Page 177 - SHBe20.vp

P. 177

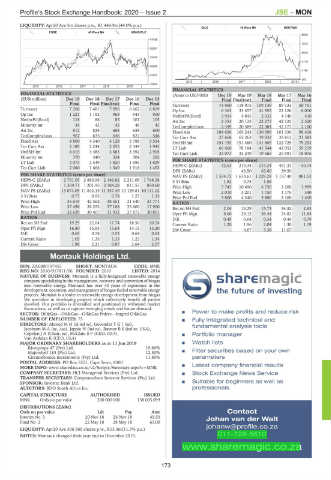

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – MON

LIQUIDITY: Apr20 Ave 5m shares p.w., R1 444.9m(49.0% p.a.)

OILG 40 Week MA MONTAUK

FORE 40 Week MA MONDIPLC

9900

43438

7973

38391

6045

33345

4118

28299

2190

23252

263

2015 | 2016 | 2017 | 2018 | 2019 |

18206

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in USD’000) Dec 19 Mar 19 Mar 18 Mar 17 Mar 16

(EUR million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Final Final(rst) Final Final Final

Final Final Final(rst) Final Final Turnover 73 960 118 975 109 149 89 133 50 751

Turnover 7 268 7 481 7 096 6 662 6 819 Op Inc 6 363 33 457 41 955 22 126 6 010

Op Inc 1 221 1 192 968 943 900 NetIntPd(Rcvd) 3 954 4 845 2 032 4 140 410

NetIntPd(Rcvd) 118 88 85 101 105 Att Inc 2 353 20 125 22 275 42 125 2 320

Minority Int 34 42 43 48 45 TotCompIncLoss 2 349 20 589 22 384 42 177 2 160

Att Inc 812 824 668 638 600 Fixed Ass 184 636 165 243 130 396 101 330 98 438

TotCompIncLoss 967 635 646 822 546 Tot Curr Ass 27 668 65 263 39 832 33 812 21 583

Fixed Ass 4 800 4 340 4 128 3 788 3 554 Ord SH Int 154 155 151 460 141 605 122 729 79 253

Tot Curr Ass 2 189 2 244 2 055 2 344 1 943 LT Liab 66 660 78 184 41 544 42 052 59 219

Ord SH Int 4 015 3 485 3 683 3 392 2 905 Tot Curr Liab 23 073 33 249 19 566 25 991 18 076

Minority Int 370 340 324 304 282 PER SHARE STATISTICS (cents per share)

LT Liab 2 075 2 549 1 820 1 696 1 829

Tot Curr Liab 2 080 1 668 1 549 1 918 1 453 HEPS-C (ZARc) 32.63 215.34 215.24 451.37 - 50.14

DPS (ZARc) - 43.50 63.00 39.50 -

PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 1 574.72 1 610.61 1 229.28 1 157.40 881.53

HEPS-C (ZARc) 2 791.05 2 886.58 2 186.82 2 211.09 1 748.58 3 Yr Beta 1.52 0.75 1.56 - -

DPS (ZARc) 1 369.71 1 201.95 2 384.28 811.55 850.60 Price High 5 745 10 490 6 750 2 200 1 999

NAV PS (ZARc) 13 074.05 11 842.15 11 357.49 10 129.81 10 141.02 Price Low 2 010 3 201 1 750 1 175 340

3 Yr Beta 0.77 0.95 0.78 1.27 1.33 Price Prd End 3 800 4 340 5 800 2 100 1 400

Price High 35 619 42 562 38 551 31 640 33 771

RATIOS

Price Low 27 498 28 253 27 108 25 600 17 900 Ret on SH Fnd 2.04 13.29 15.73 34.32 2.93

Price Prd End 32 629 30 407 31 932 27 872 30 851 Oper Pft Mgn 8.60 28.12 38.44 24.82 11.84

RATIOS D:E 0.49 0.64 0.34 0.44 0.79

Ret on SH Fnd 19.29 22.64 17.74 18.56 20.24 Current Ratio 1.20 1.96 2.04 1.30 1.19

Oper Pft Mgn 16.80 15.93 13.64 14.15 13.20 Div Cover - 4.67 3.38 11.07 -

D:E 0.65 0.74 0.53 0.64 0.65

Current Ratio 1.05 1.35 1.33 1.22 1.34

Div Cover 1.98 2.21 0.87 2.64 2.07

Montauk Holdings Ltd.

MON

ISIN: ZAE000197455 SHORT: MONTAUK CODE: MNK

REG NO: 2010/017811/06 FOUNDED: 2010 LISTED: 2014

NATURE OF BUSINESS: Montauk is a fully-integrated renewable energy TM

company specializing in the management, recovery, and conversion of biogas

sharemagic

into renewable energy. Montauk has over 30 years of experience in the

development, operation, and management of biogas-fueled renewable energy

projects. Montauk is a leader in renewable energy development from biogas. the future of investing

We specialize in developing projects which collectively benefit all parties

involved. Our portfolio is diversified and positioned to withstand market

fluctuations, as well as to capture emerging trends and future demand.

SECTOR: Oil&Gas—Oil&Gas—Oil&Gas Prdcrs—Intgrtd Oil&Gas Power to make profits and reduce risk

NUMBER OF EMPLOYEES: 75 Fully integrated technical and

DIRECTORS: AhmedMH(ld ind ne), GovenderTG((ne), fundamental analysis tools

JacobsonMA(ne, Aus), Jappie N (ind ne), RaynorBS(ind ne, USA),

Copelyn J A (Chair, ne), McClain S F (CEO, USA), Portfolio manager

Van Asdalan K (CFO, USA)

MAJOR ORDINARY SHAREHOLDERS as at 11 Jun 2019 Watch lists

Rivetprops 47 (Pty) Ltd. 19.90%

Majorshelf 183 (Pty) Ltd. 12.50% Filter securities based on your own

Circumference Investments (Pty) Ltd. 11.80% parameters

POSTAL ADDRESS: PO Box 5251, Cape Town, 8000

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MNK Latest company financial results

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. Stock Exchange News Service

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. Suitable for beginners as well as

AUDITORS: BDO South Africa Inc. professionals

CAPITAL STRUCTURE AUTHORISED ISSUED

MNK Ords no par value 200 000 000 138 005 099

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Contact

Interim No 3 20 Nov 18 26 Nov 18 43.50 Johan van der Walt

Final No 2 22 May 18 28 May 18 63.00

johanw@profile.co.za

LIQUIDITY: Apr20 Ave 306 369 shares p.w., R13.3m(11.5% p.a.)

NOTES: Montauk changed their year end to December 2019. 011-728-5510

www.sharemagic.co.za

173