Page 114 - Stock Exchange Handbook 2020 - Issue 3

P. 114

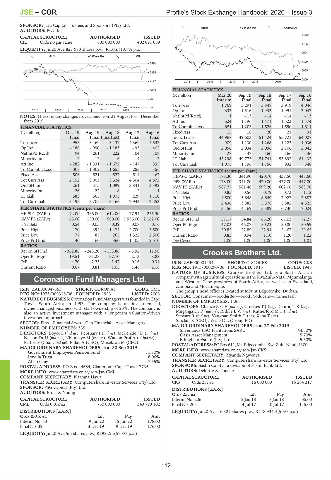

JSE – COR Profile’s Stock Exchange Handbook: 2020 – Issue 3

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

GENF 40 Week MA CORONAT

AUDITORS: PwC Inc.

14123

CAPITAL STRUCTURE AUTHORISED ISSUED

CIL Ords no par value 600 000 000 402 091 069 11858

LIQUIDITY: Jul20 Ave 827 973 shares p.w., R1.0m(10.7% p.a.)

9594

ALSH 40 Week MA CIL

7329

3594

5065

2885

2800

2177 2015 | 2016 | 2017 | 2018 | 2019 |

1469 FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

760

Interim Final Final Final Final

Turnover 1 769 3 291 3 848 3 919 4 046

52

2015 | 2016 | 2017 | 2018 | 2019 | Op Inc 832 1 516 1 933 1 991 2 047

NOTES: The company changed its year-end from 31 August to 31 December NetIntPd(Rcvd) 1 - 13 - 14 - 14 - 13

from 2019. Att Inc 624 1 196 1 471 1 523 1 574

TotCompIncLoss 651 1 203 1 526 1 590 1 611

FINANCIAL STATISTICS

(R million) Dec 19 Aug 19 Aug 18 Aug 17 Aug 16 Fixed Ass 15 18 20 21 31

Inv & Loans 44 967 49 603 51 424 55 721 64 007

Final Final Final(rst) Final Final

Turnover 955 3 169 3 137 4 369 4 532 Tot Curr Ass 909 1 130 1 268 1 122 1 036

Op Inc - 186 - 990 - 1 183 - 93 402 Ord SH Int 2 056 2 034 2 096 2 106 2 042

NetIntPd(Rcvd) 94 261 222 104 108 Minority Int 127 147 160 166 136

Minority Int - 2 - 12 - 6 - 4 - 2 LT Liab 45 298 49 775 51 744 55 892 64 432

Att Inc - 282 - 1 331 - 1 672 - 147 395 Tot Curr Liab 1 075 1 196 1 156 932 848

TotCompIncLoss - 307 - 1 302 - 1 655 283 456

PER SHARE STATISTICS (cents per share)

Fixed Ass 506 521 527 514 467 HEPS-C (ZARc) 178.30 341.90 420.70 437.50 447.60

Tot Curr Ass 2 152 3 003 3 324 4 304 4 872 DPS (ZARc) 178.00 341.00 420.00 437.00 447.00

Ord SH Int 261 575 1 099 3 841 3 392 NAV PS (ZARc) 587.77 581.48 599.20 602.06 583.76

Minority Int - 26 - 22 - 8 - 2 1 3 Yr Beta 0.85 0.56 0.79 0.73 1.12

LT Liab 583 565 1 075 229 1 110 Price High 4 500 5 648 8 649 7 922 7 882

Tot Curr Liab 3 195 3 705 3 166 2 943 2 253 Price Low 2 436 3 882 5 378 5 882 4 525

Price Prd End 3 150 4 169 5 389 6 730 7 024

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 72.00 - 366.00 - 612.00 - 77.94 255.30 RATIOS

NAV PS (ZARc) 65.00 150.00 560.00 1 956.00 2 162.00 Ret on SH Fnd 57.17 54.84 65.20 67.03 72.27

3 Yr Beta 0.54 - 0.05 0.39 0.08 0.76 Oper Pft Mgn 47.03 46.07 50.23 50.80 50.59

Price High 170 394 1 474 2 700 3 580 D:E 20.82 22.89 22.94 24.67 29.65

Price Low 77 85 265 1 322 2 500 Current Ratio 0.85 0.94 1.10 1.20 1.22

Price Prd End 140 160 360 1 405 2 570 Div Cover 1.00 1.00 1.00 1.00 1.01

RATIOS

Ret on SH Fnd - 362.86 - 243.20 - 153.86 - 3.92 11.58 Crookes Brothers Ltd.

Oper Pft Mgn - 19.51 - 31.23 - 37.70 - 2.13 8.88

CRO

D:E 4.70 2.23 1.47 0.16 0.34 ISIN: ZAE000001434 SHORT: CROOKES CODE: CKS

Current Ratio 0.67 0.81 1.05 1.46 2.16 REG NO: 1913/000290/06 FOUNDED: 1913 LISTED: 1948

NATURE OF BUSINESS: Crookes Brothers Ltd. is a South African

Coronation Fund Managers Ltd. company with agricultural operationsin the KwaZulu-Natal,Mpumalanga

and Western Cape provinces of South Africa, as well as in Swaziland,

COR Zambia and Mozambique.

ISIN: ZAE000047353 SHORT: CORONAT CODE: CML The group’s head office is located at Mount Edgecombe, Durban.

REG NO: 1973/009318/06 FOUNDED: 1993 LISTED: 2003 SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

NATURE OF BUSINESS:Coronation FundManagers wasfounded in Cape

Town, South Africa in 1993. The company is an investment-led, NUMBER OF EMPLOYEES: 1 066

owner-managed business, with staff ownership of 25%. The company is DIRECTORS: ChanceRGF(ind ne), CrookesTJ(ne), DentonTK(ne),

also an active investment manager with a long-term valuation-driven Mnganga Dr P (ind ne), RiddleLW(ne), RutherfordMT(ind ne),

investment approach. Stewart R (ind ne), Vaughan-Smith G (ne), Xaba T (ne),

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers Sinclair K (CEO), Veale G L (Group FD)

NUMBER OF EMPLOYEES: 335 MAJOR ORDINARY SHAREHOLDERS as at 27 Feb 2019 44.80%

Silverlands (SA) Plantations SARL

DIRECTORS: Boyce L (ind ne), February J (ind ne), McKenzieJD(ind ne), Oasis Asset Management 5.70%

Nelson Dr H (ind ne), Nhlumayo M (ind ne), Watson Prof A (ld ind ne), Ellingham Estate (Pty) Ltd. 5.50%

Pather S (Chair, ind ne), Pillay A (CEO), Musekiwa M (CFO)

POSTAL ADDRESS:POBox611, Mt.Edgecombe, KwaZulu-Natal,4300

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 MORE INFO: www.sharedata.co.za/sdo/jse/CKS

Government Employees Pension Fund 11.70%

Imvula Trust 8.06% COMPANY SECRETARY: Ziyanda Ngwenya

Allan Gray 7.55% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 44684, Claremont, Cape Town, 7735 SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/CML AUDITORS: Deloitte & Touche

COMPANY SECRETARY: Nazrana Hawa

CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CKS Ords 25c ea 16 000 000 15 264 317

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Ernst & Young DISTRIBUTIONS [ZARc]

Ords 25c ea Ldt Pay Amt

Interim No 206 2 Jan 18 8 Jan 18 35.00

CAPITAL STRUCTURE AUTHORISED ISSUED

CML Ords 0.01c ea 750 000 000 349 799 102 Final No 205 4 Jul 17 10 Jul 17 115.00

LIQUIDITY: Jul20 Ave 16 327 shares p.w., R748 934.4(5.6% p.a.)

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

Interim No 33 9 Jun 20 15 Jun 20 178.00

Final No 32 3 Dec 19 9 Dec 19 176.00

LIQUIDITY: Jul20 Ave 5m shares p.w., R198.2m(67.8% p.a.)

112