Page 120 - Stock Exchange Handbook 2020 - Issue 3

P. 120

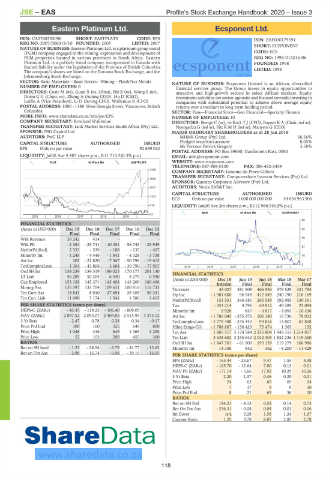

JSE – EAS Profile’s Stock Exchange Handbook: 2020 – Issue 3

Eastern Platinum Ltd. Ecsponent Ltd.

EAS ECS

ISIN: CA2768555096 SHORT: EASTPLATS CODE: EPS ISIN: ZAE000179594

REG NO: 2007/006318/10 FOUNDED: 2005 LISTED: 2007 SHORT: ECSPONENT

NATURE OF BUSINESS: Eastern Platinum Ltd. is a platinum group metal

(PGM) company engaged in the mining, exploration and development of CODE: ECS

PGM properties located in various provinces in South Africa. Eastern REG NO: 1998/013215/06

Platinum Ltd. is a publicly listed company incorporated in Canada with FOUNDED: 1998

limited liability under the legislation of the Province of British Columbia.

The company’s shares are listed on the Toronto Stock Exchange, and the LISTED: 1998

Johannesburg Stock Exchange.

SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals NATURE OF BUSINESS: Ecsponent Limited is an African, diversified

NUMBER OF EMPLOYEES: 0 financial services group. The Group invess in equity opportunities in

DIRECTORS: Cosic M (ne), Guan X (ne, China), Shi B (ne), Wang S (ne), attractive and high-growth sectors in select African markets. Equity

Dorin G G (Chair, ne), Zhang A (Acting COO), Hu D (CEO), investment activities are sector-agnostic and focused towards investing in

Lubbe A (Vice President), Li D (Acting CFO), Wallenius R (CFO) companies with substantial potential to achieve above average equity

POSTAL ADDRESS: 1080 - 1188 West Georgia Street, Vancouver, British returns over a medium to long term holding period.

Columbia SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

MORE INFO: www.sharedata.co.za/sdo/jse/EPS NUMBER OF EMPLOYEES: 10

COMPANY SECRETARY: Rowland Wallenius DIRECTORS: Beetge C (ne), de Kock T J (CFO), Rayner K A (Chair, ind ne),

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Nyengedza G (ind ne), Pitt R M H (ind ne), Manyere G (CEO)

SPONSOR: PSG Capital Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 28 Jun 2019

AUDITORS: PwC LLP MHMK Group (Pty) Ltd. 56.56%

Pledged securities account 8.05%

CAPITAL STRUCTURE AUTHORISED ISSUED Mr Terence Patrick Gregory 3.58%

EPS Ords no par value - 92 639 032

POSTAL ADDRESS: PO Box 39660, Garsfontein East, 0060

LIQUIDITY: Jul20 Ave 4 487 shares p.w., R11 710.2(0.3% p.a.) EMAIL: info@ecsponent.com

PLAT 40 Week MA EASTPLATS WEBSITE: www.ecsponent.com

TELEPHONE: 087-808-0100 FAX: 086-432-3459

3336

COMPANY SECRETARY: Lezanne du Preez-Cilliers

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

2682

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

2027 AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

1372

ECS Ords no par value 1 000 000 000 000 44 054 963 906

718 LIQUIDITY: Jun20 Ave 2m shares p.w., R112 966.9(0.2% p.a.)

ASIN 40 Week MA ECSPONENT

63

2015 | 2016 | 2017 | 2018 | 2019 |

65

FINANCIAL STATISTICS

(Amts in USD’000) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 52

Final Final Final Final Final

Wrk Revenue 39 242 414 - - - 40

Wrk Pft - 2 384 - 25 741 - 10 451 - 56 745 - 29 949

27

NetIntPd(Rcd) 2 533 - 539 - 188 - 135 - 407

Minority Int - 1 249 - 4 446 - 1 841 - 4 328 - 3 738 15

Att Inc 103 - 21 820 - 7 367 - 50 796 - 19 615

TotCompIncLoss 1 364 - 43 806 3 604 - 39 790 - 77 907 2015 | 2016 | 2017 | 2018 | 2019 | 2

Ord SH Int 138 239 134 319 180 025 170 177 201 130

LT Liab 56 289 50 204 6 340 8 279 6 590 FINANCIAL STATISTICS

(Amts in ZAR’000)

Cap Employed 153 158 145 371 145 408 143 200 180 498 Dec 19 Jun 19 Jun 18 Mar 18 Mar 17

Mining Ass 135 397 133 704 109 631 100 816 116 733 Turnover Interim 381 909 466 984 379 529 321 795

Final

Final

Final

Final

45 027

Tot Curr Ass 18 843 8 010 27 694 29 105 59 331 Op Inc - 1 981 800 96 948 412 449 240 190 218 169

Tot Curr Liab 11 690 5 174 1 541 1 586 3 615

NetIntPd(Rcvd) 151 531 346 681 260 585 192 985 130 351

Tax - 353 214 4 796 69 812 49 289 23 094

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 43.35 - 119.25 - 106.40 - 809.05 - Minority Int 5 928 847 - 4 817 - 4 093 - 10 436

NAV (ZARc) 2 097.52 2 093.07 2 404.85 2 515.95 3 373.12 Att Inc - 1 786 045 - 255 376 102 180 16 736 78 012

3 Yr Beta - 2.47 0.78 0.28 0.34 - 0.17 TotCompIncLoss - 1 779 488 - 245 440 94 816 13 807 67 858

Price Prd End 300 160 325 649 800 Hline Erngs-CO - 1 788 867 - 136 423 75 474 1 363 132

Price High 1 048 416 649 1 365 2 295 Tot Ass 1 805 517 3 174 584 2 235 804 1 943 315 1 214 817

Price Low 52 103 200 455 360 Tot Liab 3 638 682 3 235 642 2 042 303 1 832 236 1 119 260

Ord SH Int - 1 847 501 - 61 900 193 139 119 279 106 986

RATIOS

Ret on SH fund - 1.23 - 28.54 - 6.79 - 41.77 - 13.62 Minority Int 14 336 842 362 - 8 200 - 11 429

Ret on Tot Ass - 2.98 - 16.74 - 6.98 - 39.10 - 16.05

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 165.44 - 23.67 9.47 1.55 8.38

HEPS-C (ZARc) - 165.70 - 12.64 7.00 0.13 0.01

NAV PS (ZARc) - 171.14 - 5.66 17.92 10.29 10.26

3 Yr Beta 2.20 1.37 0.46 0.20 0.01

Price High 24 63 69 69 24

Price Low 7 17 9 9 10

Price Prd End 8 21 65 36 10

RATIOS

Ret on SH Fnd 194.21 - 4.13 0.53 0.14 0.73

Ret On Tot Ass - 236.31 - 0.08 0.04 0.01 0.06

Int Cover n/a 0.28 1.58 1.24 1.67

Current Ratio 1.25 3.78 8.07 2.85 2.78

118