Page 245 - SHB 2020 Issue 1

P. 245

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – SUN

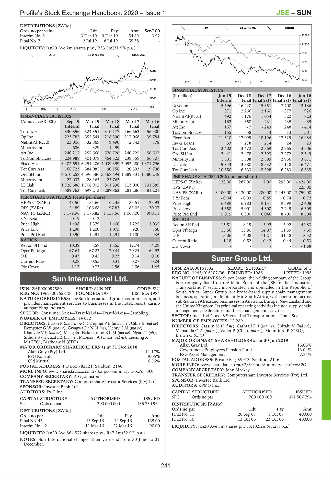

DISTRIBUTIONS [ZARc]

TRAV 40 Week MA SUNINT

Ords no par value Ldt Pay Amt Scr/100

Interim No 8 3 Dec 19 9 Dec 19 54.89 3.92 13890

Final No 7 2 Jul 19 8 Jul 19 55.38 -

11850

LIQUIDITY: Jan20 Ave 2m shares p.w., R33.5m(31.5% p.a.)

9810

ALSH 40 Week MA STOR-AGE

7770

1418 5730

1279 3690

2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

1139

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Jun 16

1000

Interim Final Final(rst) Final(rst) Final(rst)

Revenue 5 596 16 420 15 351 7 700 12 186

861

| 2016 | 2017 | 2018 | 2019

Op Inc 871 2 266 2 160 877 926

FINANCIAL STATISTICS NetIntPd(Rcvd) 492 1 176 1 054 522 723

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 Minority Int 162 358 231 - 235 - 89

Interim Final Final Final Final Att Inc 167 - 7 - 243 248 - 414

Turnover 330 856 524 351 310 177 166 663 56 900 TotCompIncLoss 155 558 - 14 13 - 301

Op Inc 223 782 352 544 218 390 117 068 39 784 Fixed Ass 11 310 17 099 18 196 17 329 16 984

NetIntPd(Rcvd) 23 006 32 869 9 490 2 743 878 Inv & Loans 33 278 214 24 23

Minority Int 686 329 1 499 - - Tot Curr Ass 12 402 3 472 2 369 2 765 3 506

Att Inc 240 217 257 566 576 726 240 725 56 507 Ord SH Int 2 441 2 478 - 2 593 - 2 272 - 2 549

TotCompIncLoss 224 988 401 078 454 323 239 359 56 507 Minority Int 1 801 1 808 2 899 2 936 3 671

Fixed Ass 6 402 651 6 251 206 4 039 399 2 052 280 1 371 796 LT Liab 9 843 13 380 18 532 17 118 16 471

Tot Curr Ass 166 723 384 085 90 156 20 593 19 798 Tot Curr Liab 10 550 6 633 5 598 6 283 6 635

Ord SH Int 4 610 258 4 596 586 3 468 494 1 889 831 1 380 248 PER SHARE STATISTICS (cents per share)

Minority Int 27 037 28 165 25 765 - - HEPS-C (ZARc) 128.00 287.00 7.00 295.00 - 424.00

LT Liab 1 726 686 1 706 902 801 598 113 000 131 885

DPS (ZARc) - - - - 225.00

Tot Curr Liab 589 763 697 213 287 862 281 286 81 201

NAV PS (ZARc) 3 100.00 3 130.00 280.00 2 145.00 2 759.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta - 0.04 - 0.03 0.85 0.74 0.72

HEPS-C (ZARc) 43.50 54.66 162.35 85.51 29.93 Price High 6 489 6 983 9 131 9 599 12 408

DPS (ZARc) 54.89 106.68 97.83 88.05 30.07 Price Low 4 658 5 001 4 600 7 249 6 305

NAV PS (ZARc) 1 179.96 1 176.82 1 157.56 1 068.00 990.11 Price Prd End 5 015 6 300 6 046 8 700 8 604

3 Yr Beta 0.19 0.13 - - - RATIOS

Price High 1 498 1 379 1 400 1 225 1 035 Ret on SH Fnd 15.51 8.19 - 3.92 3.92 - 44.83

Price Low 1 290 1 200 1 075 920 850 Oper Pft Mgn 15.56 13.80 14.07 11.39 7.60

Price Prd End 1 390 1 291 1 291 1 100 935 D:E 3.06 4.08 71.21 31.48 18.32

RATIOS Current Ratio 1.18 0.52 0.42 0.44 0.53

Ret on SH Fnd 10.39 5.58 16.55 12.74 4.09 Div Cover - - - - - 1.88

Oper Pft Mgn 67.64 67.23 70.41 70.24 69.92

D:E 0.43 0.42 0.23 0.14 0.10 Super Group Ltd.

Current Ratio 0.28 0.55 0.31 0.07 0.24

SUP

Div Cover 1.12 0.75 2.56 2.06 1.45 ISIN: ZAE000161832 SHORT: SUPRGRP CODE: SPG

REG NO: 1943/016107/06 FOUNDED: 1986 LISTED: 1996

Sun International Ltd. NATURE OF BUSINESS: Super Group, the holding company of the Group,

is a company listed on the Main Board of the JSE in the “Industrial

SUN

ISIN: ZAE000097580 SHORT: SUNINT CODE: SUI Transportation” sector, incorporated and domiciled in the Republic of

REG NO: 1967/007528/06 FOUNDED: 1984 LISTED: 1984 South Africa. Super Group is a broad-based supply chain management

NATURE OF BUSINESS: The Sun International group has interests in, and business, operating predominantly in South Africa, with operations across

provides management services to businesses in the hotel, resort, casino sub-Saharan Africa and businesses in Australia, Europe, New Zealand and

the United Kingdom. Its principal operating activities include supply chain

andgambling industry.

management, dealerships and fleet management activities.

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Gambling SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

NUMBER OF EMPLOYEES: 14 632

DIRECTORS: Bacon P (ind ne, UK), Campher P L (ld ind ne), Cibie E (ind ne), NUMBER OF EMPLOYEES: 12 289

Dempster G W (ind ne), Gwagwa Dr N N (ne), Henry C M (ind ne), DIRECTORS: Cassim M (ind ne), Cathrall D I (ind ne), Chitalu V (ind ne),

Khanyile V P (ind ne), Makgabo-Fiskerstrand B L M (ind ne), Ngara T (alt), Mabandla O A (ind ne), Vallet P (Chair, ind ne), Mountford P (CEO),

Sithole S (ne), Zatu Z (ind ne), Mabuza J A (Chair, ind ne), Leeming A Brown C (CFO)

M (CEO), Basthdaw N (CFO) MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 Allan Gray Ltd. 16.05%

Alan Gray (Pty) Ltd. 11.17% Government Employees Pension Fund 13.04%

PSG Konsult 9.05% PSG Asset Management 7.84%

Old Mutual 6.56% POSTAL ADDRESS: Private Bag X9973, Sandton, 2146

POSTAL ADDRESS: PO Box 782121, Sandton, 2146 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SPG

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SUI COMPANY SECRETARY: John Mackay

COMPANY SECRETARY: A G Johnston TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSOR: Investec Bank Ltd. AUDITORS: KPMG Inc.

AUDITORS: PwC Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED SPG Ords no par 700 000 000 371 507 794

SUI Ords no par 200 000 000 136 730 964 DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords no par Ldt Pay Amt

Ords no par Ldt Pay Amt Final No 11 20 Sep 07 1 Oct 07 400.00

Final No 43 13 Sep 16 19 Sep 16 135.00 Final No 10 13 Oct 06 23 Oct 06 400.00

Interim No 42 11 Mar 16 22 Mar 16 90.00 LIQUIDITY: Jan20 Ave 3m shares p.w., R102.2m(41.2% p.a.)

LIQUIDITY: Jan20 Ave 864 572 shares p.w., R47.1m(32.9% p.a.)

NOTES: Sun International changed their year end from 30 June to 31

December.

241