Page 163 - Stock Exchange Handbook 2020 - Issue 3

P. 163

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – LIG

AUDITORS: BDO & Co

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

Allan Gray Investment Council 20.54%

PIC 15.53% CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund (PIC) 12.72% LTE Ords no par val - 730 575 237

POSTAL ADDRESS: Private Bag X13, Northlands, 2116 DISTRIBUTIONS [EURc]

MORE INFO: www.sharedata.co.za/sdo/jse/LHC Ords no par val Ldt Pay Amt

COMPANY SECRETARY: Avanthi Parboosing Interim No 8 19 May 20 25 May 20 1.58

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 7 26 Nov 19 2 Dec 19 1.50

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) LIQUIDITY: Jul20 Ave 3m shares p.w., R26.5m(24.4% p.a.)

AUDITORS: PwC Inc.

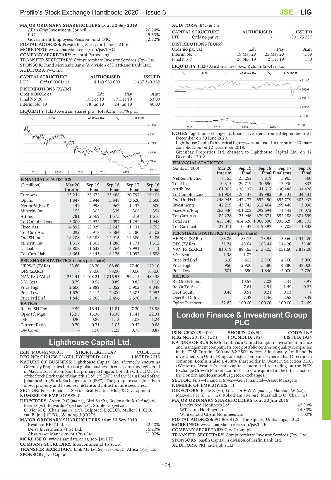

ALSH 40 Week MA LIGHTCAP

CAPITAL STRUCTURE AUTHORISED ISSUED

LHC Ords 0.0001c ea 4 149 980 000 1 467 349 162 31480

25297

DISTRIBUTIONS [ZARc]

Ords 0.0001c ea Ldt Pay Amt

Final No 20 10 Dec 19 17 Dec 19 53.00 19115

Interim No 19 18 Jun 19 24 Jun 19 40.00

12933

LIQUIDITY: Jul20 Ave 22m shares p.w., R489.3m(76.7% p.a.)

6750

HEAL 40 Week MA LIFEHC

4560 568

2016 | 2017 | 2018 | 2019 |

NOTES: Lighthouse changed its financial year-end from 30 September to 31

3901

December on 30 June 2020.

3243 Lighthouse Capital’shistoricalfigureswereadjustedintheratio1:20 share

consolidation on 12 December 2018.

2584 Greenbay Properties Ltd. changed to Lighthouse Capital Ltd. on 12

December 2018.

1925

FINANCIAL STATISTICS

(Amts in ‘000)

1267 Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

2015 | 2016 | 2017 | 2018 | 2019 |

Interim Final Final Final(rst) Final

NetRent/InvInc 7 155 25 252 8 819 5 965 360

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 Total Inc 10 315 29 719 30 690 13 930 833

Attrib Inc - 61 902 - 26 137 41 617 - 30 488 34 428

Interim Final Final Final Final

Turnover 13 244 25 672 23 488 20 797 16 404 TotCompIncLoss - 61 904 - 26 137 39 982 - 30 131 34 431

Op Inc 1 847 3 944 3 848 3 620 3 660 Ord UntHs Int 248 945 247 277 592 450 893 779 383 937

NetIntPd(Rcvd) 447 998 962 1 137 500 Investments 42 219 43 742 312 464 159 448 3 096

Minority Int 155 302 339 305 354 FixedAss/Prop 263 330 301 202 292 694 71 442 70 072

Att Inc 781 2 569 1 575 814 1 616 Tot Curr Ass 82 228 25 946 379 671 552 188 301 599

TotCompIncLoss 3 000 2 934 2 097 1 259 1 948 Total Ass 415 148 414 626 1 068 890 935 629 385 775

Fixed Ass 14 892 12 929 12 243 11 131 7 752 Tot Curr Liab 29 071 10 437 319 397 16 705 1 838

Tot Curr Ass 6 092 5 978 8 584 5 180 3 102

PER SHARE STATISTICS (cents per share)

Ord SH Int 18 208 16 188 14 916 14 380 5 486 HEPS-C (ZARc) - 188.86 - 83.75 123.95 - 150.60 1 344.20

Minority Int 1 317 1 303 1 286 1 171 1 312 DPS (ZARc) 31.74 48.64 168.44 144.20 35.40

LT Liab 13 808 11 632 14 764 9 991 6 111 NAV PS (ZARc) 810.19 895.65 2 136.05 3 051.60 2 819.00

Tot Curr Liab 8 661 8 443 8 176 11 097 4 588 3 Yr Beta 1.38 1.07 - - -

Price Prd End 610 802 2 700 4 760 3 060

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 53.80 88.70 108.80 77.40 179.10 Price High 950 2 900 5 580 4 880 48 000

DPS (ZARc) - 93.00 88.00 80.00 165.00 Price Low 501 650 1 840 3 000 2 720

NAV PS (ZARc) 1 251.41 1 103.21 1 016.53 992.14 489.38 RATIOS

3 Yr Beta 0.79 0.54 0.89 0.82 1.16 RetOnSH Funds - - 10.57 7.02 - 3.41 8.97

Price High 2 600 2 889 3 052 3 902 4 048 RetOnTotAss - 7.61 2.94 1.49 0.22

Price Low 1 620 2 112 2 300 2 305 2 953 Debt:Equity 0.48 0.51 0.21 0.03 -

Price Prd End 1 846 2 268 2 456 2 370 3 787 OperRetOnInv - 7.32 1.46 2.58 0.49

OpInc:Turnover 52.82 100.00 100.00 100.00 74.69

RATIOS

Ret on SH Fnd 9.59 16.41 11.81 7.20 28.98

Oper Pft Mgn 13.95 15.36 16.38 17.41 22.31 London Finance & Investment Group

D:E 0.90 0.86 1.13 1.08 1.24

Current Ratio 0.70 0.71 1.05 0.47 0.68 PLC

Div Cover - 1.90 1.23 0.78 0.87 LON

ISIN: GB0002994001 SHORT: LONFIN CODE: LNF

REG NO: 201151 (UK) FOUNDED: 1924 LISTED: 1924

Lighthouse Capital Ltd. NATURE OF BUSINESS: Lonfin is a United Kingdom investment finance

and management company. Its core portfolio centres on quality companies

LIG

ISIN: MU0461N00015 SHORT: LIGHTCAP CODE: LTE in the FTSE Eurofirst 300 and S&P 500 indices. Additionally, Lonfin holds

REG NO: C124756 C1/GBL FOUNDED: 2014 LISTED: 2015 investments in United Kingdom listed companies where it has Directors in

NATURE OF BUSINESS: Lighthouse Capital Ltd. (formerly known as common. Lonfin is also a 43.8% shareholder in Western Selection P.L.C.

Greenbay Properties Ltd.) is a global business licence company registered (Western). Western’s share capital is admitted to trading on the NEX

inMauritius. The companyhasprimary listingsonboth the Official Market Exchange Growth Market. Lonfin’s shares are quoted in the official lists of

of the Stock Exchange of Mauritius Ltd. (“SEM”)andthe Main Boardof the the London and Johannesburg stock exchanges.

Johannesburg Stock Exchange Ltd. (“JSE”). The group invests globally in SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

direct property and listed real estate and infrastructure securities. NUMBER OF EMPLOYEES: 11

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development DIRECTORS: Beale E (ne), Lucas DrFWA(ind ne), Marshall W (ne),

NUMBER OF EMPLOYEES: 0 MaxwellJH(snr ind ne), RobothamJM(ne), Marshall D C (Chair, ne)

DIRECTORS: AxtenDC(ind ne), Bird S (alt), Bodenstein K (ind ne), de MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Beer D (ne), Edwards P (ind ne, UK), Stuhler B (ind ne), Lynchwood Nominees Ltd. 47.80%

Olivier M C (Chair, ind ne, UK), Delport S E (CEO), Muller J J (CIO), WT Lamb Holdings Ltd. 14.80%

van Biljon J (CFO), Wandrag J (COO) Winterflood Client Nominees Ltd. 7.00%

POSTAL ADDRESS: PO Box 4126, The Square, Umhalanga, 4320

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

Resilient REIT Ltd. 22.40% MORE INFO: www.sharedata.co.za/sdo/jse/LNF

Delsa Investments (Pty) Ltd. 15.20% COMPANY SECRETARY: City Group plc

Absa Asset Management (Pty) Ltd. 11.00% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/LTE SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

COMPANY SECRETARY: Intercontinental Trust Ltd. AUDITORS: PKF Littlejohn LLP

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSOR: Java Capital

161