Page 161 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 161

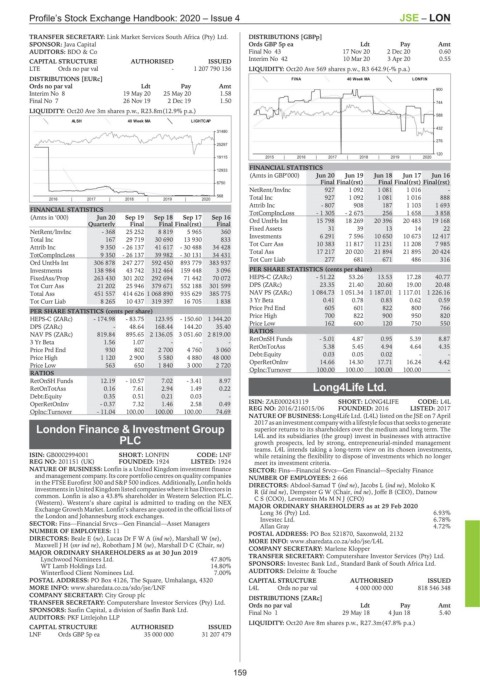

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – LON

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. DISTRIBUTIONS [GBPp]

SPONSOR: Java Capital Ords GBP 5p ea Ldt Pay Amt

AUDITORS: BDO & Co Final No 43 17 Nov 20 2 Dec 20 0.60

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 42 10 Mar 20 3 Apr 20 0.55

LTE Ords no par val - 1 207 790 136 LIQUIDITY: Oct20 Ave 569 shares p.w., R3 642.9(-% p.a.)

DISTRIBUTIONS [EURc] FINA 40 Week MA LONFIN

Ords no par val Ldt Pay Amt

900

Interim No 8 19 May 20 25 May 20 1.58

Final No 7 26 Nov 19 2 Dec 19 1.50 744

LIQUIDITY: Oct20 Ave 3m shares p.w., R23.8m(12.9% p.a.)

588

ALSH 40 Week MA LIGHTCAP

432

31480

276

25297

120

19115 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

12933

(Amts in GBP’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

6750 Final Final(rst) Final Final(rst) Final(rst)

NetRent/InvInc 927 1 092 1 081 1 016 -

568 Total Inc 927 1 092 1 081 1 016 888

2016 | 2017 | 2018 | 2019 | 2020

Attrib Inc - 807 908 187 1 103 1 693

FINANCIAL STATISTICS TotCompIncLoss - 1 305 - 2 675 256 1 658 3 858

(Amts in ‘000) Jun 20 Sep 19 Sep 18 Sep 17 Sep 16

Quarterly Final Final Final(rst) Final Ord UntHs Int 15 798 18 269 20 396 20 483 19 168

NetRent/InvInc - 368 25 252 8 819 5 965 360 Fixed Assets 31 39 13 14 22

6 291

7 596

Total Inc 167 29 719 30 690 13 930 833 Investments 10 383 11 817 10 650 10 673 12 417

11 231

11 208

Tot Curr Ass

7 985

Attrib Inc 9 350 - 26 137 41 617 - 30 488 34 428

TotCompIncLoss 9 350 - 26 137 39 982 - 30 131 34 431 Total Ass 17 217 20 020 21 894 21 895 20 424

Ord UntHs Int 306 878 247 277 592 450 893 779 383 937 Tot Curr Liab 277 681 671 486 316

Investments 138 984 43 742 312 464 159 448 3 096 PER SHARE STATISTICS (cents per share)

FixedAss/Prop 263 430 301 202 292 694 71 442 70 072 HEPS-C (ZARc) - 51.22 53.26 13.53 17.28 40.77

Tot Curr Ass 21 202 25 946 379 671 552 188 301 599 DPS (ZARc) 23.35 21.40 20.60 19.00 20.48

Total Ass 451 557 414 626 1 068 890 935 629 385 775 NAV PS (ZARc) 1 084.73 1 051.34 1 187.01 1 117.01 1 226.16

Tot Curr Liab 8 265 10 437 319 397 16 705 1 838 3 Yr Beta 0.41 0.78 0.83 0.62 0.59

Price Prd End 605 601 822 800 766

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 174.98 - 83.75 123.95 - 150.60 1 344.20 Price High 700 822 900 950 820

162

600

120

Price Low

550

750

DPS (ZARc) - 48.64 168.44 144.20 35.40

NAV PS (ZARc) 819.84 895.65 2 136.05 3 051.60 2 819.00 RATIOS

3 Yr Beta 1.56 1.07 - - - RetOnSH Funds - 5.01 4.87 0.95 5.39 8.87

Price Prd End 930 802 2 700 4 760 3 060 RetOnTotAss 5.38 5.45 4.94 4.64 4.35

0.02

0.03

0.05

Price High 1 120 2 900 5 580 4 880 48 000 Debt:Equity 14.66 14.30 17.71 16.24 - 4.42 -

OperRetOnInv

Price Low 563 650 1 840 3 000 2 720

RATIOS OpInc:Turnover 100.00 100.00 100.00 100.00 -

RetOnSH Funds 12.19 - 10.57 7.02 - 3.41 8.97

RetOnTotAss 0.16 7.61 2.94 1.49 0.22 Long4Life Ltd.

Debt:Equity 0.35 0.51 0.21 0.03 - LON

OperRetOnInv - 0.37 7.32 1.46 2.58 0.49 ISIN: ZAE000243119 SHORT: LONG4LIFE CODE: L4L

OpInc:Turnover - 11.04 100.00 100.00 100.00 74.69 REG NO: 2016/216015/06 FOUNDED: 2016 LISTED: 2017

NATURE OF BUSINESS: Long4Life Ltd. (L4L) listed on the JSE on 7 April

2017 asaninvestmentcompanywithalifestylefocusthatseekstogenerate

London Finance & Investment Group superior returns to its shareholders over the medium and long term. The

PLC L4L and its subsidiaries (the group) invest in businesses with attractive

growth prospects, led by strong, entrepreneurial-minded management

teams. L4L intends taking a long-term view on its chosen investments,

LON

ISIN: GB0002994001 SHORT: LONFIN CODE: LNF while retaining the flexibility to dispose of investments which no longer

REG NO: 201151 (UK) FOUNDED: 1924 LISTED: 1924 meet its investment criteria.

NATURE OF BUSINESS: Lonfin is a United Kingdom investment finance SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

and management company. Its core portfolio centres on quality companies NUMBER OF EMPLOYEES: 2 666

in the FTSE Eurofirst 300 and S&P 500 indices. Additionally, Lonfin holds DIRECTORS: Abdool-Samad T (ind ne), Jacobs L (ind ne), Moloko K

investments in United Kingdom listed companies where it has Directors in R(ld ind ne), Dempster G W (Chair, ind ne), Joffe B (CEO), Datnow

common. Lonfin is also a 43.8% shareholder in Western Selection P.L.C. C S (COO), Levenstein MsMNJ (CFO)

(Western). Western’s share capital is admitted to trading on the NEX

Exchange Growth Market. Lonfin’s shares are quoted in the official lists of MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 6.93%

Long 36 (Pty) Ltd.

the London and Johannesburg stock exchanges. Investec Ltd. 6.78%

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers Allan Gray 4.72%

NUMBER OF EMPLOYEES: 11 POSTAL ADDRESS: PO Box 521870, Saxonwold, 2132

DIRECTORS: Beale E (ne), Lucas DrFWA(ind ne), Marshall W (ne), MORE INFO: www.sharedata.co.za/sdo/jse/L4L

MaxwellJH(snr ind ne), RobothamJM(ne), Marshall D C (Chair, ne) COMPANY SECRETARY: Marlene Klopper

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Lynchwood Nominees Ltd. 47.80% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WT Lamb Holdings Ltd. 14.80% SPONSORS: Investec Bank Ltd., Standard Bank of South Africa Ltd.

Winterflood Client Nominees Ltd. 7.00% AUDITORS: Deloitte & Touche

POSTAL ADDRESS: PO Box 4126, The Square, Umhalanga, 4320 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/LNF L4L Ords no par val 4 000 000 000 818 546 348

COMPANY SECRETARY: City Group plc DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par val Ldt Pay Amt

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. Final No 1 29 May 18 4 Jun 18 5.40

AUDITORS: PKF Littlejohn LLP

LIQUIDITY: Oct20 Ave 8m shares p.w., R27.3m(47.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

LNF Ords GBP 5p ea 35 000 000 31 207 479

159