Page 172 - SHBe20.vp

P. 172

JSE – MAZ Profile’s Stock Exchange Handbook: 2020 – Issue 2

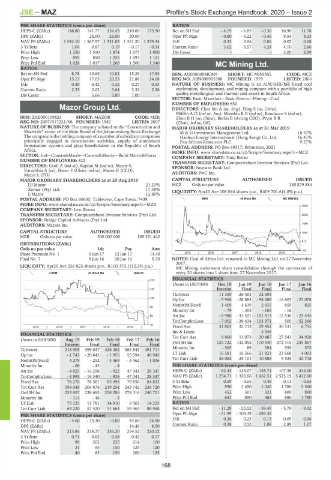

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 148.80 141.77 154.43 210.00 175.90 Ret on SH Fnd - 4.19 - 6.85 - 0.36 16.90 11.78

DPS (ZARc) - 26.00 26.00 30.00 - Oper Pft Mgn - 0.80 - 5.22 - 0.46 9.54 8.33

NAV PS (ZARc) 1 542.10 1 567.97 1 331.82 1 351.20 1 239.24 D:E 0.32 0.06 0.06 0.02 0.08

3 Yr Beta 1.04 0.87 0.19 - 0.17 - 0.34 Current Ratio 3.02 3.57 4.24 4.10 2.66

Price High 1 250 1 550 1 874 1 675 1 900 Div Cover - - - 3.00 2.99

Price Low 895 850 1 255 1 093 1 121

Price Prd End 1 028 1 017 1 260 1 500 1 340 MC Mining Ltd.

RATIOS

MCM

Ret on SH Fnd 8.78 10.65 10.82 15.25 17.85 ISIN: AU000000MCM9 SHORT: MC MINING CODE: MCZ

Oper Pft Mgn 15.13 17.05 20.53 21.88 24.68 REG NO: ABN008905388 FOUNDED: 1979 LISTED: 2006

D:E 0.40 0.42 0.32 0.27 0.33 NATURE OF BUSINESS: MC Mining is an AIM/ASX/JSE listed coal

Current Ratio 2.25 2.63 3.64 2.32 2.26 exploration, development, and mining company with a portfolio of high

Div Cover - 5.66 5.89 7.00 - quality metallurgical and thermal coal assets in South Africa.

SECTOR: Basic Materials—Basic Resrcs—Mining—Coal

NUMBER OF EMPLOYEES: 650

Mazor Group Ltd. DIRECTORS: Chee Sin A (ne, Sing), Ding S (ne, China),

MifflinAD(ind ne, Aus), MosehlaKB(ind ne), Randazzo S (ind ne),

MAZ

ISIN: ZAE000109823 SHORT: MAZOR CODE: MZR ZhenBH(ne, China), Berlin B (Acting CEO), Pryor B R

REG NO: 2007/017221/06 FOUNDED: 1981 LISTED: 2007 (Chair, ind ne, UK)

NATURE OF BUSINESS: The company is listed on the “Construction and MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Materials” sector of the Main Board of the Johannesburg Stock Exchange. M & G Investment Management Ltd. 16.57%

The company is the holding company of a number of subsidiary companies Haohua Energy International (Hong Kong) Co. Ltd. 16.41%

principally engaged in construction activities, supply of aluminium Pan African Resources PLC 9.27%

fenestration systems and glass beneficiation in the Republic of South POSTAL ADDRESS: PO Box 69517, Bryanston, 2021

Africa. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MCZ

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs COMPANY SECRETARY: Tony Bevan

NUMBER OF EMPLOYEES: 522 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Groll A (ind ne), Kaplan M (ind ne), Mazor S, SPONSOR: Investec Bank Ltd.

Varachhia A (ne), Boner F (Chair, ind ne), Mazor R (CEO), AUDITORS: PwC Inc.

Mazor L (FD)

MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

DJ Mazor 21.23% MCZ Ords no par value - 140 879 584

Zomar (Pty) Ltd. 17.38% LIQUIDITY: Apr20 Ave 108 044 shares p.w., R409 701.6(4.0% p.a.)

L Mazor 12.80%

POSTAL ADDRESS: PO Box 60635, Tableview, Cape Town, 7439 MINI 40 Week MA MC MINING

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MZR 2500

COMPANY SECRETARY: Ivor Bloom

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 2028

SPONSOR: Bridge Capital Advisors (Pty) Ltd.

AUDITORS: Mazars Inc. 1556

CAPITAL STRUCTURE AUTHORISED ISSUED 1084

MZR Ords no par value 500 000 000 109 351 442

612

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 140

Share Premium No 1 6 Jun 17 12 Jun 17 14.40 2015 | 2016 | 2017 | 2018 | 2019 |

Final No 7 9 Jun 16 20 Jun 16 8.50 NOTES: Coal of Africa Ltd. renamed to MC Mining Ltd. on 27 November

2017.

LIQUIDITY: Apr20 Ave 256 825 shares p.w., R100 370.1(12.2% p.a.)

MC Mining underwent share consolidation through the conversion of

CONM 40 Week MA MAZOR every 20 shares into 1 share from 27 November 2017.

FINANCIAL STATISTICS

210

(Amts in USD’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

170 Interim Final Final Final Final

Turnover 11 359 26 403 32 693 - -

130

Op Inc - 5 906 - 28 883 - 94 608 - 16 803 - 23 078

NetIntPd(Rcvd) 1 409 4 639 2 435 859 825

90

Minority Int - 79 - 305 - 165 - 16 -

50 Att Inc - 6 980 - 33 421 - 101 413 - 15 536 - 23 445

TotCompIncLoss - 7 002 - 39 434 - 103 971 505 - 52 366

10 Fixed Ass 31 803 32 713 29 452 30 531 6 755

2015 | 2016 | 2017 | 2018 | 2019 |

Inv & Loans - - 3 946 - -

FINANCIAL STATISTICS Tot Curr Ass 9 860 13 073 20 487 27 541 34 928

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final Ord SH Int 125 722 132 052 170 340 272 315 235 867

Turnover 218 905 399 037 426 482 582 845 491 711 Minority Int - 565 89 394 559 575

Op Inc - 1 741 - 20 843 - 1 955 55 594 40 945 LT Liab 16 581 16 566 21 821 23 668 4 003

NetIntPd(Rcvd) 4 279 - 252 - 3 469 - 3 462 - 1 036 Tot Curr Liab 26 062 25 101 10 886 9 525 32 718

Minority Int - 68 - 43 - 4 - - PER SHARE STATISTICS (cents per share)

Att Inc - 4 825 - 16 298 - 922 47 041 28 347 HEPS-C (ZARc) - 62.43 - 125.07 - 155.74 - 107.38 - 344.00

TotCompIncLoss - 4 893 - 16 340 - 926 47 041 28 347 NAV PS (ZARc) 1 254.71 1 320.66 1 662.51 2 523.19 3 412.60

Fixed Ass 78 276 78 581 85 498 79 856 84 832 3 Yr Beta 0.59 0.05 0.48 - 0.13 - 0.65

Tot Curr Ass 194 048 204 876 219 254 243 742 236 720 Price High 950 1 450 1 040 1 780 2 360

Ord SH Int 233 857 238 683 258 286 278 316 240 701 Price Low 452 301 321 800 800

Minority Int - 114 - 46 - 3 - - Price Prd End 641 850 465 880 1 780

LT Liab 75 125 11 781 14 910 6 563 14 225 RATIOS

Tot Curr Liab 64 220 57 420 51 664 59 463 88 968 Ret on SH Fnd - 11.28 - 25.52 - 59.49 - 5.70 - 9.92

PER SHARE STATISTICS (cents per share) Oper Pft Mgn - 51.99 - 109.39 - 289.38 - -

HEPS-C (ZARc) - 4.60 - 15.30 - 0.80 43.60 26.90 D:E 0.26 0.23 0.13 0.09 0.06

DPS (ZARc) - - - 14.40 8.50 Current Ratio 0.38 0.52 1.88 2.89 1.07

NAV PS (ZARc) 213.86 218.27 236.20 254.52 220.12

3 Yr Beta 0.71 0.62 0.48 0.42 0.17

Price High 99 202 225 214 160

Price Low 31 85 150 125 120

Price Prd End 40 85 150 200 125

168