Page 176 - SHBe20.vp

P. 176

JSE – MOM Profile’s Stock Exchange Handbook: 2020 – Issue 2

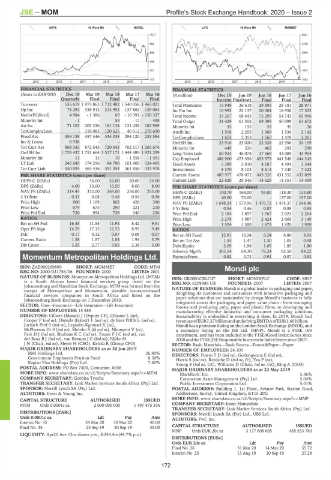

SUPS 40 Week MA MIXTEL LIFE 40 Week MA MOMMET

1077 3927

883 3438

689 2950

495 2461

301 1972

107 1483

2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Mar 19 Mar 18 Mar 17 Mar 16 (R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Quarterly Final Final Final Final Interim Final(rst) Final Final Final

Turnover 536 619 1 975 863 1 712 482 1 540 058 1 465 021 Total Premiums 15 949 36 618 29 893 28 181 28 971

Op Inc 78 292 338 912 214 952 137 862 139 084 Inc Fm Inv 10 992 22 137 20 084 18 958 17 522

NetIntPd(Rcvd) 4 984 - 1 386 69 - 10 391 - 150 327 Total Income 35 267 68 643 75 299 54 743 65 996

Minority Int - 1 - 59 - 17 - 498 Total Outgo 31 429 61 552 69 399 50 099 61 672

Att Inc 71 103 202 336 181 134 121 458 182 989 Minority Int 55 155 53 45 36

TotCompIncLoss - 318 083 120 625 40 512 270 690 Attrib Inc 1 518 2 255 1 369 1 536 2 142

Fixed Ass 556 138 457 446 334 038 294 120 235 584 TotCompIncLoss 1 652 2 353 1 560 1 478 2 261

Inv & Loans 8 938 - - - - Ord SH Int 23 916 23 020 22 328 22 956 24 109

Tot Curr Ass 868 343 872 545 720 043 702 517 1 265 674 Minority Int 449 526 462 292 290

Ord SH Int 1 729 437 1 751 664 1 517 171 1 444 489 1 921 299 Long-Term Liab 50 924 46 078 37 569 43 089 43 954

Minority Int 11 13 10 - 1 558 - 1 491 Cap Employed 488 900 473 356 453 575 441 549 444 243

LT Liab 246 645 174 256 84 790 101 900 124 495 Fixed Assets 5 389 5 010 4 187 4 494 3 544

Tot Curr Liab 550 095 465 436 391 354 361 858 333 978 Investments 8 370 8 103 8 614 7 340 7 422

PER SHARE STATISTICS (cents per share) Current Assets 485 977 478 072 443 526 431 552 433 899

HEPS-C (ZARc) - 36.00 32.00 20.00 24.00 Current Liab 22 629 29 546 14 629 14 351 14 459

DPS (ZARc) 4.00 13.00 10.50 8.00 8.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 314.45 312.00 269.00 256.00 253.00 HEPS-C (ZARc) 100.70 168.00 93.00 118.30 133.80

3 Yr Beta - 0.33 0.08 0.48 0.54 0.36 DPS (ZARc) 40.00 70.00 - 157.00 157.00

Price High 900 1 109 802 428 390 NAV PS (ZARc) 1 648.24 1 579.96 1 476.72 1 474.37 1 544.46

Price Low 679 675 290 221 210 3 Yr Beta 0.54 0.46 0.87 0.89 0.95

Price Prd End 720 954 739 340 236 Price Prd End 2 184 1 897 1 767 2 024 2 264

RATIOS Price High 2 278 1 987 2 424 2 669 3 149

Ret on SH Fnd 16.45 11.55 11.94 8.42 9.51 Price Low 1 524 1 500 1 673 1 920 1 900

Oper Pft Mgn 14.59 17.15 12.55 8.95 9.49 RATIOS

D:E 0.17 0.12 0.07 0.08 0.07 Ret on SH Fund 12.91 10.24 6.24 6.80 8.93

Current Ratio 1.58 1.87 1.84 1.94 3.79 Ret on Tot Ass 1.55 1.47 1.30 1.05 0.98

Div Cover 3.25 2.77 3.05 2.38 3.00 Debt:Equity 2.09 1.96 1.65 1.85 1.80

Solvency Mgn% 305.54 64.30 76.24 82.50 84.22

Momentum Metropolitan Holdings Ltd. Payouts:Prem 0.82 0.73 0.91 0.87 0.92

MOM

ISIN: ZAE000269890 SHORT: MOMMET CODE: MTM Mondi plc

REG NO: 2000/031756/06 FOUNDED: 2000 LISTED: 2001

NATURE OF BUSINESS: Momentum Metropolitan Holdings Ltd. (MTM) ISIN: GB00B1CRLC47 SHORT: MONDIPLC CODE: MNP

MON

is a South African based financial services group listed on the REG NO: 6209386 UK FOUNDED: 2007 LISTED: 2007

Johannesburg and Namibian Stock Exchange. MTM was formed from the NATURE OF BUSINESS: Mondi is a global leader in packaging and paper,

merger of Metropolitan and Momentum, sizeable insurance-based delighting its customers and consumers with innovative packaging and

financial services companies in South Africa and listed on the

Johannesburg Stock Exchange on 1 December 2010. paper solutions that are sustainable by design.Mondi’s business is fully

integrated across the packaging and paper value chain - from managing

SECTOR: Fins—Insurance—Life Insurance—Life Insurance forests and producing pulp, paper and plastic films, to developing and

NUMBER OF EMPLOYEES: 15 885 manufacturing effective industrial and consumer packaging solutions.

DIRECTORS: Cilliers (Marais) J (Deputy CE), Chiume L (ne), Sustainability is embedded in everything it does. In 2019, Mondi had

Cooper P (ind ne), Daniels (Jakoet) F (ind ne), de Beer PrfDr L (ind ne), revenuesofEUR7.27 billionandunderlyingEBITDAofEUR1.66 billion.

Jurisich Prof S (ind ne), Legoabe-Kgomari K (ne), Mondi has a premium listing on the London Stock Exchange (MNDI), and

McPherson Dr S (ind ne), Moloko S (ld ind ne), Nkonyeni V (ne), a secondary listing on the JSE Ltd. (MNP). Mondi is a FTSE 100

ParkDJ(ind ne), ShubaneKC(ind ne), TruterFJC(ind ne), van constituent, and has been included in the FTSE4Good Index Series since

der RossBJ(ind ne), van ReenenJC(ind ne), Njeke M 2008 andtheFTSE/JSEResponsibleInvestmentIndexSeriessince2007.

J N (Chair, ind ne), Meyer H (CEO), Ketola R (Group CFO) SECTOR: Basic Materials—Basic Resrcs—Forest&Paper—Paper

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 NUMBER OF EMPLOYEES: 26 100

RMI Holdings Ltd. 26.80% DIRECTORS: FrattoTD(ind ne), Godongwana E (ind ne),

Government Employees Pension Fund 8.50% Harris S (ind ne), Reiniche D (ind ne, Fr), Yea P (ne),

Kagiso Tiso Holdings (Pty) Ltd. 7.60% Young S (ind ne, UK), Williams D (Chair, ind ne, UK), King A (CEO)

POSTAL ADDRESS: PO Box 7400, Centurion, 0046 MAJOR ORDINARY SHAREHOLDERS as at 23 May 2019

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MTM BlackRock, Inc. 5.86%

COMPANY SECRETARY: Gcobisa Tyusha Coronation Asset Management (Pty) Ltd. 5.04%

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Public Investment Corporation Ltd. 5.01%

SPONSOR: Merrill Lynch SA (Pty) Ltd. POSTAL ADDRESS: Building 1, 1st Floor, Aviator Park, Station Road,

AUDITORS: Ernst & Young Inc. Addlestone, Surrey, United Kingdom, KT15 2PG

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MNP

CAPITAL STRUCTURE AUTHORISED ISSUED

MTM Ords 0.0001c ea 2 000 000 000 1 497 475 356 COMPANY SECRETARY: Jenny Hampshire

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSORS: Merrill Lynch SA (Pty) Ltd., UBS Ltd.

Ords 0.0001c ea Ldt Pay Amt AUDITORS: PwC Inc.

Interim No 35 24 Mar 20 30 Mar 20 40.00

Final No 34 23 Sep 19 30 Sep 19 35.00 CAPITAL STRUCTURE AUTHORISED ISSUED

MNP Ords EUR 20c ea 3 177 608 605 485 553 780

LIQUIDITY: Apr20 Ave 13m shares p.w., R244.4m(44.7% p.a.)

DISTRIBUTIONS [EURc]

Ords EUR 20c ea Ldt Pay Amt

Final No 26 31 Mar 20 14 May 20 55.72

Interim No 25 13 Aug 19 20 Sep 19 27.28

172