Page 186 - Stock Exchange Handbook 2020 - Issue 3

P. 186

JSE – OAN Profile’s Stock Exchange Handbook: 2020 – Issue 3

Oando Plc Oasis Crescent Property Fund

OAN OAS

ISIN: NGOANDO00002 SHORT: OANDO CODE: OAO ISIN: ZAE000074332 SHORT: OASIS CODE: OAS

REG NO: 2005/038824/10 FOUNDED: 2005 LISTED: 2005 REG NO: 2003/012266/06 FOUNDED: 2005 LISTED: 2005

NATURE OF BUSINESS: Oando PLC is one of Africa’s largest integrated NATUREOF BUSINESS:OasisCrescentPropertyFundManagersLtd.was

energy solutions provider with a proud heritage. It has a primary listing on established to manage and administer direct property funds that subscribe

the Nigeria Stock Exchange and a secondary listing on the Johannesburg to the principles of Islamic finance to enable investors to diversify the asset

Stock Exchange. With shared values of Teamwork, Respect, Integrity, allocation of their investment portfolio.

Passion and Professionalism (TRIPP). The Oando Group comprises four SECTOR: AltX

companies who are leaders in their market: Oando Energy Resources, NUMBER OF EMPLOYEES: 0

Oando Trading, OVH Energy. DIRECTORS: EbrahimAA(ind ne), Ebrahim Z,

SECTOR: Oil&Gas—Oil&Gas—Oil&Gas Prdcrs—Intgrtd Oil&Gas Mahomed Dr Y (ld ind ne), Mayman A (ind ne), Mohamed E (ind ne),

NUMBER OF EMPLOYEES: 137 Ebrahim M S (Chair), Ebrahim N (Dep Chair), Swingler M (FD)

DIRECTORS: AjiABG(ne, Nig), Akinrele A (ne, Nig), Irune Dr A A,

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Osakwe I (ind ne, Nig), Yakubu T (ind ne, Nig), ZubairuMM(Nig), Oasis Crescent Property Company (Pty) Ltd. 12.50%

GbadeboOMA (Chair, ind ne, Nig), Tinubu J (CEO, Nig), Oasis Crescent Equity Fund 12.40%

Boyo O (Deputy CEO, Nig), Adeyemo O (FD, Nig) Oasis Crescent Bal Progressive Fund of Funds 11.50%

POSTAL ADDRESS: PO Box 1217, Cape Town, 8000

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

Ocean and Oil Development Partners Ltd. 53.37% MORE INFO: www.sharedata.co.za/sdo/jse/OAS

Mangal Group 15.92% COMPANY SECRETARY: Nazeem Ebrahim

POSTAL ADDRESS: 9th -12th Floor, The Wings Office Complex, 17a TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ozumba Mbadiwe, Victoria Island, Lagos, Nigeria, PMB12801 DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/OAO AUDITORS: PwC Inc.

COMPANY SECRETARY: Ayotola Jagun

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. OAS Units no par - 65 203 334

AUDITORS: Ernst & Young DISTRIBUTIONS [ZARc]

Units no par Ldt Pay Amt Scr/100

CAPITAL STRUCTURE AUTHORISED ISSUED

OAO Ords of 50 kobo ea 30 000 000 000 12 431 412 481 Final No 29 2 Jun 20 8 Jun 20 48.79 2.25

Interim No 28 26 Nov 19 2 Dec 19 52.21 2.33

DISTRIBUTIONS [NGNk]

LIQUIDITY: Jul20 Ave 47 532 shares p.w., R1.0m(3.8% p.a.)

Ords of 50 kobo ea Ldt Pay Amt

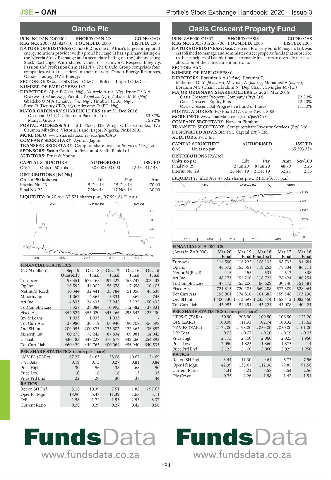

Interim No 23 5 Dec 14 15 Dec 14 70.00 SAPY 40 Week MA OASIS

Final No 22 7 Nov 14 17 Nov 14 30.00

2175

LIQUIDITY: Jul20 Ave 37 521 shares p.w., R7 994.8(-% p.a.)

1861

OILP 40 Week MA OANDO

416 1547

335 1233

253 919

605

172

2015 | 2016 | 2017 | 2018 | 2019 |

91 FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

10

2015 | 2016 | 2017 | 2018 | 2019 | Final Final Final(rst) Final Final

Turnover 114 590 116 225 106 135 98 733 94 684

FINANCIAL STATISTICS Op Inc 48 572 155 361 119 253 78 834 86 711

(NGN million)

NetIntPd(Rcvd) 115 155 531 - 512 - 338

Dec 18

Dec 16

Dec 15

Dec 17

Sep 19

Att Inc 48 173 155 206 118 722 78 424 86 254

Quarterly Final Final Final Final

Turnover 98 351 679 465 497 422 455 747 203 432 TotCompIncLoss 48 173 155 206 66 629 30 140 151 381

Op Inc 18 592 44 002 56 678 - 7 658 10 403

NetIntPd(Rcvd) 10 344 32 441 33 784 51 056 48 638 Fixed Ass 721 815 720 185 669 288 572 309 528 964

174 810

198 061

Tot Curr Ass

103 296

159 148

161 685

Minority Int 1 062 4 365 5 831 369 745

Att Inc 4 833 24 433 13 942 3 125 - 50 435 Ord SH Int 1 400 330 1 373 697 1 235 374 1 158 412 1 083 450

45 008

Tot Curr Liab

45 221

54 391

40 424

45 955

TotCompIncLoss 7 357 38 084 70 995 112 382 - 37 831

Fixed Ass 354 524 355 020 343 466 293 542 223 130 PER SHARE STATISTICS (cents per share)

Inv & Loans 1 033 1 033 1 033 - - HEPS-C (ZARc) 30.90 205.90 109.50 106.50 123.20

Tot Curr Ass 128 980 130 119 106 940 190 708 356 598 DPS (ZARc) 100.99 111.93 102.74 100.32 115.62

Ord SH Int 209 055 200 875 175 602 122 363 36 852 NAV PS (ZARc) 2 172.00 2 198.00 2 059.00 2 050.00 2 101.00

Minority Int 80 275 76 242 87 834 69 981 14 042 3 Yr Beta 0.02 - 0.07 - 0.10 - 0.19 - 0.03

LT Liab 330 183 348 228 376 677 342 260 254 893 Price High 2 175 2 100 2 060 2 025 1 950

Tot Curr Liab 460 429 449 765 400 064 456 940 640 535 Price Low 2 050 1 825 1 860 1 875 14

Price Prd End 2 125 2 100 2 060 2 025 1 950

PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 67.27 64.63 58.06 40.67 24.69 RATIOS 3.44 11.30 9.61 6.77 7.96

Ret on SH Fnd

3 Yr Beta 0.19 0.73 0.27 0.81 0.84

Price High 30 56 38 68 150 Oper Pft Mgn 42.39 133.67 112.36 79.85 91.58

3.58

Current Ratio

2.56

3.54

3.21

4.31

Price Low 10 16 16 13 33 Div Cover 0.75 2.26 1.98 1.43 1.51

Price Prd End 22 20 30 38 44

RATIOS

Ret on SH Fnd 8.15 10.39 7.51 1.82 - 97.63

Oper Pft Mgn 18.90 6.48 11.39 - 1.68 5.11

D:E 1.58 1.74 1.95 2.53 8.37

Current Ratio 0.28 0.29 0.27 0.42 0.56

184