Page 157 - Stock Exchange Handbook 2020 - Issue 3

P. 157

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – KAA

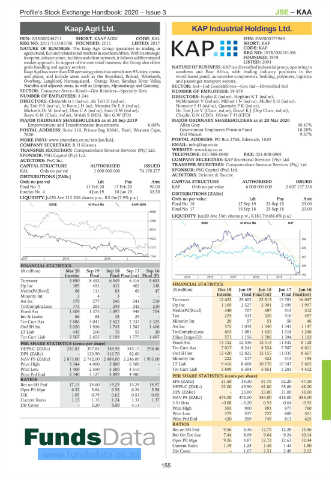

Kaap Agri Ltd. KAP Industrial Holdings Ltd.

KAA KAP

ISIN: ZAE000244711 SHORT: KAAP AGRI CODE: KAL ISIN: ZAE000171963

REG NO: 2011/113185/06 FOUNDED: 2011 LISTED: 2017 SHORT: KAP

NATURE OF BUSINESS: The Kaap Agri Group specialises in trading in CODE: KAP

agricultural,fuelandrelatedretailmarketsinsouthernAfrica.Withitsstrategic REG NO: 1978/000181/06

footprint, infrastructure, facilitiesandclient network, it followsadifferentiated FOUNDED: 1978

market approach. In support of the core retail business, the Group also offers LISTED: 2004

grain handling and agency services. NATUREOF BUSINESS:KAPisadiversifiedindustrialgroup, operatingin

KaapAgrihasmorethan200operatingpointsthatstretchover95cities,towns southern and East Africa, with leading industry positions in the

and places, and include areas such as the Swartland, Boland, Winelands, wood-based panel, automotive components, bedding, polymers, logistics

Overberg, Langkloof, Namaqualand, Orange River, Sundays River Valley, and passenger transport sectors.

Namibia and adjacent areas, as well as Limpopo, Mpumalanga and Gauteng. SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Specialty Rets NUMBER OF EMPLOYEES: 19 579

NUMBER OF EMPLOYEES: 3 244 DIRECTORS: Fuphe Z (ind ne), HopkinsKT(ind ne),

DIRECTORS: Chalumbira I (ind ne), du Toit D (ind ne), McMenamin V (ind ne), MkhariIN(ind ne), MüllerSH(ind ne),

du ToitBS(ind ne), le RouxJH(ne), Messina DrEA(ind ne), NomveteSH(ind ne), QuarmbyPK(ind ne),

Michaels Dr W (ind ne), OttoCA(ind ne), SmitHM(ind ne), Du Toit J de V (Chair, ind ne), Grové K J (Dep Chair, ind ne),

Steyn G M (Chair, ind ne), Walsh S (MD), Sim G W (FD) Chaplin G N (CEO), Olivier F H (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 MAJOR ORDINARY SHAREHOLDERS as at 20 Mar 2020

Empowerment and Transformation Investments 6.00% Allan Gray 30.47%

POSTAL ADDRESS: Suite 110, Private Bag X3041, Paarl, Western Cape, Government Employees Pension Fund 10.28%

7620 Old Mutual 9.87%

MORE INFO: www.sharedata.co.za/sdo/jse/KAL POSTAL ADDRESS: PO Box 2766, Edenvale, 1610

COMPANY SECRETARY: R H Köstens EMAIL: info@kap.co.za

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. WEBSITE: www.kap.co.za

SPONSOR: PSG Capital (Pty) Ltd. TELEPHONE: 021-808-0900 FAX: 021-808-0901

AUDITORS: PwC Inc. COMPANY SECRETARY: KAP Secretarial Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

KAL Ords no par val 1 000 000 000 74 170 277 SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

Ords no par val Ldt Pay Amt

Final No 5 11 Feb 20 17 Feb 20 90.00 KAP Ords no par value 6 000 000 000 2 607 137 238

Interim No 4 4 Jun 19 10 Jun 19 33.50

LIQUIDITY: Jul20 Ave 112 206 shares p.w., R3.0m(7.9% p.a.) DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

GERE 40 Week MA KAAP AGRI Final No 18 17 Sep 19 23 Sep 19 23.00

Final No 17 18 Sep 18 25 Sep 18 23.00

8688

LIQUIDITY: Jun20 Ave 33m shares p.w., R181.7m(66.6% p.a.)

7299

GENI 40 Week MA KAP

5910

4522 784

3133 626

1744 467

2017 | 2018 | 2019 |

309

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

150

Interim Final Final Final(rst) Final (P) 2015 | 2016 | 2017 | 2018 | 2019 |

Turnover 4 890 8 452 6 549 6 416 5 653

Op Inc 309 493 431 402 338 FINANCIAL STATISTICS

NetIntPd(Rcvd) 68 111 83 69 47 (R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Minority Int 3 4 3 - - Interim Final Final(rst) Final Final(rst)

Att Inc 170 277 246 241 210 Turnover 12 622 25 602 22 813 19 783 16 047

TotCompIncLoss 173 283 249 242 210 Op Inc 1 169 2 527 2 901 2 499 1 997

Fixed Ass 1 604 1 375 1 097 948 754 NetIntPd(Rcvd) 340 707 697 515 312

Inv & Loans 66 68 38 29 - Tax 224 533 520 510 487

Tot Curr Ass 2 886 3 041 2 622 2 333 2 325 Minority Int 29 57 51 50 46

Ord SH Int 2 020 1 926 1 743 1 582 1 406 Att Inc 575 1 033 1 540 1 343 1 147

LT Liab 445 206 76 53 30 TotCompIncLoss 603 1 081 1 630 1 318 1 246

Tot Curr Liab 2 507 2 655 2 109 1 775 1 697 Hline Erngs-CO 571 1 156 1 596 1 394 1 163

Fixed Ass 13 152 12 536 12 513 11 832 8 128

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 241.83 397.85 348.98 345.15 298.46 Tot Curr Ass 7 017 8 241 8 524 7 587 6 611

DPS (ZARc) - 123.50 116.70 82.60 - Ord SH Int 12 420 12 825 12 155 11 035 8 667

NAV PS (ZARc) 2 873.00 2 742.00 2 484.00 2 246.00 1 995.00 Minority Int 222 217 322 313 195

Price High 3 344 4 000 5 800 6 500 - LT Liab 9 416 8 468 10 176 10 347 5 665

Price Low 1 400 2 550 3 500 4 510 - Tot Curr Liab 5 899 6 594 5 851 5 283 4 412

Price Prd End 2 340 3 127 3 899 4 980 -

PER SHARE STATISTICS (cents per share)

RATIOS EPS (ZARc) 21.50 38.30 57.70 52.20 47.10

Ret on SH Fnd 17.15 14.60 14.29 15.24 14.97 HEPS-C (ZARc) 22.00 45.90 61.60 55.60 48.20

Oper Pft Mgn 6.32 5.84 6.58 6.26 5.98 DPS (ZARc) - 23.00 23.00 21.00 18.00

D:E 1.05 0.79 0.62 0.53 0.65

Current Ratio 1.15 1.15 1.24 1.31 1.37 NAV PS (ZARc) 474.00 474.00 454.00 415.00 355.00

- 0.20

- 0.08

0.95

0.64

0.53

3 Yr Beta

Div Cover - 3.20 3.00 4.14 -

Price High 593 900 991 977 760

Price Low 375 537 727 600 501

Price Prd End 420 559 749 813 625

RATIOS

Ret on SH Fnd 9.56 8.36 12.75 12.28 13.46

Ret On Tot Ass 7.44 8.09 9.64 9.24 10.14

Oper Pft Mgn 9.26 9.87 12.72 12.63 12.44

Current Ratio 1.19 1.25 1.46 1.44 1.50

Div Cover - 1.67 2.51 2.49 2.62

155