Page 185 - SHBe20.vp

P. 185

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – NET

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Financial Admin POSTAL ADDRESS: Private Bag X34, Benmore, 2010

NUMBER OF EMPLOYEES: 3 146 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NTC

DIRECTORS: Mockett A (ind ne), PeinAJK(ne), Singh-Bushell E (ind COMPANY SECRETARY: Lynelle Bagwandeen

ne, USA), Seabrooke C S (Chair, ne), Edwards P (Dep Chair, ne, UK), TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

Kotzé H G (CEO), SmithAMR (CFO, UK) SPONSOR: Nedbank Corporate and Investment Banking

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 AUDITORS: Deloitte & Touche

IFC Investors 17.65%

International Value Advisers, LLC 14.38% CAPITAL STRUCTURE AUTHORISED ISSUED

Prescott Group Capital Management 10.03% NTC Ords 1c ea 2 500 000 000 1 451 843 229

POSTAL ADDRESS: PO Box 2424, Parklands, 2121 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NT1 Ords 1c ea Ldt Pay Amt

COMPANY SECRETARY: A M R Smith Final No 21 21 Jan 20 27 Jan 20 64.00

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Interim No 20 2 Jul 19 8 Jul 19 47.00

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) LIQUIDITY: Apr20 Ave 30m shares p.w., R601.4m(108.1% p.a.)

AUDITORS: Deloitte & Touche

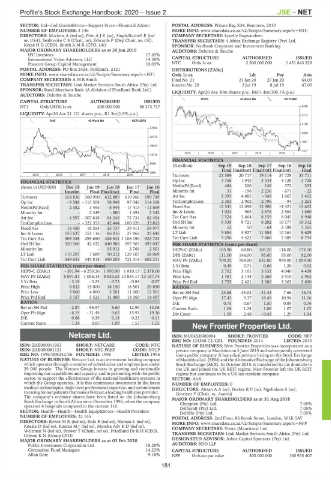

HEES 40 Week MA NETCARE

CAPITAL STRUCTURE AUTHORISED ISSUED

NT1 Ords USD0.1c ea 200 000 000 56 373 737 4286

LIQUIDITY: Apr20 Ave 21 121 shares p.w., R1.3m(1.9% p.a.)

3712

IIND 40 Week MA NET1UEPS

3138

27500

2565

22772

1991

18044

1417

2015 | 2016 | 2017 | 2018 | 2019 |

13316

FINANCIAL STATISTICS

8588

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final(rst) Final(rst) Final(rst) Final

3860

2015 | 2016 | 2017 | 2018 | 2019 | Turnover 21 589 20 717 19 114 37 729 33 711

FINANCIAL STATISTICS Op Inc 3 768 1 942 3 534 4 128 3 728

(Amts in USD’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 NetIntPd(Rcvd) 484 326 146 372 333

Interim Final Final(rst) Final Final Minority Int 31 - 196 - 2 236 - 671 - 22

Turnover 154 836 360 990 612 889 610 066 590 749 Att Inc 2 393 4 885 - 549 1 667 2 412

Op Inc - 9 588 - 113 508 58 949 97 043 114 368 TotCompIncLoss 2 383 2 902 - 2 796 - 94 3 263

NetIntPd(Rcvd) 2 582 3 495 - 8 944 - 17 413 - 11 869 Fixed Ass 12 541 12 098 13 908 14 421 13 622

Minority Int - 2 349 - 880 1 694 2 342 Inv & Loans 1 024 965 2 876 2 564 1 680

Att Inc - 4 597 - 307 618 64 246 75 734 82 454 Tot Curr Ass 5 524 5 464 8 159 8 045 8 948

TotCompIncLoss - - 322 353 42 444 100 026 33 815 Ord SH Int 9 539 9 721 8 282 10 177 10 312

Fixed Ass 16 450 18 554 25 737 39 411 54 977 Minority Int 52 50 - 64 2 188 3 325

Inv & Loans 155 627 151 116 86 016 27 862 25 645 LT Liab 5 884 5 927 11 584 10 161 8 629

Tot Curr Ass 309 358 295 650 426 841 1 106 190 923 723 Tot Curr Liab 5 296 4 422 7 666 7 489 8 754

Ord SH Int 320 560 42 432 640 986 597 569 493 047 PER SHARE STATISTICS (cents per share)

Minority Int - - 95 911 2 766 2 501 HEPS-C (ZARc) 165.90 68.80 169.20 118.00 174.10

LT Liab 119 297 7 689 90 212 129 107 58 069 DPS (ZARc) 111.00 144.00 95.00 95.00 92.00

Tot Curr Liab 249 653 345 818 390 205 721 314 602 211 NAV PS (ZARc) 709.22 764.00 652.00 959.00 1 059.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.49 0.71 0.66 1.20 0.92

HEPS-C (ZARc) - 381.94 - 6 250.26 1 993.90 1 810.13 2 378.00 Price High 2 762 3 161 3 632 4 040 4 438

NAV PS (ZARc) 8 091.81 1 056.14 8 835.53 13 834.17 13 187.74 Price Low 1 481 2 144 2 268 2 910 2 962

3 Yr Beta - 3.18 - 3.23 - 0.75 - 0.84 0.57 Price Prd End 1 755 2 421 2 380 3 363 3 630

Price High 6 822 15 000 18 150 18 501 29 850 RATIOS

Price Low 3 860 4 000 3 501 11 000 12 501 Ret on SH Fnd 23.68 45.02 - 31.43 7.66 16.74

Price Prd End 5 157 5 525 11 400 13 060 14 497 Oper Pft Mgn 17.45 9.37 18.49 10.94 11.06

RATIOS D:E 0.75 0.67 1.50 0.89 0.76

Ret on SH Fnd - 2.87 - 95.57 8.60 12.90 14.06 Current Ratio 1.04 1.24 1.06 1.07 1.02

Oper Pft Mgn - 6.19 - 31.44 9.62 15.91 19.36 Div Cover 1.59 2.48 - 0.43 1.29 1.94

D:E 0.68 0.29 0.18 0.23 0.11

Current Ratio 1.24 0.85 1.09 1.53 1.53

New Frontier Properties Ltd.

NEW

Netcare Ltd. ISIN: MU0453N00004 SHORT: FRONTIER CODE: NFP

REG NO: 123368 C1/GBL FOUNDED: 2014 LISTED: 2015

NET

ISIN: ZAE000011953 SHORT: NETCARE CODE: NTC NATURE OF BUSINESS: New Frontier Properties was incorporated as a

ISIN: ZAE000081121 SHORT: NTC PREF CODE: NTCP private company in Mauritius on 5 June 2014 and subsequently converted

REG NO: 1996/008242/06 FOUNDED: 1996 LISTED: 1996 into a public company. It has a dual primary listing on the Stock Exchange

NATURE OF BUSINESS: Netcare Ltd. is an investment holding company of Mauritius Ltd.(SEM)andthe AlternativeExchange of the Johannesburg

which operates through a number of subsidiaries and employs just under Stock Exchange (AltX). In October 2015, it transferred its tax domicile to

29 000 people. The Netcare Group invests in growing and continually the UK and joined the UK REIT regime. New Frontier left the UK REIT

improving our capabilities and capacity, and in partnering with the public regime but continues to be a UK tax resident company.

sector, to support the effectiveness of the national healthcare systems in SECTOR: AltX

which the Group operates. It is this continuous investment in the latest NUMBER OF EMPLOYEES: 0

medical technologies, high-level professional expertise, and commitment DIRECTORS: AhsanAA(ne), BeckerRP(ne), Ngebulana S (ne),

tocaringforourpatientsthatmakesNetcarealeadinghealthcare provider. Gmeiner F (Chair, ne, Austria)

The company’s ordinary shares have been listed on the Johannesburg MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2018

Stock Exchange in South Africa since December 1996, when the company Clyroplex (Pty) Ltd. 7.05%

operated 4 hospitals compared to the current 116. Delficraft (Pty) Ltd. 7.05%

SECTOR: Health—Health—Health Equip&Srvcs—Health Providers Delfiflo (Pty) Ltd. 7.05%

NUMBER OF EMPLOYEES: 22 165 POSTAL ADDRESS: 2nd Floor, 86 Brook Street, London, W1K 5AY

DIRECTORS: BowerMR(ind ne), Bulo B (ind ne), Human L (ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NFP

Kneale D (ind ne), KuscusMJ(ind ne), Moroka AdvKD(ind ne), COMPANY SECRETARY: Vistra (Mauritius) Ltd.

Weltman N (ind ne), Brewer T (Chair, ind ne), Friedland Dr R H (CEO),

Gibson K N (Group CFO) TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 03 Feb 2020 DESIGNATED ADVISOR: Arbor Capital Sponsors (Pty) Ltd.

Public Investment Corporation Ltd. 18.28% AUDITORS: BDO LLP

Coronation Fund Managers 14.23% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray 9.18% NFP Ords no par value 300 000 000 160 935 407

181