Page 162 - Stock Exchange Handbook 2020 - Issue 3

P. 162

JSE – LIB Profile’s Stock Exchange Handbook: 2020 – Issue 3

that operate nationally across 31 sites located in Gauteng, Mpumalanga,

Liberty Two Degrees Kwa-Zulu Natal, Western Cape and Eastern Cape provinces.

LIB SECTOR: Consumer—Food&Bev—Food Producers—Food

ISIN: ZAE000260576 SHORT: LIBERTY2D CODE: L2D NUMBER OF EMPLOYEES: 7 592

REG NO: 2007/029492/07 FOUNDED: 2016 LISTED: 2016 DIRECTORS: Khanna S (ind ne), LandmanJP(ld ind ne), Masinga S (ind

NATURE OF BUSINESS: L2D has a quality, iconic property portfolio of ne), Smith R W, Luhabe W (Chair, ind ne), van Rensburg A V (CEO),

South African assets and was the first listed as a Collective Investment de Villiers C (CFO)

Scheme in Property(CISP) on the JSE in December 2016. With effect from

1 November 2018, L2D was reconstituted as a corporate REIT named as MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 37.00%

Apef Pacific Mauritius Ltd.

Liberty Two Degrees Ltd. (L2D).This better positions L2D for sustainable Government Employees Pension Fund 12.70%

growth whilst unlocking shareholder value. The group is engaged in Business Venture Investments 2071 5.80%

property investments and operates principally in South Africa. POSTAL ADDRESS: PO Box 630, Northlands, 2116

SECTOR: Fins—Rest—Inv—Div

NUMBER OF EMPLOYEES: 0 MORE INFO: www.sharedata.co.za/sdo/jse/LBR

COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd.

DIRECTORS: Adams Z (ne), Band A (ind ne), CesmanWE(ld ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MunroDC(ne), NelsonPG(ind ne), Ntuli L (ind ne), Beattie A (CEO),

Snyders J (FD) SPONSOR: Standard Bank of South Africa Ltd.

AUDITORS: Moore Stephens

MAJOR ORDINARY SHAREHOLDERS as at 11 Jun 2020

Liberty Group 58.50%

CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Asset Management (Pty) Ltd. 18.13% LBR Ords no par val 10 000 000 000 681 921 408

Public Investment Corporation (SOC) Ltd. 8.63%

POSTAL ADDRESS: PO Box 202, Melrose Arch, Johannesburg, 2076 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/L2D Ords no par val Ldt Pay Amt

COMPANY SECRETARY: Ben Swanepoel Final No 2 21 Sep 20 28 Sep 20 25.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 1 2 Apr 19 8 Apr 19 22.00

SPONSOR: Standard Bank of South Africa Ltd. LIQUIDITY: Jul20 Ave 2m shares p.w., R18.7m(18.4% p.a.)

AUDITORS: PwC Inc.

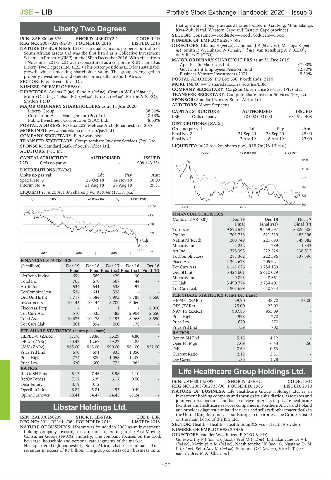

FOOD 40 Week MA LIBSTAR

1229

CAPITAL STRUCTURE AUTHORISED ISSUED

L2D Ords no par val - 908 443 334

1103

DISTRIBUTIONS [ZARc]

977

Units no par val Ldt Pay Amt

Special No 5 26 Oct 18 14 Nov 18 18.00

Interim No 4 21 Aug 18 27 Aug 18 29.31

852

LIQUIDITY: Jul20 Ave 3m shares p.w., R19.4m(17.5% p.a.)

726

SAPY 40 Week MA LIBERTY2D

600

1154 2018 | 2019 |

994 FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Dec 18 Dec 17

834

Final Final(rst) Final (P)

Turnover 9 892 545 9 659 597 8 826 506

674

Op Inc 701 758 621 519 485 196

NetIntPd(Rcvd) 208 749 221 693 149 882

513

Minority Int 1 232 789 1 343

353 Att Inc 278 395 222 224 136 512

2017 | 2018 | 2019 |

TotCompIncLoss 287 362 222 596 137 396

Fixed Ass 1 392 678 1 205 921 -

FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Oct 16 Tot Curr Ass 4 141 076 3 784 159 -

Final Final Final(rst) Final(rst) Final (P) Ord SH Int 5 424 601 5 410 079 -

NetRent/InvInc 694 589 429 30 - Minority Int 9 893 8 661 -

Total Inc 765 670 567 44 - LT Liab 3 490 774 2 734 401 -

Attrib Inc 534 641 538 97 - Tot Curr Liab 1 901 689 1 640 734 -

TotCompIncLoss 534 641 538 - -

Ord UntHs Int 8 717 8 584 8 993 8 788 8 650 PER SHARE STATISTICS (cents per share)

Investments 10 145 10 144 8 709 6 060 - HEPS-C (ZARc) 59.90 48.70 38.00

FixedAss/Prop - - 1 - 6 000 DPS (ZARc) 25.00 22.00 -

NAV PS (ZARc) 907.85 955.09 -

Tot Curr Ass 510 333 483 2 904 2 650

Total Ass 10 673 10 478 9 193 8 966 8 650 Price High 998 1 270 -

Tot Curr Liab 261 894 200 178 - Price Low 670 570 -

Price Prd End 759 700 -

PER SHARE STATISTICS (cents per share)

RATIOS

HEPLU-C (ZARc) 57.76 59.86 56.29 4.80 -

Ret on SH Fnd 5.15 4.12 -

DPLU (ZARc) 60.43 12.69 59.22 4.85 - Oper Pft Mgn 7.09 6.43 5.50

NAV (ZARc) 965.00 945.00 990.00 964.00 952.00 D:E 0.69 0.53 -

Price Prd End 670 691 835 1 050 - Current Ratio 2.18 2.31 -

Price High 774 880 1 058 1 200 - Div Cover 1.86 1.78 -

Price Low 620 660 775 985 -

RATIOS Life Healthcare Group Holdings Ltd.

RetOnSH Funds 6.13 7.46 5.98 1.10 -

LIF

RetOnTotAss 7.17 6.39 6.17 0.50 - ISIN: ZAE000145892 SHORT: LIFEHC CODE: LHC

Debt:Equity 0.19 0.12 - - - REG NO: 2003/002733/06 FOUNDED: 1983 LISTED: 2010

OperRetOnInv 6.84 5.81 4.93 0.49 - NATURE OF BUSINESS: Life Healthcare Group Holdings Ltd. is an

OpInc:Turnover 69.41 64.47 64.45 67.24 - investment holding company and through its subsidiaries, associates and

joint ventures operates and has extensive interests in private healthcare

Libstar Holdings Ltd. facilities and healthcare services companies in southern Africa and Poland

and provides diagnostic-related services and sells radiopharmaceuticals in

LIB the United Kingdom and various European territories. The Group is listed

ISIN: ZAE000250239 SHORT: LIBSTAR CODE: LBR on the main board of the JSE Ltd.

REG NO: 2014/032444/06 FOUNDED: 2014 LISTED: 2018 SECTOR: Health—Health—Health Equip&Srvcs—Health Providers

NATURE OF BUSINESS: Libstar was founded in 2005 as an investment NUMBER OF EMPLOYEES: 20 436

holding company investing in companies operating in the Fast Moving

Consumer Goods (FMCG) industry. The company focuses on the food, DIRECTORS: van der Westhuizen P (CEO & FD),

beverage, household and personal care segments of the market. GolesworthyPJ(ind ne), Jacobs Prof M (ind ne), Litlhakanyane DrVLJ

Headquartered in Johannesburg, South Africa, Libstar has annualised net (ind ne), MothupiAM(ind ne), NetshitenzheJK(ind ne), Ngatane Dr M

revenues in excess of R7 billion. The group consists of 28 business units P(ind ne), Sello Adv M (ind ne), SolomonGC(ind ne), ViceRT(snr

ind ne), Brey M A (Chair, ne)

160