Page 152 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 152

JSE – ISA Profile’s Stock Exchange Handbook: 2020 – Issue 4

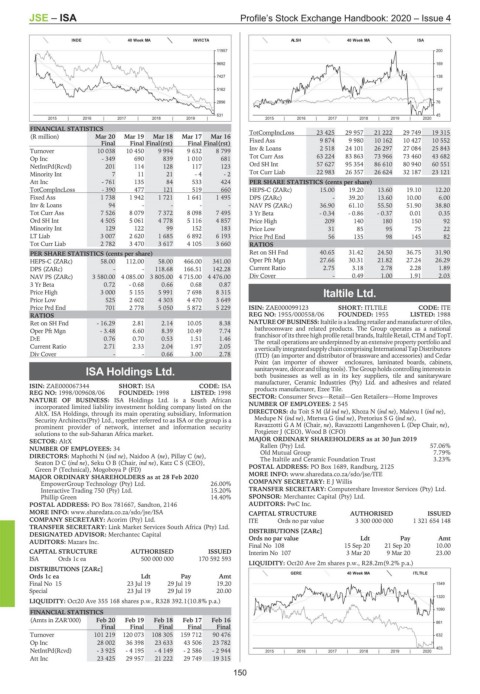

INDE 40 Week MA INVICTA ALSH 40 Week MA ISA

11957 200

9692 169

7427 138

5162 107

2896 76

631 45

2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS TotCompIncLoss 23 425 29 957 21 222 29 749 19 315

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final Final(rst) Final Final(rst) Fixed Ass 9 874 9 980 10 162 10 427 10 552

Turnover 10 038 10 450 9 994 9 632 8 799 Inv & Loans 2 518 24 101 26 297 27 084 25 843

Op Inc - 349 690 839 1 010 681 Tot Curr Ass 63 224 83 863 73 966 73 460 43 682

NetIntPd(Rcvd) 201 114 128 117 123 Ord SH Int 57 627 95 354 86 610 80 940 60 551

Minority Int 7 11 21 - 4 - 2 Tot Curr Liab 22 983 26 357 26 624 32 187 23 121

Att Inc - 761 135 84 533 424 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 390 477 121 519 660 HEPS-C (ZARc) 15.00 19.20 13.60 19.10 12.20

Fixed Ass 1 738 1 942 1 721 1 641 1 495 DPS (ZARc) - 39.20 13.60 10.00 6.00

Inv & Loans 94 - - - - NAV PS (ZARc) 36.90 61.10 55.50 51.90 38.80

Tot Curr Ass 7 526 8 079 7 372 8 098 7 495 3 Yr Beta - 0.34 - 0.86 - 0.37 0.01 0.35

Ord SH Int 4 505 5 061 4 778 5 116 4 857 Price High 209 140 180 150 92

Minority Int 129 122 99 152 183 Price Low 31 85 95 75 22

LT Liab 3 007 2 620 1 685 6 892 6 193 Price Prd End 56 135 98 145 82

Tot Curr Liab 2 782 3 470 3 617 4 105 3 660 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 40.65 31.42 24.50 36.75 31.90

HEPS-C (ZARc) 58.00 112.00 58.00 466.00 341.00 Oper Pft Mgn 27.66 30.31 21.82 27.24 26.29

DPS (ZARc) - - 118.68 166.51 142.28 Current Ratio 2.75 3.18 2.78 2.28 1.89

NAV PS (ZARc) 3 580.00 4 085.00 3 805.00 4 715.00 4 476.00 Div Cover - 0.49 1.00 1.91 2.03

3 Yr Beta 0.72 - 0.68 0.66 0.68 0.87

Price High 3 000 5 155 5 991 7 698 8 315 Italtile Ltd.

Price Low 525 2 602 4 303 4 470 3 649

ITA

Price Prd End 701 2 778 5 050 5 872 5 229 ISIN: ZAE000099123 SHORT: ITLTILE CODE: ITE

RATIOS REG NO: 1955/000558/06 FOUNDED: 1955 LISTED: 1988

Ret on SH Fnd - 16.29 2.81 2.14 10.05 8.38 NATURE OF BUSINESS: Italtile is a leading retailer and manufacturer of tiles,

Oper Pft Mgn - 3.48 6.60 8.39 10.49 7.74 bathroomware and related products. The Group operates as a national

D:E 0.76 0.70 0.53 1.51 1.46 franchisor of its three high profile retail brands, Italtile Retail, CTM and TopT.

The retail operations are underpinned by an extensive property portfolio and

Current Ratio 2.71 2.33 2.04 1.97 2.05 averticallyintegratedsupplychaincomprisingInternationalTapDistributors

Div Cover - - 0.66 3.00 2.78 (ITD) (an importer and distributor of brassware and accessories) and Cedar

Point (an importer of shower enclosures, laminated boards, cabinets,

ISA Holdings Ltd. sanitaryware, décor andtiling tools). The Group holdscontrolling interestsin

both businessesaswellasinits key suppliers, tile and sanitaryware

ISA manufacturer, Ceramic Industries (Pty) Ltd. and adhesives and related

ISIN: ZAE000067344 SHORT: ISA CODE: ISA products manufacturer, Ezee Tile.

REG NO: 1998/009608/06 FOUNDED: 1998 LISTED: 1998 SECTOR: Consumer Srvcs—Retail—Gen Retailers—Home Improves

NATURE OF BUSINESS: ISA Holdings Ltd. is a South African

incorporated limited liability investment holding company listed on the NUMBER OF EMPLOYEES: 2 545

AltX. ISA Holdings, through its main operating subsidiary, Information DIRECTORS: du ToitSM(ld ind ne), Khoza N (ind ne), Malevu I (ind ne),

Security Architects(Pty) Ltd., together referred to as ISA or the group is a MedupeN(ind ne), Mtetwa G (ind ne), Pretorius S G (ind ne),

prominent provider of network, internet and information security Ravazzotti G A M (Chair, ne), Ravazzotti Langenhoven L (Dep Chair, ne),

solutions to the sub-Saharan Africa market. Potgieter J (CEO), Wood B (CFO)

SECTOR: AltX MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

NUMBER OF EMPLOYEES: 34 Rallen (Pty) Ltd. 57.06%

7.79%

Old Mutual Group

DIRECTORS: Maphothi N (ind ne), Naidoo A (ne), Pillay C (ne), The Italtile and Ceramic Foundation Trust 3.23%

SeatonDC(ind ne), Seku O B (Chair, ind ne), Katz C S (CEO),

Green P (Technical), Mogoboya P (FD) POSTAL ADDRESS: PO Box 1689, Randburg, 2125

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2020 MORE INFO: www.sharedata.co.za/sdo/jse/ITE

EmpowerGroup Technology (Pty) Ltd. 26.00% COMPANY SECRETARY: E J Willis

Interactive Trading 750 (Pty) Ltd. 15.20% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Phillip Green 14.40% SPONSOR: Merchantec Capital (Pty) Ltd.

POSTAL ADDRESS: PO Box 781667, Sandton, 2146 AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/ISA CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Acorim (Pty) Ltd. ITE Ords no par value 3 300 000 000 1 321 654 148

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. DISTRIBUTIONS [ZARc]

DESIGNATED ADVISOR: Merchantec Capital Ords no par value Ldt Pay Amt

AUDITORS: Mazars Inc.

Final No 108 15 Sep 20 21 Sep 20 10.00

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 107 3 Mar 20 9 Mar 20 23.00

ISA Ords 1c ea 500 000 000 170 592 593

LIQUIDITY: Oct20 Ave 2m shares p.w., R28.2m(9.2% p.a.)

DISTRIBUTIONS [ZARc]

GERE 40 Week MA ITLTILE

Ords 1c ea Ldt Pay Amt

Final No 15 23 Jul 19 29 Jul 19 19.20 1549

Special 23 Jul 19 29 Jul 19 20.00

1320

LIQUIDITY: Oct20 Ave 355 168 shares p.w., R328 392.1(10.8% p.a.)

1090

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 861

Final Final Final Final Final

Turnover 101 219 120 073 108 305 159 712 90 476 632

Op Inc 28 002 36 398 23 633 43 506 23 782

403

NetIntPd(Rcvd) - 3 925 - 4 195 - 4 149 - 2 586 - 2 944 2015 | 2016 | 2017 | 2018 | 2019 | 2020

Att Inc 23 425 29 957 21 222 29 749 19 315

150