Page 250 - SHB 2020 Issue 1

P. 250

JSE – TIG Profile’s Stock Exchange Handbook: 2020 – Issue 1

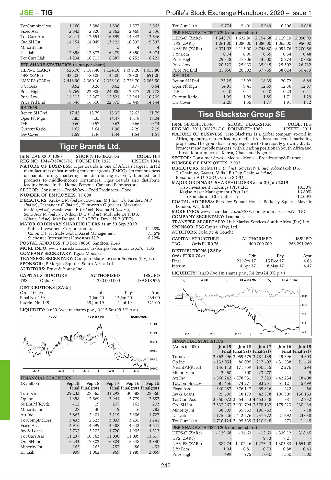

TotCompIncLoss 1 160 3 588 1 896 1 577 2 562 Tot Curr Liab 5 774 5 401 5 949 6 506 9 018

Fixed Ass 2 843 2 820 2 862 2 469 2 336 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 18 211 17 554 16 599 14 343 13 646 HEPS-C (ZARc) 1 348.70 1 632.80 2 154.68 2 119.19 2 090.99

Ord SH Int 14 154 14 049 13 122 10 397 9 897 DPS (ZARc) 1 061.00 1 080.00 1 080.00 1 065.00 950.00

Minority Int - - 5 4 4 NAV PS (ZARc) 8 031.02 9 115.00 8 748.80 8 094.76 7 200.56

LT Liab 12 898 12 877 6 279 5 350 5 974 3 Yr Beta 0.74 0.90 0.65 0.34 0.48

Tot Curr Liab 11 234 10 715 8 387 6 252 6 221 Price High 29 348 47 806 43 500 40 274 40 086

PER SHARE STATISTICS (cents per share) Price Low 20 323 25 933 35 945 25 502 26 732

HEPS-C (ZARc) 526.70 1 187.40 1 124.10 1 099.20 1 055.80 Price Prd End 21 056 26 502 37 735 38 024 30 479

DPS (ZARc) 335.00 780.00 745.00 720.00 691.00 RATIOS

NAV PS (ZARc) 2 418.90 2 360.10 2 358.10 2 728.70 2 063.50 Ret on SH Fnd 25.25 13.92 18.39 20.72 6.84

3 Yr Beta 0.52 0.26 0.62 0.77 0.64 Oper Pft Mgn 14.91 9.41 12.59 12.36 12.87

Price High 19 769 22 900 24 080 17 577 20 178 D:E 0.10 0.11 0.10 0.23 0.41

Price Low 14 112 15 367 12 821 12 344 10 205 Current Ratio 1.95 1.99 1.85 1.71 1.29

Price Prd End 16 346 16 300 22 375 15 449 14 144 Div Cover 2.20 1.35 1.77 1.91 1.12

RATIOS

Ret on SH Fnd 17.42 18.79 18.35 22.62 21.79 Tiso Blackstar Group SE

Oper Pft Mgn 7.85 8.35 14.47 16.18 17.04

TIS

D:E 0.60 0.57 0.62 0.66 0.74 ISIN: GB00BF37LF46 SHORT: BLACKSTAR CODE: TBG

Current Ratio 1.62 1.64 1.98 2.29 2.19 REG NO: 2011/008274/10 FOUNDED: 1989 LISTED: 2011

Div Cover 1.59 1.46 1.44 1.54 1.51 NATURE OF BUSINESS: Tiso Blackstar is a global company rooted in

Africa, operating market-leading media, broadcast and retail marketing

Tiger Brands Ltd. properties. The group has strong exposure to the rapidly growing digital,

broadcast and mobile markets, with a leading position in South Africa and

TIG a broad footprint across Kenya, Ghana and Nigeria.

ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment

REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944 NUMBER OF EMPLOYEES: 2 933

NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed DIRECTORS: Mehta H K (ind ne), Sowazi N L (ne), Adomakoh D K

manufacturers of fast-moving consumer goods (FMCG). Its core business T (Chair, ne, Ghana), Mills J B (Dep Chair, ld ind ne),

is manufacturing, marketing and distributing everyday branded food Bonamour A D (CEO), Grota S (FD)

products to middle-income consumers. Tiger Brands also distribute MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

leading brands in the Home, Personal Care and Baby sectors. Tiso Investment Holdings (Pty) Ltd. 18.50%

SECTOR: Consumer—Food&Bev—Food Producers—Food Kagiso Asset Management (Pty) Ltd. 16.80%

NUMBER OF EMPLOYEES: 17 608 Tiso Foundation Charitable Trust 12.00%

DIRECTORS: Ajukwu M (ind ne), Bowman M J (ind ne), Fandeso M P POSTAL ADDRESS: Berkeley Square House, Berkeley Square, Mayfair,

(ind ne), Fernandez C (ind ne), Klintworth G (ind ne), Makanjee London, W1J 6BD

Ms M (ind ne), Mashilwane E (ind ne), Nyama M (ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TBG

Sello Adv M (ind ne), Wilson D G (ind ne), Mokhele Dr K D K

(Chair, ind ne), Mac Dougall L C (CEO), Doyle N P (CFO) COMPANY SECRETARY: Leanna Isaac

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Public Investment Corporation Ltd. 11.28% SPONSOR: PSG Capital (Pty) Ltd.

Colonial First State Global Asset Management 7.36% AUDITORS: Deloitte & Touche

Silchester International Investors LLP 6.22% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 78056, Sandton, 2146 TBG Ords EUR0.76 ea 400 000 000 268 291 260

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TBS DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Kgosi Monaisa Ords EUR0.76 ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final 21 Nov 17 15 Dec 17 4.66

SPONSOR: JP Morgan Equities South Africa Ltd. Interim 4 Apr 17 8 May 17 4.47

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jan20 Ave 1m shares p.w., R4.2m(24.0% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

TBS Ords 10c ea 250 000 000 189 818 926 ALSH 40 Week MA BLACKSTAR

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

Final No 150 7 Jan 20 13 Jan 20 434.00 1248

Interim No 149 25 Jun 19 1 Jul 19 321.00

1005

LIQUIDITY: Jan20 Ave 4m shares p.w., R915.5m(99.3% p.a.)

761

FOOD 40 Week MA TIGBRANDS

518

47001

275

41621 2015 | 2016 | 2017 | 2018 | 2019

36241 FINANCIAL STATISTICS

(Amts in ‘000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

30860 Final Final(rst) Final(rst) Final Final(rst)

Turnover 2 362 296 3 059 575 3 781 139 19 696 4 303

25480

Op Inc - 133 054 80 095 217 407 - 31 538 21 469

20100 NetIntPd(Rcvd) 146 113 171 759 150 515 2 276 294

2015 | 2016 | 2017 | 2018 | 2019

Minority Int 12 460 300 - 23 270 - - 9

FINANCIAL STATISTICS Att Inc - 560 242 - 378 931 7 823 - 42 234 18 408

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 TotCompIncLoss - 581 456 - 374 277 - 83 251 - 51 121 5 499

Final Final(rst) Final Final(rst) Final(rst) Fixed Ass 340 287 376 147 965 816 222 56

Turnover 29 233 28 365 31 298 30 588 28 660 Inv & Loans 25 600 18 173 42 378 100 300 156 153

Op Inc 4 358 2 669 3 941 3 779 3 687 Tot Curr Ass 2 350 072 2 554 543 4 453 348 887 2 732

NetIntPd(Rcvd) - 12 19 207 162 203 Ord SH Int 2 333 263 2 901 794 3 378 132 179 223 230 434

Minority Int 28 30 19 16 - 785 Minority Int 38 509 35 962 190 762 - - 18

Att Inc 3 863 2 401 3 119 3 306 1 727 LT Liab 1 175 626 1 412 276 1 737 972 21 292 23 038

TotCompIncLoss 3 493 2 323 3 033 3 235 1 241 Tot Curr Liab 1 710 124 2 495 639 3 110 948 273 1 445

Fixed Ass 4 976 4 599 4 588 4 542 4 641 PER SHARE STATISTICS (cents per share)

Inv & Loans 2 732 5 102 4 720 4 905 4 312 HEPS-C (ZARc) - 129.68 - 24.63 - 12.63 - 339.12 318.45

Tot Curr Ass 11 237 10 763 11 030 11 099 11 617 DPS (ZARc) - - 9.13 8.21 -

Ord SH Int 15 244 17 302 16 804 15 548 13 830 NAV PS (ZARc) 887.74 1 102.16 1 273.43 1 305.83 1 651.00

Minority Int 163 163 257 486 - 53 3 Yr Beta 1.04 0.81 0.73 0.88 0.43

LT Liab 999 1 062 969 1 989 2 059

Price High 499 975 1 040 1 350 1 500

246