Page 159 - Stock Exchange Handbook 2020 - Issue 3

P. 159

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – KUM

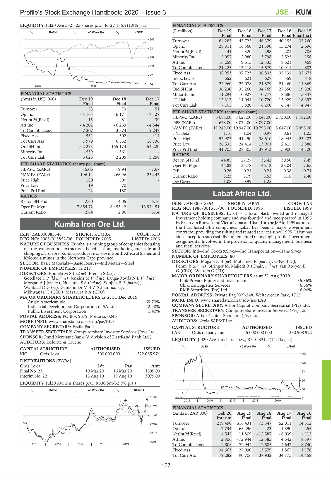

LIQUIDITY: Jul20 Ave 582 505 shares p.w., R127 185.9(1.9% p.a.) FINANCIAL STATISTICS

(R million)

BASM 40 Week MA KORE Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

Final Final Final Final Final(rst)

302

Turnover 64 285 45 725 46 379 40 155 35 260

Op Inc 28 811 16 360 21 390 15 274 2 696

244

NetIntPd(Rcvd) - 441 - 320 - 298 201 705

Minority Int 5 057 2 980 3 798 2 523 158

187

Att Inc 16 259 9 615 12 335 8 621 469

129

TotCompIncLoss 21 225 13 118 15 679 10 911 882

Fixed Ass 38 953 37 723 36 833 32 131 32 671

72

Inv & Loans 652 621 627 559 818

14 Tot Curr Ass 22 960 22 078 21 879 21 460 11 869

2018 | 2019 |

Ord SH Int 36 230 35 260 34 769 27 850 19 320

Minority Int 11 294 10 927 10 777 8 686 5 847

FINANCIAL STATISTICS

(Amts in USD’000) Dec 19 Dec 18 Dec 17 LT Liab 12 312 11 044 10 720 13 929 18 397

Tot Curr Liab 7 105 5 820 6 200 6 747 4 947

Final Final Final

Turnover 53 73 51

Op Inc - 4 163 - 6 171 - 7 127 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 15 81 39 HEPS-C (ZARc) 5 088.00 3 028.00 3 047.00 2 730.00 1 182.00 -

-

DPS (ZARc)

4 678.00 3 024.00 3 097.00

Att Inc - 4 202 - 6 269 - 4 344

TotCompIncLoss - 7 307 - 13 374 9 247 NAV PS (ZARc) 11 249.00 10 947.00 10 795.00 8 647.00 5 998.00

0.97

1.16

1.25

3 Yr Beta

0.61

1.04

Fixed Ass 561 302 414

Tot Curr Ass 7 979 6 532 16 736 Price High 52 903 41 490 38 610 18 945 25 102

26 535

24 414

2 415

2 886

13 901

Price Low

Ord SH Int 162 293 155 174 154 220 Price Prd End 41 705 28 305 37 913 15 900 4 120

Minority Int - 559 - 561 -

Tot Curr Liab 3 023 2 205 3 258 RATIOS

Ret on SH Fnd 44.85 27.27 35.42 30.50 2.49

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 44.82 35.78 46.12 38.04 7.65

HEPS-C (ZARc) - 5.06 - 9.94 - 7.67 D:E 0.26 0.24 0.24 0.38 0.74

NAV PS (ZARc) 196.14 266.96 252.43

Current Ratio 3.23 3.79 3.53 3.18 2.40

Price High 180 500 - Div Cover 1.08 0.99 1.25 - -

Price Low 19 70 -

Price Prd End 22 180 -

Labat Africa Ltd.

RATIOS

RetonSHFnd -2.60 - 4.05 -6.76 LAB

ISIN: ZAE000018354 SHORT: LABAT CODE: LAB

Oper Pft Mgn - 7 854.72 - 8 453.42 - 13 974.51 REG NO: 1986/001616/06 FOUNDED: 1995 LISTED: 1999

Current Ratio 2.64 2.96 5.14 NATURE OF BUSINESS: Labat is a local black owned and managed

Investment holding company and was founded and incorporated in 1995

Kumba Iron Ore Ltd. by BrianvanRooyenandVictor Labatandlistedonthe JSEin1999 asoneof

the first listed BEE companies. Labat has been a major Government

KUM contractor providing consulting and related services since 1995. Labat has

ISIN: ZAE000085346 SHORT: KUMBA CODE: KIO

REG NO: 2005/015852/06 FOUNDED: 2005 LISTED: 2006 since inception successfully implemented many high-profile Government

assignments. Involved in the provision of quality management, business

NATURE OF BUSINESS: Kumba is a mining group of companies focusing and retail services.

on the exploration, extraction, beneficiation, marketing and sale and SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

shipping ofironore.Kumba producesironoreinSouth Africa atSishenand

Kolomela mines in the Northern Cape province. NUMBER OF EMPLOYEES: 80

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Steel DIRECTORS: MogapiNS(ne), Mohamed R (ind ne), O’Neill D J,

NUMBER OF EMPLOYEES: 12 217 Penny B (ind ne), Stringer M, Majiedt R (Chair, ind ne), van Rooyen B

G (CEO), Walters G (FD)

DIRECTORS: BomelaMS(ind ne), French S (ne),

GoodlaceTP(ld ind ne), Jenkins M (ind ne), Langa-RoydsNB(ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019 35.86%

Link Private Equity and Investments

MorganAJ(ind ne), NtsalubaSS(ind ne), SonjicaBP(ind ne),

WanbladDG(ne), Gantsho DrMSV (Chair, ind ne), Chronos Logistics Services 6.66%

6.04%

RMB Securities (Pty) Ltd.

Mkhwanazi T (CEO), Mazarura B A (CFO)

POSTAL ADDRESS: Private Bag X09-248, Weltevreden Park, 1715

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 MORE INFO: www.sharedata.co.za/sdo/jse/LAB

Anglo American plc 69.70%

Industrial Development Corporation of SA Ltd. 12.90% COMPANY SECRETARY: Arbor Capital Company Secretarial (Pty) Ltd.

Public Investment Corporation 1.40% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 9679, Pretoria, 0046 SPONSOR: Arbor Capital Sponsors (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/KIO AUDITORS: Nexia SAB&T Inc.

COMPANY SECRETARY: Fazila Patel

CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LAB Ords no par value 5 000 000 000 390 908 922

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: Deloitte & Touche LIQUIDITY: Jul20 Ave 1m shares p.w., R510 331.1(14.1% p.a.)

ALSH 40 Week MA LABAT

CAPITAL STRUCTURE AUTHORISED ISSUED

KIO Ords 1c ea 500 000 000 322 085 974 150

DISTRIBUTIONS [ZARc]

122

Ords 1c ea Ldt Pay Amt

Final No 23 10 Mar 20 16 Mar 20 1599.00 93

Interim No 22 13 Aug 19 19 Aug 19 3079.00

65

LIQUIDITY: Jul20 Ave 2m shares p.w., R830.5m(32.9% p.a.)

INDM 40 Week MA KUMBA 36

51308 8

2015 | 2016 | 2017 | 2018 | 2019 |

41574

FINANCIAL STATISTICS

(Amts in ZAR’000)

31841 Feb 20 Aug 19 Aug 18 Aug 17 Aug 16

Interim Final Final Final Final

Turnover 219 490 616 431 73 347 52 011 14 312

22107

Op Inc 7 734 - 65 296 23 - 1 890 255

12374 NetIntPd(Rcvd) 4 545 11 809 - 12 587 - 6 039 - 112

Att Inc 2 806 - 72 944 12 585 4 642 8 397

2640

2015 | 2016 | 2017 | 2018 | 2019 | TotCompIncLoss 2 806 - 72 944 12 585 4 642 8 740

Fixed Ass 34 663 27 090 13 579 1 867 1 176

Tot Curr Ass 79 282 90 706 37 932 34 175 14 458

157