Page 187 - Stock Exchange Handbook 2020 - Issue 3

P. 187

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – OCE

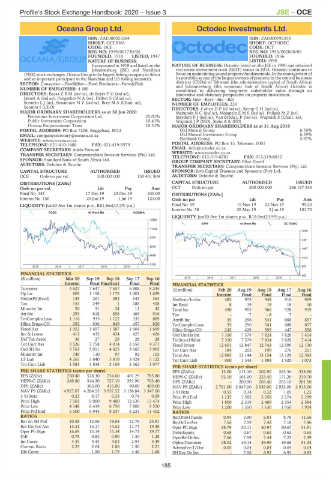

Oceana Group Ltd. Octodec Investments Ltd.

OCE OCT

ISIN: ZAE000025284 ISIN: ZAE000192258

SHORT: OCEANA SHORT: OCTODEC

CODE: OCE CODE: OCT

REG NO: 1939/001730/06 REG NO: 1956/002868/06

FOUNDED: 1918 LISTED: 1947 FOUNDED: 1956

LISTED: 1990

NATURE OF BUSINESS:

Incorporated in 1918 and listed on the NATURE OF BUSINESS: Octodec listed on the JSE in 1990 and obtained

Johannesburg (JSE) and Namibian real estate investment trust (REIT) status in 2013. Octodec continues to

(NSX) stock exchanges, Oceana Group is the largest fishing company in Africa focus on maintaining sound property fundamentals. In the management of

and an important participant in the Namibian and US fishing industries. its portfolio as one of the largest owners of property in the central business

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish districts (CBDs) of Tshwane (the administrative capital of South Africa)

NUMBER OF EMPLOYEES: 4 409 and Johannesburg (the economic hub of South Africa) Octodec is

committed to delivering long-term stakeholder value through an

DIRECTORS: BassaZBM(ind ne), de BeyerPG(ind ne), innovative and visionary perspective on property investment.

Jakoet A (ind ne), PangarkerNA(ne), Pather S (ld ind ne), SECTOR: Fins—Rest—Inv—Ret

SenneloLJ(ne), SimamaneNV(ind ne), Brey M A (Chair, ne), NUMBER OF EMPLOYEES: 224

Soomra I (CEO) DIRECTORS: CohenDP(ld ind ne), KempGH(ind ne),

MabundaNC(ind ne), MojapeloEMS(ind ne), PollackMZ(ne),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Brimstone Investment Corporation Ltd. 25.01% StrydomPJ(ind ne), Van BredaLP(ind ne), Wapnick S (Chair, ne),

Public Investment Corporation 10.41% Wapnick J P (MD), Stein A K (FD)

Oceana Empowerment Trust 10.31%

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

POSTAL ADDRESS: PO Box 7206, Roggebaai, 8012 Old Mutual Group 6.76%

EMAIL: companysecretary@oceana.co.za Old Mutual Investment Group 6.59%

WEBSITE: www.oceana.co.za Nedbank Group 5.97%

TELEPHONE: 021-410-1400 FAX: 021-419-5979 POSTAL ADDRESS: PO Box 15, Tshwane, 0001

COMPANY SECRETARY: Adela Fortune EMAIL: info@octodec.co.za

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. WEBSITE: www.octodec.co.za FAX: 012-319-8812

TELEPHONE: 012-319-8781

SPONSOR: Standard Bank of South Africa Ltd. GROUP COMPANY SECRETARY: Elize Greeff

AUDITORS: Deloitte & Touche

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

OCE Ords no par val. 300 000 000 130 431 804 AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc]

OCT Ords no par 500 000 000 266 197 535

Ords no par val. Ldt Pay Amt

Final No 151 17 Dec 19 23 Dec 19 240.00

DISTRIBUTIONS [ZARc]

Interim No 150 25 Jun 19 1 Jul 19 123.00

Ords no par Ldt Pay Amt

LIQUIDITY: Jun20 Ave 1m shares p.w., R81.8m(47.2% p.a.) Final No 59 19 Nov 19 25 Nov 19 99.20

Interim No 58 28 May 19 3 Jun 19 101.70

FOOD 40 Week MA OCEANA

LIQUIDITY: Jun20 Ave 1m shares p.w., R19.0m(23.9% p.a.)

12890

SAPY 40 Week MA OCTODEC

11342

2856

9794

2381

8246

1907

6698

1432

5150

2015 | 2016 | 2017 | 2018 | 2019 | 957

482

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 2015 | 2016 | 2017 | 2018 | 2019 |

Interim Final Final(rst) Final Final

Turnover 3 627 7 647 7 657 6 808 8 244 FINANCIAL STATISTICS

(R million)

Op Inc 605 1 158 1 175 1 001 1 629 Feb 20 Aug 19 Aug 18 Aug 17 Aug 16

Interim Final Final Final Final

NetIntPd(Rcvd) 139 261 292 343 363 NetRent/InvInc 482 975 948 910 909

Tax 153 249 1 188 408 Int Recd 8 19 19 18 10

Minority Int 20 31 24 11 42 Total Inc 490 993 966 928 919

Att Inc 293 618 858 468 916 Tax - 7 - 8 7 -

TotCompIncLoss 1 116 935 1 122 335 889 Attrib Inc 35 296 541 688 857

Hline Erngs-CO 292 636 849 457 820 TotCompIncLoss 35 296 541 688 857

Fixed Ass 1 953 1 697 1 587 1 604 1 669 Hline Erngs-CO 245 429 595 447 556

Inv & Loans 411 432 434 425 426 Ord UntHs Int 7 350 7 579 7 824 7 828 7 414

Def Tax Asset 36 27 29 28 28 TotStockHldInt 7 350 7 579 7 824 7 828 7 414

Tot Curr Ass 3 526 3 758 4 014 3 550 4 371 Fixed Invest 12 601 12 847 12 743 12 599 12 130

Ord SH Int 5 761 5 011 4 625 3 665 3 905 Tot Curr Ass 184 202 199 276 201

Minority Int 149 110 97 92 103 Total Ass 12 883 13 144 13 154 13 129 12 593

LT Liab 4 265 3 840 3 819 3 924 5 122 Tot Curr Liab 900 1 344 1 984 1 920 1 073

Tot Curr Liab 1 583 1 838 2 159 2 362 1 977

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 13.00 111.10 202.90 263.30 338.90

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 250.40 528.30 734.60 401.29 785.80 HEPS-C (ZARc) 92.10 161.00 223.40 171.20 219.70

HEPS-C (ZARc) 249.80 544.30 727.10 391.90 703.40 DPS (ZARc) - 200.90 203.40 203.10 201.50

DPS (ZARc) - 363.00 416.00 90.00 469.00 NAV PS (ZARc) 2 761.00 2 847.00 2 939.00 2 933.00 2 913.00

NAV PS (ZARc) 4 927.07 4 284.55 3 957.52 3 138.84 3 347.00 3 Yr Beta 0.55 0.34 0.32 1.05 1.23

3 Yr Beta 0.23 0.17 0.33 0.74 0.59 Price Prd End 1 235 1 592 2 058 2 274 2 299

Price High 7 501 9 000 9 400 12 639 13 474 Price High 1 800 2 319 2 469 2 554 2 584

Price Low 4 148 6 419 6 750 7 800 9 550 Price Low 1 200 1 550 1 630 1 950 1 904

Price Prd End 5 500 6 944 8 247 8 233 11 402

RATIOS

RetOnSH Funds 0.94 3.90 6.91 8.78 11.56

RATIOS

Ret on SH Fnd 10.58 12.66 18.68 12.76 23.91 RetOnTotAss 7.66 7.59 7.42 7.18 7.46

Ret On Tot Ass 15.31 15.17 14.52 11.74 19.48 Oper Pft Mgn 48.79 50.11 50.97 50.67 51.91

Oper Pft Mgn 16.69 15.14 15.34 14.71 19.77 Debt:Equity 0.68 0.67 0.62 0.62 0.65

D:E 0.75 0.82 0.90 1.30 1.28 OperRetOnInv 7.66 7.59 7.44 7.22 7.49

Int Cover 4.35 4.44 4.03 2.94 4.49 OpInc:Turnover 48.02 49.15 49.99 49.68 51.34

Current Ratio 2.23 2.04 1.86 1.50 2.21 AdminFee:T/Ovr 0.05 0.04 0.04 0.04 0.04

Div Cover - 1.50 1.75 4.46 1.68 SH Ret On Inv - 7.06 6.92 6.92 6.92

185