73 51

208

Op Inc - 1 312 - 4 163 - 6 171 - 7 127

140 NetIntPd(Rcvd) 10 15 81 39

Minority Int 23 1 - -

73 Att Inc - 1 344 - 4 203 - 6 269 - 4 344

TotCompIncLoss - 160 - 7 307 - 13 374 9 247

5

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Fixed Ass 520 561 302 414

NOTES: Kibo Mining Plc changed to Kibo Energy PLC effective 7 August Tot Curr Ass 2 124 7 979 6 532 16 736

2018. Ord SH Int 162 240 162 293 155 174 154 220

FINANCIAL STATISTICS Minority Int - 536 - 559 - 561 -

(Amts in GBP’000) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Tot Curr Liab 671 3 023 2 205 3 258

Final Final Final Final Final PER SHARE STATISTICS (cents per share)

Turnover - - - 18 44 HEPS-C (ZARc) - 1.37 - 5.06 - 9.94 - 7.67

Op Inc - 4 549 - 4 075 - 4 521 - 5 000 - 19 NAV PS (ZARc) 191.50 196.14 266.96 252.43

NetIntPd(Rcvd) - 646 - 38 - 1 - 1 415 - 196 Price High 56 180 500 -

Minority Int - 403 - 648 - 807 - - Price Low 14 19 70 -

Att Inc - 3 500 - 3 389 - 3 713 - 3 585 177 Price Prd End 20 22 180 -

TotCompIncLoss - 3 817 - 4 438 - 4 503 - 1 959 194 RATIOS

Fixed Ass 64 20 8 9 7 Ret on SH Fnd - 1.63 - 2.60 - 4.05 - 6.76

Tot Curr Ass 1 267 743 826 433 740 Oper Pft Mgn - 4 859.26 - 7 854.72 - 8 453.42 - 13 974.51

Ord SH Int 28 270 26 412 16 025 17 526 17 536 Current Ratio 3.17 2.64 2.96 5.14

Minority Int 27 409 927 - 1 -

Tot Curr Liab 1 560 302 1 477 513 807

Kumba Iron Ore Ltd.

PER SHARE STATISTICS (cents per share)

KUM

HEPS-C (ZARc) - 9.22 - 7.06 - 17.14 - 20.00 - 19.52 ISIN: ZAE000085346 SHORT: KUMBA CODE: KIO

NAV PS (ZARc) 61.54 85.60 87.33 84.28 127.78 REG NO: 2005/015852/06 FOUNDED: 2005 LISTED: 2006

3 Yr Beta 2.64 1.21 0.43 - 1.95 - 1.76 NATURE OF BUSINESS: Kumba is a mining group of companies focusing

Price High 70 140 137 180 173 on the exploration, extraction, beneficiation, marketing and sale and

Price Low 7 30 72 51 55 shippingofironore.KumbaproducesironoreinSouthAfricaatSishenand

Price Prd End 11 50 107 115 100 Kolomela mines in the Northern Cape province.

RATIOS SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Steel

Ret on SH Fnd - 13.79 - 15.05 - 26.66 - 20.46 1.01 NUMBER OF EMPLOYEES: 12 217

DIRECTORS: BomelaMS(ind ne), French S (ne),

Oper Pft Mgn - - - - - 43.18 GoodlaceTP(ld ind ne), Jenkins M (ind ne), Langa-RoydsNB(ind ne),

D:E 0.02 - 0.07 0.01 0.03 MorganAJ(ind ne), NtsalubaSS(ind ne), SonjicaBP(ind ne),

Current Ratio 0.81 2.46 0.56 0.84 0.92 WanbladDG(ne), Gantsho DrMSV (Chair, ind ne),

Mkhwanazi T (CEO), Mazarura B A (CFO)

Kore Potash plc MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Anglo American plc 69.70%

KOR Industrial Development Corporation of SA Ltd. 12.90%

ISIN: GB00BYP2QJ94 SHORT: KORE CODE: KP2

REG NO: 10933682 FOUNDED: 2017 LISTED: 2018 Public Investment Corporation 1.40%

NATURE OF BUSINESS: Kore Potash plc (ASX:KP2) is an advanced stage POSTAL ADDRESS: PO Box 9679, Pretoria, 0046

mineral exploration and development company that is incorporated in the MORE INFO: www.sharedata.co.za/sdo/jse/KIO

United Kingdom and is in the process of an AIM listing. The primary asset COMPANY SECRETARY: Fazila Patel

of KP2 is the 97%-owned Sintoukola Potash SA (SPSA) in the Republic of TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Congo. SPSA has 100% ownership of the Kola Mining Lease within which SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

the Company’s lead project, the Kola Sylvinite Deposit (Measured and AUDITORS: Deloitte & Touche

Indicated Potash Mineral Resource of 508 million tonnes grading 35.4% CAPITAL STRUCTURE AUTHORISED ISSUED

KCl) is located. SPSA also has 100% ownership of the Dougou Mining

Lease within which the Dougou Carnallitite Deposit (Measured and KIO Ords 1c ea 500 000 000 322 085 974

Indicated Potash Mineral Resource of 1.1 billion tonnes grading 20.6% DISTRIBUTIONS [ZARc]

KCl) and the Dougou Extension Sylvinite Prospect are situated. Ords 1c ea Ldt Pay Amt

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining Interim No 24 18 Aug 20 24 Aug 20 1960.00

NUMBER OF EMPLOYEES: 36 Final No 23 10 Mar 20 16 Mar 20 1599.00

DIRECTORS: Keating T (ne), MerinoJA(ne), Netherway D (snr ind ne),

Trollip J (ne), Hathorn D A (Chair, ne), Sampson S B (CEO), LIQUIDITY: Oct20 Ave 2m shares p.w., R803.0m(31.2% p.a.)

Chamberlain G (COO), Maruta A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 21 Feb 2020

Princess Aurora Company Pte. Ltd. 19.74%

Sociedad Quimica y Minera de Chile SA (SQM) 19.26%

Dingyi Group Investments Ltd. 12.91%

MORE INFO: www.sharedata.co.za/sdo/jse/KP2

COMPANY SECRETARY: SJCS and Henko Vos

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rencap Securities (Pty) Ltd.

154