Page 182 - SHBe20.vp

P. 182

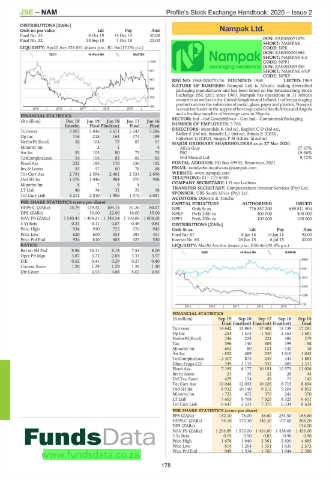

JSE – NAM Profile’s Stock Exchange Handbook: 2020 – Issue 2

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Nampak Ltd.

Final No 23 8 Oct 19 14 Oct 19 30.00 NAM

Final No 22 25 Sep 18 1 Oct 18 22.00 ISIN: ZAE000071676

SHORT: NAMPAK

LIQUIDITY: Apr20 Ave 228 841 shares p.w., R1.9m(17.0% p.a.) CODE: NPK

ISIN: ZAE000004966

TECH 40 Week MA MUSTEK

SHORT: NAMPAK 6.5

1099 CODE: NPP1

ISIN: ZAE000004958

951 SHORT: NAMPAK 6%P

CODE: NPKP

803 REG NO: 1968/008070/06 FOUNDED: 1968 LISTED: 1969

NATURE OF BUSINESS: Nampak Ltd. is Africa’s leading diversified

656

packaging manufacturer and has been listed on the Johannesburg Stock

Exchange (JSE Ltd.) since 1969. Nampak has operations in 11 African

508

countries as well as in the United Kingdom and Ireland. It offers packaging

products across the substrates of metal, glass, paper and plastics. Nampak

360

2015 | 2016 | 2017 | 2018 | 2019 | is a market leader in the supply of beverage cansin South Africa andAngola

and a leading supplier of beverage cans in Nigeria.

FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Containers&Packaging

Interim Final Final(rst) Final Final NUMBER OF EMPLOYEES: 5 766

Turnover 3 007 5 846 5 671 5 243 5 286 DIRECTORS: Mzondeki K (ind ne), RaphiriCD(ind ne),

Ridley S (ind ne), SenneloLJ(ind ne), Smuts E (CEO),

Op Inc 116 218 163 174 189

Fullerton G (CFO), Surgey P M (Chair, ld ind ne)

NetIntPd(Rcvd) 56 104 77 87 91 MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020

Minority Int - 2 1 - 4 Allan Gray 27.67%

Att Inc 53 105 80 73 75 PIC 19.98%

TotCompIncLoss 54 106 83 66 83 Old Mutual Ltd. 9.72%

Fixed Ass 222 185 170 156 152 POSTAL ADDRESS: PO Box 69983, Bryanston, 2021

Inv & Loans 55 57 60 78 68 EMAIL: nondyebo.mqulwana@nampak.com

Tot Curr Ass 2 791 2 594 2 461 2 533 2 696 WEBSITE: www.nampak.com

Ord SH Int 1 078 1 046 984 970 988 TELEPHONE: 011-719-6300

Minority Int 8 7 9 8 - COMPANY SECRETARY: I H van Lochem

LT Liab 40 34 31 29 18 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Tot Curr Liab 2 211 2 010 1 906 1 972 2 081 SPONSOR: UBS South Africa (Pty) Ltd.

AUDITORS: Deloitte & Touche

PER SHARE STATISTICS (cents per share) CAPITAL STRUCTURE AUTHORISED ISSUED

HEPS-C (ZARc) 75.79 139.32 104.15 81.26 80.07 NPK Ords 5c ea 776 857 200 689 811 504

DPS (ZARc) - 30.00 22.00 16.00 15.00 NPKP Prefs 200c ea 400 000 400 000

NAV PS (ZARc) 1 540.43 1 494.21 1 348.54 1 169.08 1 008.08 NPP1 Prefs 200c ea 100 000 100 000

3 Yr Beta 0.21 0.11 0.07 0.49 0.64 DISTRIBUTIONS [ZARc]

Price High 934 930 725 576 945 Ords 5c ea Ldt Pay Amt

Price Low 620 600 353 385 451 Final No 87 8 Jan 16 18 Jan 16 92.00

Price Prd End 934 810 685 423 530 Interim No 86 26 Jun 15 6 Jul 15 42.00

RATIOS LIQUIDITY: Mar20 Ave 6m shares p.w., R50.4m(42.8% p.a.)

Ret on SH Fnd 9.86 10.11 8.18 7.53 8.00

GENI 40 Week MA NAMPAK

Oper Pft Mgn 3.87 3.72 2.88 3.31 3.57

5969

D:E 0.52 0.41 0.29 0.27 0.40

Current Ratio 1.26 1.29 1.29 1.28 1.30

4801

Div Cover - 4.93 4.66 5.02 4.94

3633

2465

1298

130

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final(rst) Final(rst) Final(rst) Final

Turnover 14 642 15 963 17 402 19 139 17 291

Op Inc 254 1 575 1 430 2 163 1 681

NetIntPd(Rcvd) 246 224 221 486 279

Tax 396 140 304 199 - 58

Minority Int - 662 80 121 - 132 18

Att Inc - 852 489 235 1 610 1 043

TotCompIncLoss - 2 307 873 239 444 1 883

Hline Erngs-CO 349 1 115 937 681 1 311

Fixed Ass 7 195 8 177 10 151 10 573 11 026

Inv in Assoc 21 35 22 28 44

Def Tax Asset 429 174 49 71 145

Tot Curr Ass 10 048 12 032 10 026 8 715 8 894

Ord SH Int 8 932 10 140 9 312 9 204 8 802

Minority Int - 722 472 370 241 370

LT Liab 7 603 9 768 7 925 8 325 6 611

Tot Curr Liab 6 647 5 533 7 375 6 334 8 624

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 132.10 76.00 36.60 254.50 165.60

HEPS-C (ZARc) 54.10 173.30 146.30 107.60 208.20

DPS (ZARc) - - - - 134.00

NAV PS (ZARc) 1 294.89 1 573.00 1 454.00 1 438.00 1 456.00

3 Yr Beta 0.19 0.50 0.85 0.90 0.90

Price High 1 678 1 940 2 361 2 820 4 885

Price Low 814 1 264 1 551 1 635 2 572

Price Prd End 949 1 534 1 760 1 944 2 580

178