Page 244 - SHB 2020 Issue 1

P. 244

JSE – STE Profile’s Stock Exchange Handbook: 2020 – Issue 1

as its dedicated investment manager to manage the portfolio of the POSTAL ADDRESS: 180 Great Portland Street, London, W1W 5QZ

Company in accordance with section 15 of the JSE Listings MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=STP

Requirements. The Manco, in terms of its management agreement COMPANY SECRETARY: Sarah Bellilchi

with the Company, acts on behalf of the Company in sourcing, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

negotiating, concluding and executing investment opportunities for SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

the Company. The Company holds a diversified portfolio of AUDITORS: Deloitte LLP

investments spanning the financial services, industrial, engineering

and communications sectors. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: Fins—Investment Instruments—Equities—Equities STP Ords EUR0.000001 ea 1 000 000 000 298 775 175

NUMBER OF EMPLOYEES: 0 DISTRIBUTIONS [GBPp]

DIRECTORS: Bishop J (ne), Potgieter L (ld ind ne), Steyn H (ne), Ords EUR0.000001 ea Ldt Pay Amt Scr/100

Tabata D D (ind ne), Wentzel M V Z (ind ne), Roodt C (Chair, ind ne), Interim No 10 21 Jan 20 14 Feb 20 3.38 -

van Zyl P J (CEO), Graham S (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 Final No 9 23 Jul 19 16 Aug 19 3.38 2.89

Foxglove Capital Resourced Ltd. 17.95% LIQUIDITY: Jan20 Ave 709 349 shares p.w., R15.4m(12.3% p.a.)

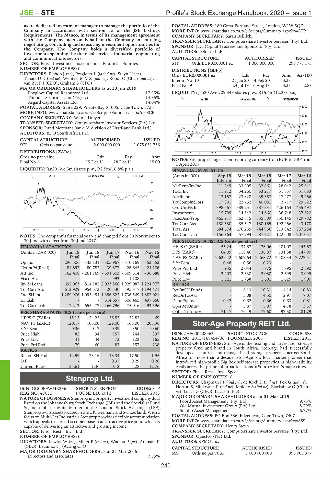

Thunder Securitisation (Pty) Ltd. 14.35% ALSH 40 Week MA STENPROP

Asgard Capital Assets Ltd. 14.04%

POSTAL ADDRESS: Suite 229, Private Bag X1005, Cape Town, 7735 3000

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SCP

COMPANY SECRETARY: Wilma Dreyer 2730

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

2460

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: BDO South Africa Inc. 2190

CAPITAL STRUCTURE AUTHORISED ISSUED

1920

SCP Ords no par value 2 000 000 000 1 075 031 756

DISTRIBUTIONS [ZARc] 1650

2015 | 2016 | 2017 | 2018 | 2019

Ords no par value Ldt Pay Amt

Final No 1 15 Dec 11 28 Dec 11 15.00 NOTES: Stenprop changed their reporting currency from EUR to GBP from

1 April 2017.

LIQUIDITY: Jan20 Ave 3m shares p.w., R2.5m(16.8% p.a.) FINANCIAL STATISTICS

ALSH 40 Week MA STELLAR (Amts in ‘000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final Final Final Final

325

NetRent/InvInc 11 249 33 905 32 861 28 042 25 841

270 Total Inc 11 912 34 260 33 217 31 837 51 683

Attrib Inc 13 157 23 828 39 357 17 477 49 266

215

TotCompIncLoss 17 801 22 752 40 081 2 717 29 622

Ord UntHs Int 398 567 389 251 387 331 426 164 455 497

159

Investments 15 709 14 542 14 660 36 748 37 620

104 FixedAss/Prop 465 917 562 815 535 509 550 145 729 782

Tot Curr Ass 188 580 85 547 180 165 192 466 43 178

49 Total Ass 684 674 676 269 744 966 813 842 857 284

2015 | 2016 | 2017 | 2018 | 2019

NOTES: The company’s financial year- end changed from 30 November to Tot Curr Liab 156 864 57 794 87 921 122 608 207 057

30 June with effect from 30 June 2017. PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS HEPS-C (ZARc) 55.24 137.67 176.06 181.07 145.67

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Nov 16 Nov 15 DPS (ZARc) 64.09 118.46 136.87 131.38 147.90

Final Final Final Final Final NAV PS (ZARc) 2 625.42 2 609.64 2 268.72 2 108.34 2 722.51

Op Inc 296 506 - 143 131 - 305 967 - 310 169 - 53 552 3 Yr Beta 0.48 0.56 0.23 - -

NetIntPd(Rcvd) 84 897 80 782 39 877 - 26 645 - 24 106 Price Prd End 1 935 2 044 1 775 1 795 2 590

Att Inc 162 408 - 261 169 - 391 603 - 309 514 - 36 688 Price High 2 203 2 330 2 080 2 699 3 099

Fixed Ass - - 993 1 108 - Price Low 1 821 1 738 1 601 1 625 1 900

Inv & Loans 692 063 814 182 2 023 866 1 929 087 1 224 977 RATIOS

Tot Curr Ass 612 929 954 573 20 530 395 817 1 194 471 RetOnSH Funds - 6.13 10.31 4.14 10.83

Ord SH Int 1 289 906 1 095 454 1 356 623 1 736 569 1 882 021 RetOnTotAss - 5.08 4.50 2.97 7.07

LT Liab - - 514 657 506 465 497 660 Debt:Equity 0.42 0.62 0.66 0.63 0.81

Tot Curr Liab 17 212 655 477 166 796 75 016 93 596 OperRetOnInv - 5.87 5.97 4.78 3.37

PER SHARE STATISTICS (cents per share) OpInc:Turnover 71.17 76.19 77.60 92.50 81.79

HEPS-C (ZARc) 15.13 - 24.23 - 36.52 - 32.83 - 4.69

NAV PS (ZARc) 120.17 105.00 129.00 166.00 203.36 Stor-Age Property REIT Ltd.

3 Yr Beta - 0.36 - 0.17 - 0.39 - 0.50 - 0.60

STO

Price High 82 94 157 244 397 ISIN: ZAE000208963 SHORT: STOR-AGE CODE: SSS

Price Low 41 44 73 122 165 REG NO: 2015/168454/06 FOUNDED: 2005 LISTED: 2015

Price Prd End 79 60 82 157 238 NATURE OF BUSINESS: Stor-Age is the leading and largest self storage

RATIOS property fund and brand in South Africa. Stor-Age had successfully

developed, acquired and managed self storage properties across South

Ret on SH Fnd 12.59 - 23.16 - 48.34 - 17.50 - 1.95 Africa for more than a decade. Stor-Age is a local market pioneer that

D:E - - 0.37 0.29 0.26 introduced high-profile Big Box self storage properties in high-visibility,

Current Ratio 35.61 1.46 0.12 5.28 12.76 easily accessible prime suburban locations in South Africa’s major cities.

SECTOR: Fins—Rest—Inv—Spec

Stenprop Ltd. NUMBER OF EMPLOYEES: 0

DIRECTORS: Chapman J (ld ind ne), de Kock K (ind ne), Fox G (ind ne),

STE Horton S, Mbikwana P (ind ne), Moloko S (ind ne), Blackshaw G (Chair,

ISIN: GG00BFWMR296 SHORT: STENPROP CODE: STP

REG NO: 47031 FOUNDED: 2012 LISTED: 2013 ne), Lucas G (CEO), Lucas S (FD)

NATURE OF BUSINESS: Stenprop is a property investment company dual MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

listed on the Johannesburg Stock Exchange (JSE) and the Specialist Fund Foord Asset Management (Pty) Ltd. 9.73%

Segment of the Main Market of the London Stock Exchange (LSE). Old Mutual Investment Group (Pty) Ltd. 8.79%

Stenprop owns assets located in the UK, Germany and Switzerland. With a Stanlib Asset Management 6.77%

focus on Multi-Let Industrials Stenprop provides flexible accommodation POSTAL ADDRESS: PO Box 386, Edgemead, Cape Town, 7407

which appeals to a broad occupier base at an attractive price point which is MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SSS

capable of delivering an attractive and growing income. COMPANY SECRETARY: Henry Steyn

SECTOR: Fins—Rest—Inv—Ind TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 SPONSOR: Questco (Pty) Ltd.

DIRECTORS: Lawlor W (ne), Miller P (ind ne), Watson P (ne), Arenson P AUDITORS: KPMG Inc.

(CEO), Beaumont J (Acting CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 SSS Ords no par value 1 000 000 000 393 005 377

Directors and associates 7.55%

240