Page 122 - Stock Exchange Handbook 2020 - Issue 3

P. 122

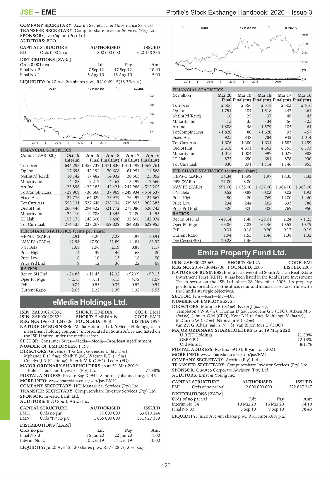

JSE – EME Profile’s Stock Exchange Handbook: 2020 – Issue 3

COMPANY SECRETARY: Acorim Secretarial & Governance Services

MEDI 40 Week MA EMEDIA

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd. 3939

AUDITORS: BDO

3199

CAPITAL STRUCTURE AUTHORISED ISSUED

ELI Ords 0.001c ea 800 000 000 620 158 235 2458

1718

DISTRIBUTIONS [ZARc]

Ords 0.001c ea Ldt Pay Amt

Final No 2 7 Sep 12 17 Sep 12 10.00 977

Final No 1 5 Aug 10 16 Aug 10 5.00

237

LIQUIDITY: Jul20 Ave 2m shares p.w., R210 694.5(18.2% p.a.) 2015 | 2016 | 2017 | 2018 | 2019 |

ALSH 40 Week MA ELLIES

FINANCIAL STATISTICS

251 (R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final(rst) Final(rst) Final(rst) Final(rst)

201 Turnover 2 506 2 356 2 318 2 303 2 416

Op Inc - 1 751 184 - 1 518 242 261

152

NetIntPd(Rcvd) 16 25 37 48 43

Minority Int 73 35 - 34 56 - 25

103

Att Inc - 1 888 48 - 1 579 105 - 64

53 TotCompIncLoss - 1 820 80 - 1 620 93 - 57

Fixed Ass 925 848 784 942 1 014

4

2015 | 2016 | 2017 | 2018 | 2019 | Tot Curr Ass 1 606 1 380 1 631 1 583 1 259

Ord SH Int 2 618 4 601 4 562 6 155 6 103

FINANCIAL STATISTICS Minority Int 1 075 1 004 997 1 027 988

(Amts in ZAR’000) Oct 19 Apr 19 Apr 18 Apr 17 Apr 16

LT Liab 875 650 684 878 990

Interim Final Final(rst) Final(rst) Final(rst)

Turnover 644 293 1 357 739 1 371 830 1 311 492 1 362 761 Tot Curr Liab 830 891 1 114 1 146 955

Op Inc - 17 696 - 42 194 70 608 - 61 954 14 568 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 10 142 17 482 14 932 20 563 25 052 HEPS-C (ZARc) 34.34 15.99 1.97 18.35 7.33

Minority Int - 4 188 - 9 212 - 4 163 - 3 499 - 2 560 DPS (ZARc) 21.00 8.00 - - -

Att Inc - 25 896 - 22 183 42 421 - 245 986 - 512 205 NAV PS (ZARc) 591.00 1 038.00 1 027.00 1 384.00 1 369.00

TotCompIncLoss - 29 969 - 30 660 37 969 - 249 934 - 514 637 3 Yr Beta 0.52 0.88 - 0.03 - 0.02 1.93

Fixed Ass 27 776 64 029 75 979 76 492 124 567 Price High 450 420 769 1 200 1 460

Tot Curr Ass 558 131 527 646 638 134 639 853 962 383 Price Low 234 244 262 633 786

Ord SH Int 266 446 294 422 321 772 278 086 520 743 Price Prd End 320 300 300 769 950

Minority Int - 24 110 - 19 788 - 11 343 - 7 180 - 1 455 RATIOS

LT Liab 153 175 148 300 7 490 32 806 142 074 Ret on SH Fnd - 49.14 1.48 - 29.01 2.24 - 1.25

Tot Curr Liab 274 435 237 267 459 029 484 832 629 955 Oper Pft Mgn - 69.86 7.82 - 65.46 10.52 10.79

D:E 0.31 0.18 0.20 0.17 0.19

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 2.91 - 3.26 7.28 - 4.97 - 50.91 Current Ratio 1.94 1.55 1.46 1.38 1.32

NAV PS (ZARc) 42.96 47.50 51.89 44.84 83.97 Div Cover(EPS) - 20.28 1.36 - - -

3 Yr Beta 1.68 1.96 2.19 0.88 1.17

Price High 14 39 46 68 120 Emira Property Fund Ltd.

Price Low 8 10 13 18 50

EMI

Price Prd End 9 12 36 22 68 ISIN: ZAE000203063 SHORT: EMIRA CODE: EMI

REG NO: 2014/130842/06 FOUNDED: 2003 LISTED: 2003

RATIOS

Ret on SH Fnd - 24.83 - 11.43 12.32 - 92.09 - 99.13 NATURE OF BUSINESS: Emira is a diversified South African Real Estate

Oper Pft Mgn - 2.75 - 3.11 5.15 - 4.72 1.07 Investment Trust (REIT). It has been listed in the Real Estate Investment

Trusts sector on the JSE Ltd. since 28 November 2003. Its property

D:E 0.84 0.55 0.33 0.57 0.54 portfolioisspreadacrossthe office, retail andindustrialsectorsinlinewith

Current Ratio 2.03 2.22 1.39 1.32 1.53 the Fund’s strategic objectives.

SECTOR: Fins—Rest—Inv—Div

eMedia Holdings Ltd. NUMBER OF EMPLOYEES: 25

DIRECTORS: Moroole B (ind ne), Nyker J (ind ne),

EME

ISIN: ZAE000208898 SHORT: E MEDIA CODE: EMH TempletonJWA(ne), Thomas D (ne), Booyens G S (CFO), Aitken M S

ISIN: ZAE000209524 SHORT: E MEDIA-N CODE: EMN (ind ne), Jennett G M (CEO), KentBH(ind ne), Mahlangu V (ind ne),

REG NO: 1968/011249/06 FOUNDED: 1968 LISTED: 1994 McCurrie W (ind ne), Nkonyeni V (ind ne),

NATURE OF BUSINESS: eMedia Holdings Ltd. (eMedia Holdings) is an van Zyl G (Chair, ind ne, Namb), van Biljon Mrs U (COO)

investment holding company, incorporated in South Africa and listed on MAJOR ORDINARY SHAREHOLDERS as at 19 May 2020

the JSE Limited under the media sector. U REIT Holdings 21.89%

SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment GEPF/PIC 12.13%

NUMBER OF EMPLOYEES: 1 198 Old Mutual 8.11%

DIRECTORS: GovenderTG(ne), Govender L (ld ind ne), POSTAL ADDRESS: PO Box 69104, Bryanston, 2021

Mphande E (ind ne), Shaik Y (ne), WatsonRD(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/EMI

Copelyn J A (Chair, ne), Sheriff M K (CEO), Lee A (FD) COMPANY SECRETARY: Acorim (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Fulela Trade and Invest 81 (Pty) Ltd. 77.98% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

POSTAL ADDRESS: Private Bag X9944, Sandton, Johannesburg, 2146 AUDITORS: Ernst & Young Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/EMH

CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. EMI Ords of no par val 2 000 000 000 522 667 247

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: BDO South Africa Inc. Ords of no par val Ldt Pay Amt

Interim No 34 10 Mar 20 16 Mar 20 74.10

Final No 33 3 Sep 19 9 Sep 19 78.48

CAPITAL STRUCTURE AUTHORISED ISSUED

EMH Ords no par 70 000 000 63 810 244

EMN Ords “N” no par 1 055 000 000 381 927 359 LIQUIDITY: Jul20 Ave 4m shares p.w., R51.3m(43.8% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

Final No 3 15 Jun 20 22 Jun 20 11.00

Interim No 2 10 Dec 19 17 Dec 19 10.00

LIQUIDITY: Jul20 Ave 12 120 shares p.w., R37 628.7(1.0% p.a.)

120