Page 178 - SHBe20.vp

P. 178

JSE – MOT Profile’s Stock Exchange Handbook: 2020 – Issue 2

POSTAL ADDRESS:POBox1719, Edenvale,1610

Motus Holdings Ltd. EMAIL: justineo@motuscorp.co.za

MOT WEBSITE: www.motuscorp.co.za

ISIN: ZAE000261913 TELEPHONE: 010-493-4335

SHORT: MOTUS COMPANY SECRETARY: Janine Jefferies

CODE: MTH

REG NO: 2017/451730/06 TRANSFER SECRETARY: Computershare

FOUNDED: 2017 Investor Services (Pty) Ltd.

LISTED: 2018 SPONSOR:TheStandardBankofSouthAfricaLtd.

AUDITORS: Deloitte & Touche

Scan the QR code to

NATURE OF BUSINESS: visit our website BANKERS:FirstNationalBankLtd.,NedbankLtd.

Motus Holdings Ltd. (“Motus”) is a South African-based

holding company with a selected international presence CALENDAR Expected Status

primarily in the United Kingdom (“UK”), Australia, and Next Final Results 26 Aug 2020 Confirmed

limited presence in South East Asia and Southern and East Annual General Meeting 10 Nov 2020 Confirmed

Africa.Through its subsidiaries andassociates, it operates as a Next Interim Results Feb 2021 Unconfirmed

diversified (non-manufacturing) business in the automotive CAPITAL STRUCTURE AUTHORISED ISSUED

sector. Motus participates in the entire automotive value MTH Ords no par val 394 999 000 196 513 720

chain through its four business segments namely: Import and

Distribution, Retail and Rental, Motor-Related Financial DISTRIBUTIONS [ZARc]

Pay

Ldt

Amt

Services and Aftermarket Parts. Ords no par val 17 Sep 19 23 Sep 19 250.00

Final No 2

The activities of Motus’ business segments are described Interim No 1 18 Mar 19 25 Mar 19 240.00

below:

*Import and Distribution: Exclusive South African importer LIQUIDITY: Mar20 Ave 4m shares p.w., R291.5m(94.6% p.a.)

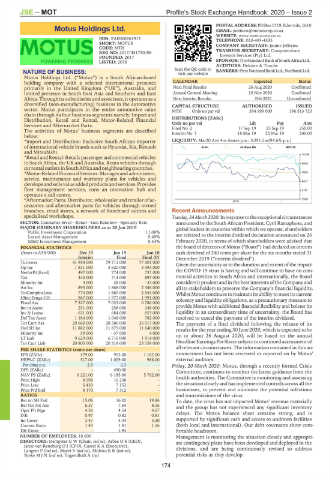

of international vehicle brands such as Hyundai, Kia, Renault ALSH 40 Week MA MOTUS

and Mitsubishi.

*Retailand Rental:Retails passenger and commercialvehicles 10189

in South Africa, the UK and Australia. Rents vehicles through 8939

carrentaloutletsinSouthAfricaandneighbouringcountries.

*Motor-Related Financial Services: Manages and administers, 7688

service, maintenance and warranty plans for vehicles and

developsandsellsvalueaddedproducts andservices. Provides 6437

fleet management services, runs an innovation hub and 5187

operates a call centre.

*Aftermarket Parts: Distributor, wholesaler and retailer of ac- 2019 | 3936

cessories and aftermarket parts for vehicles through owned

branches, retail stores, a network of franchised outlets and Recent Announcements

specialised workshops. Tuesday,24March2020:Inresponsetotheexceptionalcircumstances

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Specialty Rets announced by the South African President, Cyril Ramaphosa, and

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 global leaders in countries within which we operate, shareholders

Public Investment Corporation 11.09% are referred to the interim dividend declaration announced on 26

Lazard Asset Management 9.49%

M&G Investment Management 8.44% February 2020, in terms of which shareholders were advised that

FINANCIAL STATISTICS the board of directors of Motus (“Board”) had declared an interim

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 cash dividend of 240 cents per share for the six months ended 31

Interim Final Final (P) December 2019 (“interim dividend”).

Turnover 41 954 000 79 711 000 77 001 000 Given the uncertainty as to the duration and extent of the impact

Op Inc 1 831 000 3 620 000 3 593 000

NetIntPd(Rcvd) 497 000 774 000 737 000 the COVID-19 virus is having and will continue to have on com-

Tax 344 000 714 000 897 000 mercial activities in South Africa and internationally, the Board

Minority Int 4 000 28 000 - 33 000 considers it prudent and in the best interests of the Company and

Att Inc 895 000 1 868 000 2 346 000 all its stakeholders to preserve the Company’s financial liquidity.

TotCompIncLoss 774 000 1 680 000 2 544 000 Whilst Motus continues to maintain its ability to meet its current

Hline Erngs-CO 967 000 1 977 000 1 991 000 solvency and liquidity obligations, as a precautionary measure to

Fixed Ass 7 327 000 7 023 000 6 786 000

Inv in Assoc 251 000 258 000 348 000 provide Motus with additional financial flexibility and bolster its

Inv & Loans 631 000 684 000 653 000 liquidity in an extraordinary time of uncertainty, the Board has

Def Tax Asset 1 184 000 1 048 000 782 000 resolved to cancel the payment of the interim dividend.

Tot Curr Ass 29 660 000 28 586 000 26 917 000 The payment of a final dividend following the release of its

Ord SH Int 11 882 000 11 875 000 11 640 000 results for the year ending 30 June 2020, which is expected to be

Minority Int 59 000 - 37 000 4 000 on or about 26 August 2020, will be based on the annual

LT Liab 9 629 000 6 716 000 1 914 000

Tot Curr Liab 20 805 000 20 318 000 23 158 000 Headline EarningsPer Share subject to continuedassessment of

all relevant circumstances. The information contained in this an-

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 479.00 953.00 1 162.00 nouncement has not been reviewed or reported on by Motus’

HEPS-C (ZARc) 517.00 1 009.00 986.00 external auditors.

Pct chng p.a. 2.5 2.3 - Friday, 20 March 2020: Motus, through a recently formed Crisis

DPS (ZARc) - 490.00 - Committee, continues to monitor the latest guidance from the

NAV PS (ZARc) 6 221.00 6 185.00 5 762.00

Price High 8 598 10 238 - health authorities. The Committee is monitoring and assessing

Price Low 6 430 7 152 - thesituationcloselyandhasimplementedcontrolsacrossallthe

Price Prd End 8 170 7 312 - businesses, to prevent and minimise the potential infections

RATIOS and transmissions of the virus.

Ret on SH Fnd 15.06 16.02 19.86 To date, the virus has not impacted Motus’ revenue materially

Ret On Tot Ass 6.57 7.64 8.16 and the group has not experienced any significant inventory

Oper Pft Mgn 4.36 4.54 4.67

D:E 0.97 0.82 0.81 delays. The Motus balance sheet remains strong, and is

Int Cover 3.47 4.34 5.30 supported by significant cash and access to undrawn facilities

Current Ratio 1.43 1.41 1.16 (both local and international). Our debt covenants show com-

Div Cover - 1.94 - fortable headroom.

NUMBER OF EMPLOYEES: 18 600 Management is monitoring the situation closely and appropri-

DIRECTORS: Dempster G W (Chair, ind ne), Arbee O S (CEO), ate contingency plans have been developed and deployed in the

Janse van Rensburg O J (CFO), Cassel K A (Executive), divisions, and are being continuously revised to address

Langeni P (ind ne), Mayet S (ind ne), MolokoKR(ind ne),

NjekeMJN(ind ne), Tugendhaft A (ne) potential risks as they develop.

174