Page 118 - Stock Exchange Handbook 2020 - Issue 3

P. 118

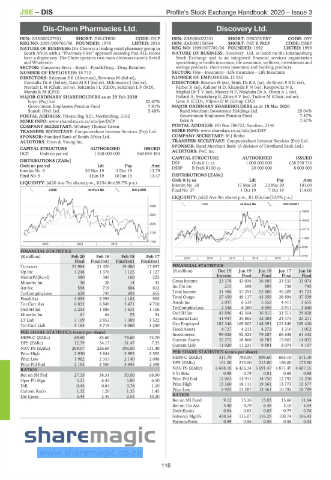

JSE – DIS Profile’s Stock Exchange Handbook: 2020 – Issue 3

Dis-Chem Pharmacies Ltd. Discovery Ltd.

DIS DIS

ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP ISIN: ZAE000022331 SHORT: DISCOVERY CODE: DSY

REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016 ISIN: ZAE000158564 SHORT: DSY B PREF CODE: DSBP

NATURE OF BUSINESS: Dis-Chem is a leading retail pharmacy group in REG NO: 1999/007789/06 FOUNDED: 1992 LISTED: 1999

South Africa with a “Pharmacy First” approach meaning that ALL stores NATURE OF BUSINESS: Discovery Ltd. is listed on the Johannesburg

have a dispensary. Dis-Chem operates two main divisions namely Retail Stock Exchange and is an integrated financial services organisation

and Wholesale. specialising in health insurance, life assurance, wellness, investments and

SECTOR: Consumer Srvcs—Retail—Food&Drug—Drug Retailers savings products, short-term insurance and banking products.

NUMBER OF EMPLOYEES: 18 710 SECTOR: Fins—Insurance—Life Insurance—Life Insurance

DIRECTORS: Saltzman S E (Alternate), Bowman M (ind ne), NUMBER OF EMPLOYEES: 12 950

Coovadia Dr A (ind ne), GaniMSI(ind ne), Mthimunye J (ind ne), DIRECTORS: Bosman H (ne), Brink DrBA(ne), de BruynSEN(ne),

Nestadt L M (Chair, ind ne), Saltzman I L (CEO), Saltzman L F (MD), Farber R (ne), Kallner H D, KhanyileFN(ne), Koopowitz N S,

Morais R M (CFO) Maphai DrTV(ne), Mayers H P, Ntsaluba Dr A, OwenAL(ne),

Pollard A, Swartzberg B, ZilwaSV(ne), Tucker M (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Ivlyn (Pty) Ltd. 52.67% Gore A (CEO), Viljoen D M (Group CFO)

Government Employees Pension Fund 7.91% MAJOR ORDINARY SHAREHOLDERS as at 18 Mar 2020

Stansh (Pty) Ltd. 5.48% Rand Merchant Investment Holdings Ltd. 25.04%

POSTAL ADDRESS: Private Bag X21, Northriding, 2162 Government Employees Pension Fund 7.87%

MORE INFO: www.sharedata.co.za/sdo/jse/DCP Gore A 7.67%

COMPANY SECRETARY: Whitney Thomas Green POSTAL ADDRESS: PO Box 786722, Sandton, 2146

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/DSY

SPONSOR: Standard Bank of South Africa Ltd. COMPANY SECRETARY: M J Botha

AUDITORS: Ernst & Young Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: PwC Inc.

DCP Ords no par val 1 500 000 000 860 084 483

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] DSY Ords 0.1c ea 1 000 000 000 658 290 736

Ords no par val Ldt Pay Amt DSBP B Prefs R100 ea 20 000 000 8 000 000

Interim No 6 26 Nov 19 2 Dec 19 12.79

Final No 5 4 Jun 19 10 Jun 19 13.47 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul20 Ave 7m shares p.w., R154.8m(39.7% p.a.) Ords 0.1c ea Ldt Pay Amt

Interim No 28 17 Mar 20 23 Mar 20 101.00

CONS 40 Week MA DIS-CHEM Final No 27 1 Oct 19 7 Oct 19 114.00

LIQUIDITY: Jul20 Ave 9m shares p.w., R1 056.6m(70.9% p.a.)

LIFE 40 Week MA DISCOVERY

3382

19000

2963

16555

2545

14110

2126

11665

1708

2017 | 2018 | 2019 |

9220

FINANCIAL STATISTICS

(R million) Feb 20 Feb 19 Feb 18 Feb 17 2015 | 2016 | 2017 | 2018 | 2019 | 6775

Final Final(rst) Final(rst) Final(rst)

Turnover 23 984 21 420 19 480 17 897 FINANCIAL STATISTICS

Op Inc 1 248 1 376 1 125 1 127 (R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

NetIntPd(Rcvd) 380 345 160 225 Interim Final Final Final Final

Minority Int 30 28 14 43 Gross Income 23 378 43 036 36 685 33 533 33 074

Att Inc 598 719 684 612 Inc Fm Inv 215 398 895 758 745

TotCompIncLoss 628 747 698 655 Total Income 31 486 57 253 52 800 45 209 43 723

Fixed Ass 3 095 2 995 1 182 995 Total Outgo 27 450 49 117 43 059 38 894 37 539

Tot Curr Ass 6 832 6 849 5 471 4 710 Attrib Inc 2 037 6 533 5 652 4 411 3 655

Ord SH Int 2 253 1 886 1 631 1 106 TotCompIncLoss 2 336 6 280 6 656 2 911 3 640

Ord SH Int 43 896 42 304 36 815 31 511 29 828

Minority Int 61 64 55 24

LT Liab 3 109 2 852 1 389 1 522 Actuarial Liab 41 947 35 865 32 084 24 373 23 211

Tot Curr Liab 5 163 5 719 4 060 3 250 Cap Employed 182 346 169 002 148 091 122 849 109 420

Fixed Assets 4 727 4 212 4 272 1 210 1 052

PER SHARE STATISTICS (cents per share) Investments 99 026 92 523 79 287 66 638 61 332

HEPS-C (ZARc) 69.60 83.60 79.60 74.70 Current Assets 22 272 18 868 18 783 15 865 14 032

DPS (ZARc) 12.79 34.17 31.47 7.35 Current Liab 11 920 11 231 9 891 8 074 9 157

NAV PS (ZARc) 269.07 226.69 196.00 131.40

Price High 2 930 3 844 3 995 2 592 PER SHARE STATISTICS (cents per share)

Price Low 1 982 2 353 2 140 2 048 HEPS-C (ZARc) 311.70 789.00 899.60 683.10 571.10

Price Prd End 2 162 2 580 3 445 2 398 DPS (ZARc) 101.00 215.00 215.00 186.00 175.50

NAV PS (ZARc) 6 668.18 6 426.34 5 691.47 4 871.49 4 607.15

RATIOS

Ret on SH Fnd 27.15 38.31 50.00 66.90 3 Yr Beta 0.98 0.79 0.81 0.69 0.88

Oper Pft Mgn 5.21 6.42 5.80 6.50 Price Prd End 12 063 14 911 14 750 12 792 12 250

D:E 0.44 0.64 0.76 1.10 Price High 15 360 18 111 19 361 13 773 15 577

Current Ratio 1.32 1.20 1.35 1.45 Price Low 9 903 13 287 12 561 10 792 10 789

Div Cover 5.44 2.45 2.53 10.20 RATIOS

Ret on SH Fund 9.12 15.16 15.03 13.66 11.94

Ret on Tot Ass 4.40 4.79 6.48 5.10 5.54

Debt:Equity 0.94 0.83 0.85 0.75 0.76

Solvency Mgn% 438.54 115.07 116.29 108.74 106.43

Payouts:Prem 0.59 0.56 0.56 0.58 0.54

116