Page 82 - SHB 2020 Issue 1

P. 82

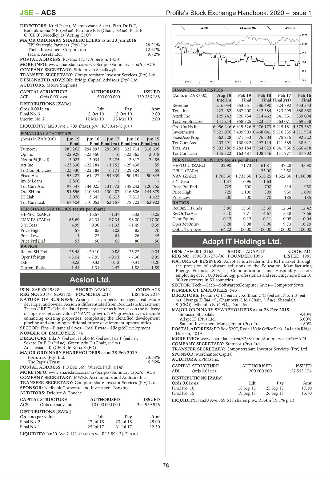

JSE – ACS Profile’s Stock Exchange Handbook: 2020 – Issue 1

DIRECTORS: Kriel P (ne), Mjamekwana A (ne), Platt Dr D E,

ALSH 40 Week MA ACSION

Ratshikhopha N E (ind ne), Patmore R B (Chair, ind ne), Platt F

C (CEO), Moodley D (Acting CFO) 1372

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

TBI Strategic Partners (Pty) Ltd. 28.91% 1142

Thebe Investment Corporation 12.67%

Jacana Assets Ltd. 9.72% 913

POSTAL ADDRESS: PO Box 1754, Alberton, 1450

684

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ACE

COMPANY SECRETARY: Sirkien van Schalkwyk 454

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Bridge Capital Advisors (Pty) Ltd. 225

2015 | 2016 | 2017 | 2018 | 2019

AUDITORS: Moore Stephens

FINANCIAL STATISTICS

CAPITAL STRUCTURE AUTHORISED ISSUED

ACE Ords 0.001c ea 500 000 000 139 366 188 (Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final(rst) Final

DISTRIBUTIONS [ZARc] Revenue 216 034 653 351 586 490 524 792 453 343

Ords 0.001c ea Ldt Pay Amt Total Inc 223 482 667 200 342 584 323 299 888 660

Final No 3 8 Oct 10 18 Oct 10 2.00 Attrib Inc 129 242 920 734 814 462 641 551 559 094

Interim No 2 12 Mar 10 23 Mar 10 2.00

TotCompIncLoss 141 214 958 725 823 617 663 071 569 558

LIQUIDITY: Jan20 Ave 1 709 shares p.w., R750.4(-% p.a.) Ord UntHs Int 6 956 246 6 819 526 5 976 173 5 215 181 4 575 387

FINANCIAL STATISTICS Investments 7 521 076 7 409 903 6 468 041 5 316 335 4 311 974

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 FixedAss/Prop 662 328 671 533 76 503 75 915 92 322

Final Final Final(rst) Final(rst) Final(rst) Tot Curr Ass 203 291 168 022 297 114 111 389 38 641

Turnover 285 262 294 893 295 061 322 714 318 609 Total Ass 9 392 780 9 283 184 7 964 923 6 641 956 5 656 418

Op Inc - 22 928 - 23 450 - 16 - 23 565 3 018 Tot Curr Liab 145 722 163 487 108 546 111 977 87 702

NetIntPd(Rcvd) 3 023 3 034 2 275 2 817 2 485 PER SHARE STATISTICS (cents per share)

Att Inc - 23 330 - 22 184 - 1 152 - 29 438 59 HEPLU-C (ZARc) 32.90 71.73 61.81 47.28 45.90

TotCompIncLoss - 23 330 - 22 184 6 171 - 29 824 59 DPLU (ZARc) - - 25.00 12.50 -

Fixed Ass 55 227 61 427 54 339 50 191 50 845 NAV (ZARc) 1 768.30 1 733.56 1 518.25 1 322.86 1 160.08

Inv & Loans 2 800 - - - - 3 Yr Beta - 1.37 - 0.96 - 1.63 - -

Tot Curr Ass 97 347 144 025 131 372 148 242 120 755 Price Prd End 725 600 700 814 950

Ord SH Int 91 556 110 341 130 487 116 506 144 879 Price High 725 1 100 899 950 1 090

LT Liab 2 076 3 645 6 613 7 312 4 422 Price Low 600 500 670 185 185

Tot Curr Liab 67 404 110 053 53 157 78 703 63 922 RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds 3.80 13.60 13.69 12.64 12.42

HEPS-C (ZARc) - - 16.57 - 1.37 6.32 0.05 RetOnTotAss 5.10 7.71 4.67 5.38 17.66

NAV PS (ZARc) 65.69 82.31 97.34 98.00 117.00 Debt:Equity 0.12 0.12 0.11 0.05 0.04

3 Yr Beta 4.99 0.90 - 1.33 - 1.49 0.39 OperRetOnInv 5.28 8.08 8.96 9.73 10.29

Price High 57 85 102 85 70 OpInc:Turnover 64.22 100.00 100.00 100.00 100.00

Price Low 4 23 61 26 45

Price Prd End 53 50 65 80 50 Adapt IT Holdings Ltd.

RATIOS

ADA

Ret on SH Fnd - 25.48 - 20.10 - 0.88 - 25.27 0.04 ISIN: ZAE000113163 SHORT: ADAPTIT CODE: ADI

Oper Pft Mgn - 8.04 - 7.95 - 0.01 - 7.30 0.95 REG NO: 1998/017276/06 FOUNDED: 1996 LISTED: 1998

D:E 0.23 0.33 0.12 0.31 0.20 NATURE OF BUSINESS: Adapt IT is a leader in the ICT market through

Current Ratio 1.44 1.31 2.47 1.88 1.89 the provision of software solutions to the Education, Manufacturing,

Energy, Financial Services, Communications and Hospitality sectors,

employing over 1 000 technology professionals and servicing more than 10

Acsion Ltd. 000 customers in 53 countries.

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

ACS

ISIN: ZAE000198289 SHORT: ACSION CODE: ACS NUMBER OF EMPLOYEES: 943

REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014 DIRECTORS: Fortuin O (ld ind ne), Koffman C C (ind ne), Ntuli B (ind

NATURE OF BUSINESS: Acsion is a property manager, real estate ne), Nyanga Z (ind ne), Chambers C M (Chair, ind ne), Shabalala

developer and owner. Acsion is differentiated from Real Estate Investment S (CEO), Mbambo N (CFO), Dunsdon T

Trusts (“REITs”) in the listed property sector as it focuses on the delivery MAJOR ORDINARY SHAREHOLDERS as at 28 Dec 2018

of superior net asset value (“NAV”) growth. NAV growth drivers include Sibusiso Shabalala 9.40%

enhancing existing properties, completing the identified development Adapt IT (Pty) Ltd. 5.00%

pipeline and obtaining additional future development opportunities. Sanlam Investment Management (Pty) Ltd. 4.80%

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development POSTAL ADDRESS: PO Box 5207, Rydall Vale Office Park, La Lucia Ridge,

NUMBER OF EMPLOYEES: 74 Durban, 4019

DIRECTORS: Bila N (ind ne), Hlobo M (ind ne), Jali T (ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ADI

Sekete Dr P D (ind ne), Green Adv D (Chair, ind ne), COMPANY SECRETARY: Statucor (Pty) Ltd.

Anastasiadis K (CEO), le Roux S (FD) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 SPONSOR: Merchantec Capital

Fortutrax (Pty) Ltd. 73.64% AUDITORS: KPMG Inc.

The Papa’s Trust 6.96%

POSTAL ADDRESS: PO Box 569, Wierda Park, 0149 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ACS ADI Ords 0.01c ea 200 000 000 152 513 154

COMPANY SECRETARY: MWRK Accountants and Auditors Inc. DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 0.01c ea Ldt Pay Amt

SPONSOR: Nedbank Corporate and Investment Banking Final No 16 18 Sep 18 25 Sep 18 17.10

AUDITORS: Deloitte & Touche Final No 15 19 Sep 17 26 Sep 17 13.70

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan20 Ave 559 618 shares p.w., R3.4m(19.1% p.a.)

ACS Ords no par value 10 000 000 000 394 959 976

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 2 17 Jul 18 23 Jul 18 25.00

Final No 1 25 Jul 17 31 Jul 17 12.50

LIQUIDITY: Jan20 Ave 2 421 shares p.w., R15 894.3(-% p.a.)

78