Page 241 - SHB 2020 Issue 1

P. 241

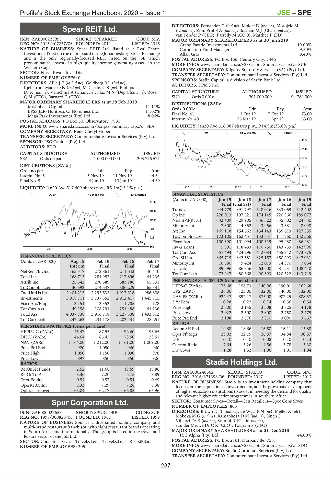

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – SPE

DIRECTORS: Fernandez C (ind ne), Molefe D (ind ne), Morojele M

Spear REIT Ltd. (ld ind ne), Zinn Prof S A (ind ne), Bosman M J (Chair, ind ne),

van Tonder P (CEO), Farrelly M (COO), Matthee P (FD)

SPE

ISIN: ZAE000228995 SHORT: SPEARREIT CODE: SEA MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

REG NO: 2015/407237/06 FOUNDED: 2011 LISTED: 2016 Grand Parade Investments Ltd. 19.00%

NATURE OF BUSINESS: Spear REIT Ltd. listed as a Real Estate Coronation Fund Managers 9.50%

Investment Trust on the main board of the Johannesburg Stock Exchange Allan Gray 8.40%

and is the only regionally-focused REIT listed on the JSE which POSTAL ADDRESS: PO Box 166, Century City, 7446

predominantly invests in high-quality income-generating assets in the MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SUR

Western Cape. COMPANY SECRETARY: Kilgetty Statutory Services (SA) (Pty) Ltd.

SECTOR: Fins—Rest—Inv—Div TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

DIRECTORS: Allie J E (ld ind ne), Goldberg B L (ind ne), AUDITORS: KPMG Inc.

Kjellstrom-Matseke N (ind ne), McCarthy C S (ne), Phillips

Dr R (ind ne), Varachhia A (Chair, ne), Flax M N (Dep Chair, ne), Rossi CAPITAL STRUCTURE AUTHORISED ISSUED

Q M (CEO), Barnard C (CFO) SUR Ords 0.001c 201 000 000 94 789 000

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 DISTRIBUTIONS [ZARc]

Mtshobela Capital 11.11% Ords 0.001c Ldt Pay Amt

BPSS JER/Huntress CI Nominess Ltd. 11.02%

Mega Park Investments (Pty) Ltd. 8.06% Final No 41 1 Oct 19 7 Oct 19 73.00

POSTAL ADDRESS: PO Box 50, Observatory, 7935 Interim No 40 26 Mar 19 1 Apr 19 63.00

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SEA LIQUIDITY: Jan20 Ave 616 087 shares p.w., R14.9m(33.8% p.a.)

COMPANY SECRETARY: Rene Cheryl Stober

TRAV 40 Week MA SPURCORP

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. 4004

AUDITORS: BDO

3546

CAPITAL STRUCTURE AUTHORISED ISSUED

SEA Ords no par 1 000 000 000 205 776 521 3087

DISTRIBUTIONS [ZARc] 2629

Ords no par Ldt Pay Amt

Interim No 6 5 Nov 19 11 Nov 19 44.64 2170

Final No 5 4 Jun 19 10 Jun 19 44.69

1712

LIQUIDITY: Jan20 Ave 517 409 shares p.w., R5.1m(13.1% p.a.) 2015 | 2016 | 2017 | 2018 | 2019

ALSH 40 Week MA SPEARREIT FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

1156

Final Final(rst) Final Final Final

Turnover 944 779 891 797 648 016 633 069 612 402

1098

Op Inc 226 013 197 521 174 145 220 566 189 077

1040 NetIntPd(Rcvd) - 32 409 - 29 905 - 36 522 - 35 602 - 24 650

Minority Int 7 300 4 362 3 956 3 681 8 098

981

Att Inc 165 118 154 662 134 143 135 619 127 555

923 TotCompIncLoss 173 105 162 457 133 637 147 760 132 366

Fixed Ass 100 390 101 094 100 319 95 480 86 481

865 Inv & Loans 5 391 118 483 110 730 143 739 142 996

2017 | 2018 | 2019

Tot Curr Ass 557 494 424 296 412 084 455 742 473 875

FINANCIAL STATISTICS Ord SH Int 865 715 842 681 825 157 850 293 847 031

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Minority Int 10 580 9 424 12 019 14 370 7 064

Interim Final Final Final LT Liab 89 596 86 956 63 600 81 537 108 440

NetRent/InvInc 163 317 272 861 211 643 40 410 Tot Curr Liab 72 947 80 668 90 393 120 522 143 749

Total Inc 168 715 281 952 217 896 44 235

Attrib Inc 28 342 270 389 383 186 65 331 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 30 592 274 547 386 229 65 331 HEPS-C (ZARc) 173.68 156.73 140.96 190.01 162.68

Ord UntHs Int 2 401 215 2 295 532 1 917 318 986 808 DPS (ZARc) 136.00 123.00 132.00 140.00 132.00

Investments 3 918 711 3 737 352 2 912 417 1 445 715 NAV PS (ZARc) 924.47 892.17 875.08 902.25 888.57

FixedAss/Prop 3 151 3 352 1 785 128 3 Yr Beta 0.28 0.22 0.74 0.56 0.54

Tot Curr Ass 49 158 108 291 251 488 41 136 Price High 2 800 3 145 3 508 3 825 4 178

Total Ass 4 037 738 3 916 718 3 227 338 1 493 512 Price Low 2 022 2 500 2 800 2 750 2 775

Tot Curr Liab 247 263 231 178 202 431 28 251 Price Prd End 2 198 2 576 2 810 3 090 3 667

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 19.68 18.66 16.50 16.11 15.88

HEPLU-C (ZARc) 45.47 87.95 92.60 96.65 Oper Pft Mgn 23.92 22.15 26.87 34.84 30.87

DPLU (ZARc) 44.64 86.42 78.50 23.51 D:E 0.10 0.10 0.08 0.10 0.13

NAV (ZARc) 1 164.00 1 212.00 1 161.00 1 009.00 Current Ratio 7.64 5.26 4.56 3.78 3.30

Price Prd End 920 1 050 960 960 Div Cover 1.28 1.32 1.06 1.01 1.04

Price High 1 050 1 150 1 090 970

Price Low 897 850 850 906

RATIOS Stadio Holdings Ltd.

RetOnSH Funds 2.52 11.68 19.59 19.86 ISIN: ZAE000248662 SHORT: STADIO CODE: SDO

STA

RetOnTotAss 8.36 7.20 6.75 8.89 REG NO: 2016/371398/06 FOUNDED: 2017 LISTED: 2017

Debt:Equity 0.54 0.57 0.54 0.49 NATURE OF BUSINESS: Stadio is an investment holding company that

OperRetOnInv 8.33 7.29 7.26 8.38 focuses on the acquisition of, investment in, and the growthand development

OpInc:Turnover 65.04 62.77 66.85 65.96 of higher education institutions to assist in meeting the demand for quality

and relevant higher educationprogrammes in southern Africa.

Spur Corporation Ltd. SECTOR: Consumer Srvcs—Retail—Gen Retailers—Spec Cons Srvcs

NUMBER OF EMPLOYEES: 803

SPU

ISIN: ZAE000022653 SHORT: SPURCORP CODE: SUR DIRECTORS: Brown Dr T (ind ne), de Waal P N (ne), Mellet A (alt),

REG NO: 1998/000828/06 FOUNDED: 1967 LISTED: 1999 Mokoka M G (ind ne), Ramaphosa D M (ind ne), Singh D,

NATURE OF BUSINESS: Spur is a diversified holding company and Vilikazi Dr B (ind ne), Stumpf R (Chair, ind ne),

multi-brand restaurant franchisor, with eight restaurant brands operating van der Merwe Dr C R (CEO), Totaram S (CFO)

in South Africa and internationally. The group is listed in the travel and MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

leisure sector of the JSE Ltd. PSG Alpha (Pty) Ltd. 44.00%

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Rests&Bars POSTAL ADDRESS: PO Box 2161, Durbanville, 7551

NUMBER OF EMPLOYEES: 305 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SDO

COMPANY SECRETARY: Stadio Corporate Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

237