Page 196 - Stock Exchange Handbook 2020 - Issue 3

P. 196

JSE – PSG Profile’s Stock Exchange Handbook: 2020 – Issue 3

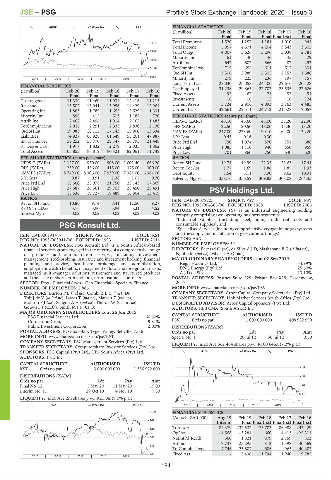

GENF 40 Week MA PSG FINANCIAL STATISTICS

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final Final Final(rst) Final

24348 Total Premiums 1 520 1 257 1 181 1 010 941

Total Income 5 057 4 571 4 204 3 843 3 502

19900 Total Outgo 4 007 3 626 3 296 3 038 2 781

Minority Int 61 40 46 45 29

15451

Attrib Inc 647 602 566 487 293

11002 TotCompIncLoss 719 654 611 517 331

Ord SH Int 3 306 2 989 2 505 2 153 1 688

6553 Minority Int 279 225 236 197 157

2015 | 2016 | 2017 | 2018 | 2019 |

Long-Term Liab 27 030 26 058 24 400 22 616 20 128

FINANCIAL STATISTICS Cap Employed 31 238 29 863 27 702 25 535 22 626

(R million)

Fixed Assets 92 67 74 53 54

Feb 20

Feb 16

Feb 17

Feb 18

Feb 19

Final Final Final Final Final

Cost of goods 11 339 11 460 11 934 12 416 11 215 Investments 16 16 15 16 124

Revenue 13 502 13 041 13 956 14 429 12 964 Current Assets 3 724 2 906 4 093 3 163 4 485

Operating Inc 1 863 1 789 1 655 2 529 1 331 Current Liab 32 661 29 511 24 712 21 528 17 057

Minority Int 896 415 513 1 187 720 PER SHARE STATISTICS (cents per share)

Attrib Inc 2 462 2 496 1 914 2 162 1 483 HEPS-C (ZARc) 48.10 45.60 43.00 37.20 22.90

TotCompIncLoss 2 926 2 291 2 335 2 830 2 130 DPS (ZARc) 22.50 20.50 18.00 15.30 13.20

Ord SH Int 19 083 18 115 17 143 15 900 13 634 NAV PS (ZARc) 247.00 223.60 190.10 164.00 132.20

Liabilities 74 927 66 928 61 549 55 261 47 987 3 Yr Beta 0.45 - 0.16 0.30 - -

Inv & Trad Sec 59 252 55 770 29 147 26 795 21 448 Price Prd End 790 1 074 870 751 688

ST Dep & Cash 1 977 1 832 2 279 2 035 1 862 Price High 1 085 1 110 940 850 959

Total Assets 105 853 96 819 90 421 82 061 71 749 Price Low 701 860 750 640 620

RATIOS

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 1 127.00 950.00 908.00 1 001.40 666.20 Ret on SH Fund 19.74 19.99 22.35 22.63 17.44

DPS (ZARc) 239.00 456.00 415.00 375.00 300.00 Ret on Tot Ass 1.77 1.69 1.86 1.85 1.93

NAV PS (ZARc) 8 749.00 8 306.00 7 939.00 7 381.00 6 364.00 Debt:Equity 7.54 8.11 8.90 9.62 10.91

3 Yr Beta 0.87 0.51 1.38 1.07 0.70 Solvency Mgn% 338.76 356.59 309.83 308.08 264.35

Price Prd End 18 660 25 978 21 750 25 143 17 369

Price High 27 687 26 561 29 703 25 450 28 491 PSV Holdings Ltd.

Price Low 18 536 19 727 19 489 16 804 13 419

PSV

RATIOS ISIN: ZAE000078705 SHORT: PSV CODE: PSV

Ret on SH Fund 10.86 9.74 8.41 12.50 9.27 REG NO: 1998/004365/06 FOUNDED: 1988 LISTED: 2006

RetOnTotalAss 3.76 3.90 3.94 5.31 4.52 NATURE OF BUSINESS: PSV is an industrial engineering holding

Interest Mgn 0.02 0.02 0.02 0.02 0.02 company comprising two operating business segments:

*Industrial Supplies (including steel, piping, industrial tools and

PSG Konsult Ltd. consumable supplies); and

*Specialised Services (including comprehensive cryogenic andgas systems

PSG and the supply and installation of geosynthetic linings).

ISIN: ZAE000191417 SHORT: PSG KST CODE: KST

REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014 SECTOR: AltX

NATURE OF BUSINESS: PSG Konsult Ltd. is a South African-based NUMBER OF EMPLOYEES: 59

financial services group engaged in the offering of a comprehensive range DIRECTORS: Bernard O (ne), da SilvaAJD, MashabaneBK(ld ind ne),

of products and administration services, including investment Ngubo M (ind ne), Mbalati A (Chair)

management, stockbroking, insurance and investment broking, financial MAJOR ORDINARY SHAREHOLDERS as at 02 Sep 2019

planning and advice, healthcare brokerage and administration, Regis Holdings Ltd. 34.99%

employment wealth benefits, management of local and foreign unit trusts, DNG Energy (Pty) Ltd. 25.60%

managed multi-manager solutions, retirement and structured products AJDda Silva 13.10%

and the issue of short-term and long-term insurance contracts. POSTAL ADDRESS: Postnet Suite 229, Private Bag X19, Gardenview,

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance 2047

NUMBER OF EMPLOYEES: 2 886 MORE INFO: www.sharedata.co.za/sdo/jse/PSV

DIRECTORS: BurtonPE(ind ne), CombiZL(ind ne), Du COMPANY SECRETARY: Arbor Capital Company Secretarial (Pty) Ltd.

ToitJdeV(ld ind ne), Isaacs T (ind ne), Matsau Z (ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MoutonPJ(ne), SangquAH(ind ne), Theron W (Chair, ne), DESIGNATED ADVISOR: Arbor Capital Sponsors (Pty) Ltd.

Gouws F J (CEO), SmithMIF (CFO) AUDITORS: HLB CMA (South Africa) Inc.

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2019

PSG Financial Services Ltd. 60.60% CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Group 9.81% PSV Ords no par 1 000 000 000 408 982 990

Public Investment Corporation 2.00%

DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536

Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/KST Special No 1 20 Jul 12 30 Jul 12 3.60

COMPANY SECRETARY: PSG Management Services (Pty) Ltd. LIQUIDITY: Jul20 Ave 562 404 shares p.w., R100 646.8(7.2% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd. ALSH 40 Week MA PSV

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

KST Ords no par 3 000 000 000 1 356 922 600 45

36

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

Final No 12 5 May 20 11 May 20 15.00 26

Interim No 11 29 Oct 19 4 Nov 19 7.50

17

LIQUIDITY: Jul20 Ave 2m shares p.w., R21.0m(9.0% p.a.)

7

FINA 40 Week MA PSG KST 2015 | 2016 | 2017 | 2018 | 2019 |

1100

FINANCIAL STATISTICS

(Amts in ZAR’000)

962 Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final(rst) Final(rst) Final(rst)

823 Turnover 84 379 237 532 175 703 186 988 243 429

Op Inc - 4 568 - 3 284 660 4 413 - 25 311

685 NetIntPd(Rcvd) 560 1 821 879 2 759 303

Att Inc - 7 747 - 25 295 - 812 - 1 398 - 40 569

546

TotCompIncLoss - 7 746 - 25 887 - 686 - 965 - 40 383

408 Fixed Ass - 5 436 11 794 11 940 9 785

2015 | 2016 | 2017 | 2018 | 2019 |

194