Page 218 - SHB 2020 Issue 1

P. 218

JSE – REM Profile’s Stock Exchange Handbook: 2020 – Issue 1

NUMBER OF EMPLOYEES: 17 594

Remgro Ltd. DIRECTORS: de Bruyn S E N (ind ne),

REM Ferreira G T (ld ind ne), Harris P K (ind ne),

Lubbe M, Mageza Mr N P (ind ne),

Moleketi P J (ind ne), Morobe M M (ind ne),

Robertson F (Co Dep Chair, ne), Rupert A (ne),

Rupert J P (Chair, ne),

Hertzog Dr E H (Co Dep Chair, ne),

Malherbe J (Co Dep Chair, ne),

Scan the QR code to Durand J J (CEO), Williams N (CFO)

visit our website POSTAL ADDRESS: PO Box 456, Stellenbosch,

7599

EMAIL: dh@remgro.com

WEBSITE: www.remgro.com

TELE PHONE: 021-888-3000 FAX: 021-888-3399

ISIN: ZAE000026480 SHORT: REMGRO CODE: REM

REG NO: 1968/006415/06 FOUNDED: 2000 LISTED: 2000 COMPANY SECRETARY: Danielle Heynes

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Remgro Ltd. is an in vest ment holding company es tab lished AUDITORS: PwC Inc.

with effect from 1 April 2000, after the re struc tur ing of the BANKERS: First National Bank

former Rembrandt Group Ltd. The Group’s interests consist CALENDAR Expected Status

mainly of investments in consumer products; banking; Next Interim Results Mar 2020 Un con firmed

healthcare; insurance; industrial; infrastructure as well as Next Final Results Sep 2020 Un con firmed

media and sport. Annual General Meeting Nov 2020 Un con firmed

The company’s ac tiv i ties are con cen trated mainly on the man -

age ment of in vest ments and the provision of support rather CAPITAL STRUCTURE AUTHORISED ISSUED

than on being involved in the day-to-day management of REM Ords no par 1 000 000 000 529 217 007

business units of investees. DISTRIBUTIONS [ZARc]

Amt

Ldt

Pay

Sub sid iar ies not wholly owned include listed companies with Ords no par 12 Nov 19 18 Nov 19 349.00

Final No 38

in de pend ent boards of directors on which this company has Interim No 37 9 Apr 19 15 Apr 19 215.00

non-executive rep re sen ta tion. Non-sub sid iary in vest ments Final No 36 13 Nov 18 19 Nov 18 328.00

comprise both listed and unlisted companies not con trolled by Interim No 35 17 Apr 18 23 Apr 18 204.00

this company and which are mostly as so ci ated companies due LIQUIDITY: Nov19 Ave 6m shares p.w., R1 158.8m(57.3% p.a.)

to sig nif i cant influence and board representation.

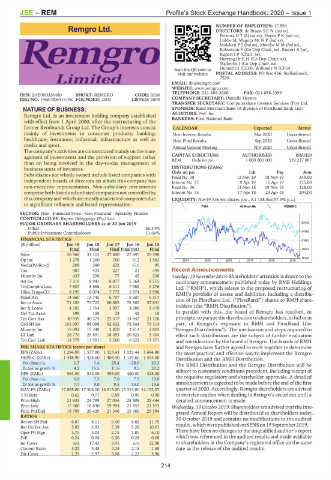

FINA 40 Week MA REMGRO

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

CONTROLLED BY: Rupert Beleggings (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 27042

Other 86.34%

Public Investment Commissioner 13.66% 24362

FINANCIAL STATISTICS 21681

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final Final(rst) Final 19001

Sales 56 968 31 115 27 600 27 697 25 590

Op Inc 3 278 1 260 760 512 1 562 2014 | 2015 | 2016 | 2017 | 2018 | 2019 16320

NetIntPd(Rcvd) 209 380 622 616 95

Tax 987 423 227 - 21 395 Recent Announcements

Minority Int 433 256 77 45 206 Tuesday, 19 November 2019: Share hold ers’ attention is drawn to the

Att Inc 7 319 8 943 8 877 5 364 8 715 cau tion ary an nounce ment published today by RMB Holdings

TotCompIncLoss 7 807 8 888 6 411 7 988 9 276 Ltd. (“RMH”), which relates to the proposed re struc tur ing of

Hline Erngs-CO 8 195 8 074 7 772 5 874 7 996 RMH’s portfolio of assets and li a bil i ties, including a dis tri bu -

Fixed Ass 14 660 13 745 6 797 6 607 6 317 tion of its FirstRand Ltd. (“FirstRand”) shares to RMH share -

Inv in Assoc 71 183 73 722 80 883 78 565 57 831

Inv & Loans 4 185 3 764 3 907 4 288 3 470 hold ers (the “RMH Dis tri bu tion”).

Def Tax Asset 199 158 23 42 18 In parallel with this, the board of Remgro has resolved, in

Tot Curr Ass 40 539 40 375 22 317 14 442 21 126 principle, to pursue the dis tri bu tion to share hold ers, in full or in

Ord SH Int 101 097 98 098 92 432 78 844 73 114 part, of Remgro’s exposure to RMH and FirstRand (the

Minority Int 15 092 15 348 2 870 2 813 2 803 “Remgro Dis tri bu tion”). The mechanism and steps required to

LT Liab 26 770 25 891 18 493 20 821 5 404 effect such dis tri bu tions are the subject of further eval u a tion

Tot Curr Liab 12 579 11 591 5 260 6 622 13 371 and con sid er ation by the board of Remgro. The boards of RMH

PER SHARE STATISTICS (cents per share) and Remgro have further agreed to work together to determine

EPS (ZARc) 1 294.00 1 577.90 1 523.43 1 022.44 1 694.90 the most practical and effective way to implement the Remgro

HEPS-C (ZARc) 1 448.90 1 424.60 1 404.40 1 119.60 1 555.00 Dis tri bu tion and the RMH Dis tri bu tion.

Pct chng p.a. 1.7 1.4 25.4 - 28.0 20.3 The RMH Dis tri bu tion and the Remgro Dis tri bu tion will be

Tr 5yr av grwth % 4.2 15.5 11.6 9.5 20.2 subject to customary con di tions precedent, including receipt of

DPS (ZARc) 564.00 532.00 495.00 460.00 428.00

Pct chng p.a. 6.0 7.5 7.6 7.5 10.0 the requisite reg u la tory and share holder approvals. A detailed

Tr 5yr av grwth % 7.7 9.0 9.5 13.0 15.6 an nounce ment is expected to be made before the end of the first

NAV PS (ZARc) 17 895.00 17 304.00 16 313.00 15 313.00 14 152.57 quarter of 2020. Ac cord ingly, Remgro share hold ers are advised

3 Yr Beta 0.62 0.77 0.89 0.99 0.90 to exercise caution when dealing in Remgro’s securities until a

Price High 21 935 24 799 27 036 28 308 28 444 detailed announcement is made.

Price Low 17 400 18 830 19 954 21 455 21 573 Wednesday, 30 October 2019: Share hold ers are advised that the In te -

Price Prd End 18 790 20 429 21 346 25 466 25 594 grated Annual Report will be dis trib uted to share hold ers today,

RATIOS 30 October 2019 and contains no mod i fi ca tions to the audited

Ret on SH Fnd 6.67 8.11 9.40 6.62 11.75

Ret On Tot Ass 5.83 2.93 7.39 5.28 10.01 results, which were published on SENS on 19 September 2019.

Oper Pft Mgn 5.75 4.05 2.75 1.85 6.10 There have been no changes to the un qual i fied auditor’s report

D:E 0.24 0.24 0.20 0.28 0.08 which was ref er enced in the audited results and made available

Int Cover n/a 17.42 2.91 n/a 22.98 to share hold ers at the Company’s reg is tered office on the same

Current Ratio 3.22 3.48 4.24 2.18 1.58 date as the release of the audited results.

Div Cover 2.29 2.97 3.08 2.22 3.96

214