Page 183 - SHBe20.vp

P. 183

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – NAS

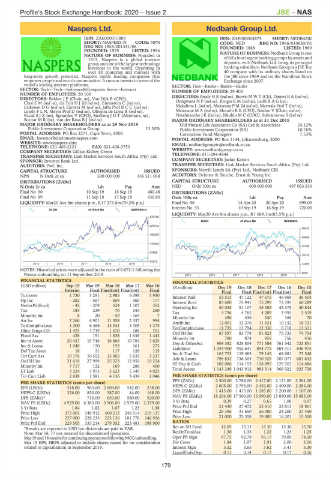

Naspers Ltd. Nedbank Group Ltd.

NAS NED

ISIN: ZAE000015889 ISIN: ZAE000004875 SHORT: NEDBANK

SHORT: NASPERS-N CODE: NPN CODE: NED REG NO: 1966/010630/06

REG NO: 1925/001431/06 FOUNDED: 1888 LISTED: 1969

FOUNDED: 1925 LISTED: 1994

NATURE OF BUSINESS: Founded in NATURE OF BUSINESS: Nedbank Group is one

of SA’s four largest banking groups by assets and

1915, Naspers is a global internet

group and one of the largest technology deposits, with Nedbank Ltd. being its principal

investors in the world. Operating in banking subsidiary. Nedbank Group is a JSE Top

over 80 countries and markets with 40 company with its ordinary shares listed on

long-term growth potential, Naspers builds leading companies that the JSE since 1969 and on the Namibian Stock

empower people and enrich communities. It runs or invests in some of the Exchange since 2007.

world’s leading internet platforms. SECTOR: Fins—Banks—Banks—Banks

SECTOR: Tech—Tech—Software&Computer Srvcs—Internet NUMBER OF EMPLOYEES: 29 403

NUMBER OF EMPLOYEES: 20 100 DIRECTORS: Brody H R (ind ne), Brown M W T (CE), Dames B A (ind ne),

DIRECTORS: Bekker J P (Chair, ne), Van Dijk B (CEO),

ChoiEM(ind ne), du ToitHJ(ld ind ne), Enenstein C (ind ne), Dongwana N P (ind ne), Kruger E M (ind ne), Leith R A G (ne),

ErikssonDG(ind ne), Girotra M (ind ne), Jafta ProfRCC(ind ne), Makalima L (ind ne), Makwana P M (ld ind ne), Marwala Prof T (ind ne),

LeteleFLN, Meyer Prof D (ind ne), Oliveira de Lima R (ind ne), Matooane M A (ind ne), Morathi R K (CFO), Naidoo V (Chair, ind ne),

PacakSJZ(ne), Sgourdos V (CFO), StofbergJDT (Alternate, ne), Netshitenzhe J K (ind ne), Nkuhlu M C (COO), Subramoney S (ind ne)

SorourMR(ne), van der RossBJ(ind ne) MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

MAJOR ORDINARY SHAREHOLDERS as at 29 Nov 2019 Old Mutual Life Assurance Co (SA) Ltd & Associates 24.12%

Public Investment Corporation Group 13.30% Public Investment Corporation (SA) 10.76%

POSTAL ADDRESS: PO Box 2271, Cape Town, 8000 Coronation Fund Managers 7.53%

EMAIL: InvestorRelations@naspers.com POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000

WEBSITE: www.naspers.com EMAIL: nedbankgroupir@nedbank.co.za

TELEPHONE: 021-406-2121 FAX: 021-406-3753

COMPANY SECRETARY: Gillian Kisbey-Green WEBSITE: www.nedbankgroup.co.za

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. TELEPHONE: 011-294-4444

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY: Jackie Katzin

AUDITORS: PwC Inc. TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSORS: Merrill Lynch SA (Pty) Ltd., Nedbank CIB

NPN N Ords 2c ea 500 000 000 435 511 058 AUDITORS: Deloitte & Touche, Ernst & Young Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

N Ords 2c ea Ldt Pay Amt NED Ords 100c ea 600 000 000 497 053 536

Final No 90 10 Sep 19 16 Sep 19 480.48 DISTRIBUTIONS [ZARc]

Final No 89 11 Sep 18 17 Sep 18 436.80 Ords 100c ea Ldt Pay Amt

LIQUIDITY: Mar20 Ave 6m shares p.w., R17 273.8m(70.2% p.a.) Final No 56 14 Apr 20 20 Apr 20 695.00

Interim No 55 10 Sep 19 16 Sep 19 720.00

SCOM 40 Week MA NASPERS-N

LIQUIDITY: May20 Ave 8m shares p.w., R1 689.1m(83.5% p.a.)

270750

BANK 40 Week MA NEDBANK

227514

36043

184279

30606

141043

25169

97808

19732

54572

2015 | 2016 | 2017 | 2018 | 2019 | 14295

NOTES: Historical prices were adjusted in the ratio of 0.672:1 following the

8858

Prosus unbundling on 11 September 2019. 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(USD million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 (R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final(rst) Final(rst) Final Final Final Final(rst) Final(rst) Final

Turnover 1 730 3 291 2 985 6 098 5 930 Interest Paid 53 513 47 122 47 675 46 969 36 404

Op Inc - 282 - 567 - 659 - 360 - 177 Interest Rcvd 83 680 75 941 75 299 73 395 60 289

NetIntPd(Rcvd) - 42 - 209 524 1 107 352 Operating Inc 50 035 51 107 48 383 45 375 40 844

Tax 183 229 70 244 260 Tax 3 796 4 762 4 209 3 955 3 519

Minority Int 8 20 - 59 - 169 7 Minority Int 496 436 340 166 70

Att Inc 2 266 6 901 11 358 2 337 994 Attrib Inc 12 001 13 376 11 621 10 132 10 721

TotCompIncLoss 1 300 6 466 13 041 3 709 1 375 TotCompIncLoss 11 735 13 794 12 330 6 718 13 311

Hline Erngs-CO 1 425 3 719 1 670 188 701

Fixed Ass 438 191 1 638 1 638 1 443 Ord SH Int 87 597 83 778 81 823 75 733 74 754

859

874

Minority Int

780

756

436

Inv in Assoc 20 437 19 746 16 666 10 784 7 625 Dep & OtherAcc 904 382 825 804 771 584 761 542 725 851

Inv & Loans 1 048 170 193 161 275 Liabilities 1 044 900 952 641 894 775 884 311 846 975

Def Tax Asset 18 21 117 128 115

Tot Curr Ass 10 176 10 552 13 065 5 639 3 237 Inv & Trad Sec 163 753 119 483 79 145 68 681 73 548

Ord SH Int 21 618 27 999 25 523 12 856 10 254 Adv & Loans 796 833 736 305 710 329 707 077 681 632

Minority Int 7 717 132 169 286 400 ST Dep & Cash 102 086 114 153 128 897 129 763 114 686

LT Liab 3 224 3 973 5 623 5 349 4 023 Total Assets 1 143 349 1 043 912 983 314 966 022 925 726

Tot Curr Liab 2 638 1 581 4 136 3 439 2 046 PER SHARE STATISTICS (cents per share)

EPS (ZARc) 2 500.00 2 768.00 2 417.00 2 121.00 2 261.00

PER SHARE STATISTICS (cents per share)

EPS (USDc) 518.00 963.00 2 604.00 542.00 238.00 HEPS-C (ZARc) 2 605.00 2 793.00 2 452.00 2 400.00 2 284.00

HEPS-C (USDc) 326.00 850.00 387.00 44.00 168.00 DPS (ZARc) 1 415.00 1 415.00 1 285.00 1 200.00 1 107.00

DPS (ZARc)* - 715.00 650.00 580.00 520.00 NAV PS (ZARc) 18 204.00 17 560.00 16 990.00 15 830.00 15 685.00

NAV PS (USDc) 4 929.00 6 383.00 5 906.00 2 979.00 2 379.00 3 Yr Beta 0.39 0.27 0.65 1.08 0.97

3 Yr Beta 1.84 1.82 1.67 1.23 1.38 Price Prd End 21 430 27 472 25 610 23 813 18 861

Price High 375 001 348 912 400 213 246 514 219 137 Price High 29 396 31 650 26 900 24 200 27 450

Price Low 227 000 228 233 223 136 181 778 146 926 Price Low 21 000 22 358 19 800 16 201 15 500

Price Prd End 229 505 333 214 279 352 223 481 198 960 RATIOS

*Results are reported in USD but dividends are paid in ZAR. Ret on SH Fund 12.69 15.13 15.30 15.30 15.70

Note: Mar 16, 17 not restated for discontinued operations. RetOnTotalAss 1.30 1.33 1.22 1.23 1.25

Mar19and18resultsforcontinuingoperationsfollowingMCGunbundling. Oper Pft Mgn 87.75 92.78 93.17 79.00 74.50

Mar 19 EPS, HEPS adjusted to include shares issued for no consideration Div Cover 1.84 1.97 1.91 2.00 2.06

related to capitalisation in September 2019. Interest Mgn 3.52 3.65 3.62 3.41 3.30

LiquidFnds:Dep 0.11 0.14 0.17 0.17 0.16

179