Page 191 - Stock Exchange Handbook 2020 - Issue 3

P. 191

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – PEP

Fixed Ass 5 464 5 466 5 251 4 613 3 714

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 19 Dec 18 Dec 17 Dec 16 Inv & Loans 192 328 253 170 950

Tot Curr Ass 28 115 26 591 23 060 19 918 24 287

Interim Final Final(rst) Final

Turnover 55 015 82 314 81 106 31 777 Ord SH Int 56 291 56 592 55 708 52 892 52 666

Op Inc 1 127 - 43 455 - 27 132 - 10 173 Minority Int 7 6 3 25 29

NetIntPd(Rcvd) 2 198 4 371 3 123 2 552 LT Liab 36 028 20 559 20 860 16 438 5 379

Att Inc - 21 946 - 40 716 - 26 806 - 9 243 Tot Curr Liab 16 393 16 364 14 407 17 758 30 771

TotCompIncLoss - 21 946 - 42 695 4 325 5 417

PER SHARE STATISTICS (cents per share)

Fixed Ass 197 611 197 449 142 891 47 690 HEPS-C (ZARc) 44.30 98.30 84.20 133.60 60.40

Tot Curr Ass 38 202 5 693 77 970 4 696 DPS (ZARc) - 20.90 27.80 - -

Ord SH Int 121 811 143 758 185 891 16 865 NAV PS (ZARc) 1 613.80 1 640.40 1 614.70 1 533.10 2 050.60

LT Liab 33 388 36 853 38 564 19 965 Price High 1 875 2 232 2 740 2 246 -

Tot Curr Liab 94 060 62 872 38 030 20 700 Price Low 975 1 515 1 434 2 135 -

Price Prd End 1 065 1 775 1 592 2 192 -

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 0.08 - 3.97 - 7.61 - 4.48 RATIOS

NAV PS (ZARc) 30.40 35.38 45.92 8.52 Ret on SH Fnd 5.24 3.82 5.20 6.74 2.50

Price High 15 50 101 - Oper Pft Mgn 10.39 7.93 9.14 10.00 5.96

Price Low 3 9 24 - D:E 0.66 0.40 0.39 0.31 0.11

Price Prd End 7 15 29 - Current Ratio 1.72 1.62 1.60 1.12 0.79

Div Cover - 3.00 3.01 - -

RATIOS

Ret on SH Fnd - 36.03 - 28.32 - 14.42 - 65.77

Oper Pft Mgn 2.05 - 52.79 - 33.45 - 32.01 Peregrine Holdings Ltd.

D:E 0.27 0.26 0.21 1.19

PER

Current Ratio 0.41 0.09 2.05 0.23 ISIN: ZAE000078127 SHORT: PERGRIN CODE: PGR

REG NO: 1994/006026/06 FOUNDED: 1996 LISTED: 1998

Pepkor Holdings Ltd. NATURE OF BUSINESS: The Peregrine Group is one of South Africa’s

premier wealth and alternative investments specialists. Peregrine is a

PEP leading financial services group that caters to a wide range of financial

ISIN: ZAE000259479 SHORT: PEPKORH CODE: PPH needs for individuals, corporates and institutions, and offers best-of-breed

REG NO: 2017/221869/06 FOUNDED: 2017 LISTED: 2017 investment management solutions and advice. The Group’s overarching

NATURE OF BUSINESS: The group is a diversified retailer of significant size objective is to provide its clients with consistent, high levels of

and scale operating across four segments. All the retail brands within the risk-adjusted returns regardless of market conditions over the medium to

segments focus on discount, value and specialised goods and retail clothing, long-term, as well as continuing to be a trusted platform to its partners.

general merchandise, household goods, furniture, appliances, consumer Peregrine prides itself on its initiatives that have launched and empowered

electronics, building materials, cellular products and services and financial numerous wealth and asset management businesses, over the past 23

services in Angola, Botswana, eSwatini, Lesotho, Malawi, Mozambique, years, in order to unlock their full potential.

Namibia, Nigeria, South Africa, Uganda, Zambia and Zimbabwe. SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets NUMBER OF EMPLOYEES: 704

NUMBER OF EMPLOYEES: 56 100 DIRECTORS: Katz R (CEO & FD), Moller A (Executive), Beaver B C

DIRECTORS: CilliersJB(ld ind ne), de Klerk T (ne), du PreezLJ(ne), (ind ne), Goetsch P (ne), Harris AdvLN(ld ind ne), Sithole S (ind ne),

Luhabe W (ind ne), MullerSH(ind ne), Petersen-Cook F (ind ne), Stein S (ind ne), Tlhabanelo B (ind ne), Melnick S A (Chair, ne, UK)

Wiese AdvJD(ne), Naidoo J (Chair, ne), Lourens L (CEO), Hanekom R

G (CFO) MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 14.80%

Allan Gray

MAJOR ORDINARY SHAREHOLDERS as at 28 Sep 2019 PIC 10.80%

Steinhoff International Holdings Ltd. 71.01% Old Mutual 8.70%

Lancaster 101 (Pty) Ltd. 8.77% POSTAL ADDRESS: PO Box 650361, Benmore, 2010

Coronation Asset Management (Pty) Ltd. 3.66% MORE INFO: www.sharedata.co.za/sdo/jse/PGR

POSTAL ADDRESS: PO Box 6100, Parow East, 7500 COMPANY SECRETARY: Peregrine Management Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/PPH TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Pepkor (Pty) Ltd. SPONSORS: Deloitte & Touche Sponsor Services (Pty) Ltd., Java Capital

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. AUDITORS: Deloitte & Touche

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED PGR Ords 0.1c ea 500 000 000 220 467 242

PPH Ords no par value 20 000 000 000 3 660 350 881

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt

Interim No 21 28 Jan 20 3 Feb 20 65.00

Ords no par value Ldt Pay Amt Scr/100

Final No 2 21 Jan 20 27 Jan 20 20.90 1.22 Final No 20 30 Jul 19 5 Aug 19 100.00

Final No 1 15 Jan 19 21 Jan 19 27.80 -

LIQUIDITY: Jul20 Ave 1m shares p.w., R21.9m(27.8% p.a.)

LIQUIDITY: Jul20 Ave 17m shares p.w., R264.3m(24.6% p.a.)

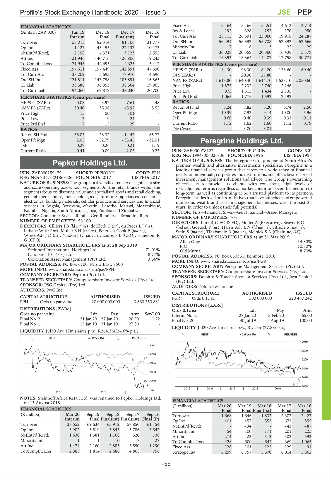

GENF 40 Week MA PERGRIN

ALSH 40 Week MA PEPKORH

2989

2571

2599

2248

2209

1925

1819

1603

1428

1280

1038

2015 | 2016 | 2017 | 2018 | 2019 |

957

2018 | 2019 |

NOTES: Steinhoff Africa Retail Ltd. was renamed to Pepkor Holdings Ltd.

on 15 August 2018. FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

FINANCIAL STATISTICS

Final Final Final(rst) Final Final

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 Turnover 1 668 1 646 1 832 2 307 2 422

Interim Final Final(rst) Final(rst) Final (P) Op Inc 404 457 552 671 855

Turnover 37 552 69 634 63 912 57 850 61 154

NetIntPd(Rcvd) - - 34 - - 43 - 87

Op Inc 3 902 5 519 5 843 5 786 3 642 Minority Int 54 100 171 201 225

NetIntPd(Rcvd) 1 630 1 581 1 168 620 738 Att Inc 274 423 513 502 593

Minority Int 1 1 10 17 27 TotCompIncLoss 428 600 642 369 1 065

Att Inc 1 474 2 160 2 885 3 550 1 290 Fixed Ass 128 101 122 129 91

TotCompIncLoss 2 385 1 814 2 686 4 868 756 Strategic Inv 6 299 6 757 5 670 6 014 5 862

189