Page 246 - SHB 2020 Issue 1

P. 246

JSE – SYG Profile’s Stock Exchange Handbook: 2020 – Issue 1

Sygnia Ltd.

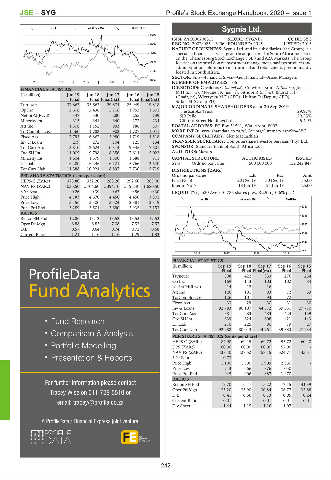

INDT 40 Week MA SUPRGRP

4599 SYG

ISIN: ZAE000208815 SHORT: SYGNIA CODE: SYG

4056 REG NO: 2007/025416/06 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Sygnia Ltd. and its subsidiaries (the Group) is a

3513 specialist financial services group headquartered in South Africa and listed

on the Johannesburg Stock Exchange (JSE ) and A2X Markets. The Group

2969 focuses on the provision of investment management, savings products and

administration solutions to institutional and retail clients predominantly

2426 located in South Africa.

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

1883

2015 | 2016 | 2017 | 2018 | 2019 NUMBER OF EMPLOYEES: 106

FINANCIAL STATISTICS DIRECTORS: Cavaleros G (ld ind ne), Crawford-Brunt A (ind ne), Jonas

M H (ind ne), Moyane I K (ind ne), Sithubi R (ind ne), Bhorat H I

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 (Chair, ne), Wierzycka M F (CEO), Hufton D (Deputy CEO),

Final Final Final(rst) Final Final(rst) Sirkot M (Group FD)

Turnover 37 862 35 663 29 874 25 949 19 818

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

Op Inc 2 606 2 436 2 116 1 952 1 501 The Zatoka Trust 29.97%

NetIntPd(Rcvd) 347 330 280 255 139 SJB Peile 29.25%

Minority Int 315 341 340 273 234 Clifford Street Holdings Ltd. 6.44%

Att Inc 1 308 1 152 993 986 807 POSTAL ADDRESS: PO Box 51591, Waterfront, 8002

TotCompIncLoss 1 560 1 783 903 1 707 1 041 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SYG

Fixed Ass 7 793 6 867 5 980 4 719 4 518 COMPANY SECRETARY: Glen MacLachlan

Inv & Loans 209 272 104 125 134 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Tot Curr Ass 13 810 12 624 10 314 9 935 7 601 SPONSOR: Standard Bank of South Africa Ltd.

Ord SH Int 11 009 9 798 8 356 7 614 5 022 AUDITORS: Mazars

Minority Int 1 604 1 579 1 500 1 688 911 CAPITAL STRUCTURE AUTHORISED ISSUED

LT Liab 6 280 6 246 6 121 5 766 3 640 SYG Ords no par value 500 000 000 152 242 847

Tot Curr Liab 11 388 10 924 8 897 7 730 5 719 DISTRIBUTIONS [ZARc]

PER SHARE STATISTICS (cents per share) Ords no par value Ldt Pay Amt

HEPS-C (ZARc) 373.80 332.20 288.20 292.60 265.00 Final No 8 20 Dec 19 30 Dec 19 35.00

NAV PS (ZARc) 3 036.50 2 704.60 2 394.10 2 196.40 1 680.50 Interim No 7 18 Jun 19 24 Jun 19 25.00

3 Yr Beta 0.26 0.39 0.62 0.56 0.30 LIQUIDITY: Jan20 Ave 310 786 shares p.w., R2.9m(10.6% p.a.)

Price High 4 183 4 670 4 450 4 450 3 801

ALSH 40 Week MA SYGNIA

Price Low 3 156 3 300 3 324 2 881 2 819

Price Prd End 3 289 3 504 3 690 3 935 3 153 2220

RATIOS

1926

Ret on SH Fnd 12.86 13.12 13.52 13.53 17.53

Oper Pft Mgn 6.88 6.83 7.08 7.52 7.57 1632

D:E 0.57 0.64 0.74 0.72 0.68

Current Ratio 1.21 1.16 1.16 1.29 1.33 1338

1044

750

| 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final Final(rst) Final Final

Turnover 508 422 333 276 234

Op Inc 169 143 103 102 84

NetIntPd(Rcvd) - 14 - 12 - 16 - -

Att Inc 126 101 93 72 59

TotCompIncLoss 126 101 93 72 -

Fixed Ass 33 29 30 31 30

Inv & Loans 92 783 80 107 44 512 39 331 27 710

Tot Curr Ass 581 283 483 424 159

l Fund Research Ord SH Int 639 624 608 421 143

225

80

19

LT Liab

27

210

Tot Curr Liab 92 988 80 013 44 761 39 383 27 734

l Comparison & Analysis PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 87.90 69.15 69.72 55.72 60.40

l Portfolio Modelling DPS (ZARc) 60.00 60.00 60.00 52.00 -

NAV PS (ZARc) 438.40 427.52 458.15 324.77 143.31

l Presentation & Reports 3 Yr Beta 0.73 - - - -

Price High 1 100 1 500 1 909 2 350 -

Price Low 713 666 876 1 050 -

Price Prd End 945 906 887 1 470 -

RATIOS

For further information please contact Ret on SH Fnd 19.70 16.17 15.22 17.15 41.39

Tracey Wise on 011-728-5510 or Oper Pft Mgn 33.20 33.90 30.84 36.77 35.88

D:E 0.41 0.36 0.13 0.05 0.24

email: tracey@profile.co.za Current Ratio 0.01 - 0.01 0.01 0.01

Div Cover 1.44 1.15 1.16 1.07 -

A ProfileData / Financial Express joint venture

242