Page 166 - Stock Exchange Handbook 2020 - Issue 3

P. 166

JSE – MAS Profile’s Stock Exchange Handbook: 2020 – Issue 3

liquor and home improvement equipment and supplies, and the leading MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

wholesaler of basic foods. Barrange (Pty) Ltd. 29.00%

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets MDG Equity Holdings (Pty) Ltd. 25.90%

NUMBER OF EMPLOYEES: 51 000 Kagiso Asset Management 11.80%

DIRECTORS: Gwagwa DrNN(ind ne), Ighodaro O (ne, Nig), POSTAL ADDRESS: PO Box 902, Fochville, 2515

Langeni P (ld ind ne), Mthimunye-BakoroLE(ne), Muigai S (ne, Can), MORE INFO: www.sharedata.co.za/sdo/jse/MDI

Redfield C (ne, USA), SuarezJP(ne, USA), Dlamini K D (Chair, ind ne), COMPANY SECRETARY: Andrew Colin Beaven

Slape M (CEO, USA), Abdool-Samad M (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 03 Mar 2020

Main Street 830 (Pty) Ltd. (Walmart) 53.00% AUDITORS: BDO SA

Investec Asset Management 9.00%

Franklin Resources Inc. 6.00% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: Private Bag X4, Sunninghill, 2157 MDI Ords no par value 500 000 000 150 592 777

MORE INFO: www.sharedata.co.za/sdo/jse/MSM DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Nicole Morgan (Interim) Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 3 14 May 19 20 May 19 26.00

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. Final No 2 15 May 18 21 May 18 26.00

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jul20 Ave 380 801 shares p.w., R3.5m(13.1% p.a.)

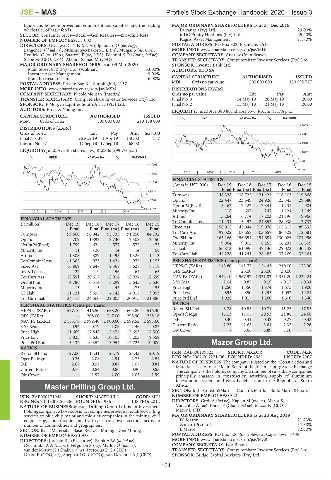

CAPITAL STRUCTURE AUTHORISED ISSUED IIND 40 Week MA MASTDRILL

MSM Ords of 1c ea 500 000 000 219 138 809

1835

DISTRIBUTIONS [ZARc]

Ords of 1c ea Ldt Pay Amt Scr/100 1572

Final No 38 26 Mar 19 1 Apr 19 140.00 1.57

Interim No 37 11 Sep 18 17 Sep 18 68.00 - 1310

LIQUIDITY: Jul20 Ave 4m shares p.w., R203.6m(99.7% p.a.)

1047

GERE 40 Week MA MASSMART

785

17903

522

2015 | 2016 | 2017 | 2018 | 2019 |

14750

FINANCIAL STATISTICS

11597

(Amts in USD’000) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

8444 Final Final(rst) Final(rst) Final Final

Turnover 148 328 138 722 121 424 118 103 119 868

5290 Op Inc 22 447 23 649 24 926 25 845 29 580

NetIntPd(Rcvd) 3 462 2 122 2 341 1 131 904

2137 Minority Int 118 697 247 1 124 1 149

2015 | 2016 | 2017 | 2018 | 2019 |

Att Inc 15 264 16 774 17 203 21 196 19 966

FINANCIAL STATISTICS TotCompIncLoss 11 434 5 492 24 853 28 938 2 737

(R million)

Fixed Ass 158 015 145 044 119 076 105 317 89 532

Dec 19

Dec 16

Dec 17

Dec 15

Dec 18

Final Final Final(rst) Final(rst) Final

Turnover 93 660 90 942 93 735 91 250 84 732 Tot Curr Ass 99 522 108 658 103 657 86 422 72 681

Op Inc 709 1 892 2 730 2 508 2 150 Ord SH Int 165 166 156 654 154 681 130 025 101 956

NetIntPd(Rcvd) 1 799 624 577 572 475 Minority Int 9 964 9 002 8 255 16 291 16 309

Minority Int 11 - 20 14 14 56 LT Liab 56 873 61 096 47 136 29 023 30 148

Att Inc - 1 308 889 1 495 1 326 1 113 Tot Curr Liab 44 228 41 241 28 485 37 269 32 164

TotCompIncLoss - 1 365 973 1 424 975 1 153 PER SHARE STATISTICS (cents per share)

Fixed Ass 16 869 9 647 9 368 8 628 8 118 HEPS-C (ZARc) 148.80 141.77 154.43 210.00 175.90

Inv & Loans 127 119 156 164 165 DPS (ZARc) - 26.00 26.00 30.00 -

Tot Curr Ass 18 591 20 617 18 914 18 924 18 699 NAV PS (ZARc) 1 542.10 1 567.97 1 331.82 1 351.20 1 239.24

Ord SH Int 4 786 6 514 6 299 5 645 5 636 3 Yr Beta 1.04 0.87 0.19 - 0.17 - 0.34

Minority Int 15 15 43 75 155 Price High 1 250 1 550 1 874 1 675 1 900

LT Liab 11 121 3 695 4 142 4 917 3 053 Price Low 895 850 1 255 1 093 1 121

Tot Curr Liab 24 416 24 560 22 005 20 975 21 886 Price Prd End 1 028 1 017 1 260 1 500 1 340

RATIOS

PER SHARE STATISTICS (cents per share)

Ret on SH Fnd 8.78 10.55 10.71 15.25 17.85

HEPS-C (ZARc) - 527.10 416.50 688.20 605.80 516.30

DPS (ZARc) - 208.00 347.00 298.90 258.16 Oper Pft Mgn 15.13 17.05 20.53 21.88 24.68

NAV PS (ZARc) 2 183.78 2 999.40 2 900.60 2 599.52 2 595.60 D:E 0.40 0.41 0.32 0.27 0.33

3 Yr Beta 0.92 0.77 1.06 1.46 0.87 Current Ratio 2.25 2.63 3.64 2.32 2.26

Price High 11 669 17 848 15 474 15 653 17 500 Div Cover - 5.66 5.89 7.00 -

Price Low 3 825 8 635 10 105 8 203 9 559

Price Prd End 5 132 10 352 13 954 12 723 10 000 Mazor Group Ltd.

MAZ

RATIOS

Ret on SH Fnd - 27.00 13.31 23.79 23.43 20.19 ISIN: ZAE000109823 SHORT: MAZOR CODE: MZR

Oper Pft Mgn 0.76 2.08 2.91 2.75 2.54 REG NO: 2007/017221/06 FOUNDED: 1981 LISTED: 2007

D:E 2.67 0.93 0.87 1.07 0.81 NATURE OF BUSINESS: The company is listed on the “Construction and

Materials” sector of the Main Board of the Johannesburg Stock Exchange.

Current Ratio 0.76 0.84 0.86 0.90 0.85 The company is the holding company of a number of subsidiary companies

Div Cover - 1.97 2.00 2.05 1.99 principally engaged in construction activities, supply of aluminium

fenestration systems and glass beneficiation in the Republic of South

Master Drilling Group Ltd. Africa.

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs

MAS

ISIN: ZAE000171948 SHORT: MASTDRILL CODE: MDI NUMBER OF EMPLOYEES: 522

REG NO: 2011/008265/06 FOUNDED: 1986 LISTED: 2012 DIRECTORS: Groll A (ind ne), Kaplan M (ind ne), Mazor S,

NATURE OF BUSINESS: Master Drilling Group Ltd. is an investment Varachhia A (ne), Boner F (Chair, ind ne), Mazor R (CEO),

holdingcompany,whosesubsidiarycompaniesprovidespecialiseddrilling Mazor L (FD)

services to blue chip major and mid-tier companies in the mining, civil MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2019

engineering, construction and hydro-electric power sectors, across a DJ Mazor 21.23%

number of commodities and geographies. Zomar (Pty) Ltd. 17.38%

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining L Mazor 12.80%

NUMBER OF EMPLOYEES: 1 958 POSTAL ADDRESS: PO Box 60635, Tableview, Cape Town, 7439

DIRECTORS: Jordaan B J (Executive), BrinkAW(ld ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MZR

DeshmukhAA(ind ne), Ferguson S (ne), Matloa O (ind ne), COMPANY SECRETARY: Ivor Bloom

van der Merwe H (Chair, ind ne), Pretorius D C (CEO), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Dixon E (COO, alt), Sheppard G R (COO), van Deventer A J (CFO) SPONSOR: Bridge Capital Advisors (Pty) Ltd.

164