Page 210 - SHB 2020 Issue 1

P. 210

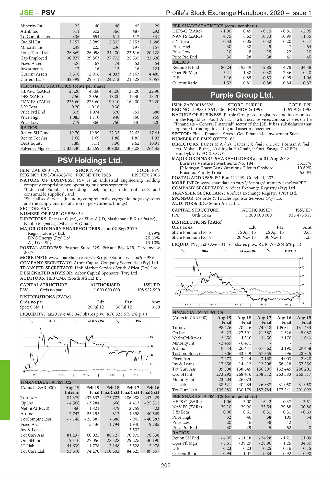

JSE – PSV Profile’s Stock Exchange Handbook: 2020 – Issue 1

Minority Int 25 40 46 45 29 PER SHARE STATISTICS (cents per share)

Attrib Inc 311 602 566 487 293 HEPS-C (ZARc) - 1.90 0.45 - 0.19 - 0.81 - 2.95

TotCompIncLoss 336 654 611 517 331 NAV PS (ZARc) 4.75 6.62 10.73 10.99 11.35

Ord SH Int 3 157 2 989 2 505 2 153 1 688 3 Yr Beta - 0.33 - 0.05 - 0.32 0.20 - 0.17

Minority Int 248 225 236 197 157 Price High 30 38 49 47 64

Long-Term Liab 26 869 26 058 24 400 22 616 20 128 Price Low 10 8 15 22 10

Cap Employed 30 927 29 863 27 702 25 535 22 626 Price Prd End 30 28 38 40 45

Fixed Assets 326 67 74 53 54 RATIOS

Investments 17 16 15 16 124 Ret on SH Fnd - 80.24 - 93.49 - 2.85 - 4.78 - 134.38

Current Assets 3 308 2 906 4 093 3 163 4 485 Oper Pft Mgn - 5.41 - 1.38 0.38 2.36 - 10.40

Current Liab 32 399 29 511 24 712 21 528 17 057 D:E 3.16 0.85 0.83 0.99 1.06

Current Ratio 1.52 0.81 0.88 0.84 0.87

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 23.20 45.60 43.00 37.20 22.90

DPS (ZARc) 7.50 20.50 18.00 15.30 13.20 Purple Group Ltd.

NAV PS (ZARc) 235.60 223.60 190.10 164.00 132.20 PUR

3 Yr Beta 0.20 - 0.16 0.30 - - ISIN: ZAE000185526 SHORT: PUR PLE CODE: PPE

Price Prd End 809 1 074 870 751 688 REG NO: 1998/013637/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: Purple Group Ltd., registered and incorporated

Price High 1 085 1 110 940 850 959 in the Republic of South Africa, is a financial services company listed on the

Price Low 779 860 750 640 620 “Financials – General Financial” sector of the JSE. It has subsidiaries that

RATIOS operate in trading, investing and asset management.

Ret on SH Fund 19.70 19.99 22.35 22.63 17.44 SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs

Ret on Tot Ass 1.66 1.69 1.86 1.85 1.93 NUMBER OF EMPLOYEES: 65

Debt:Equity 7.89 8.11 8.90 9.62 10.91 DIRECTORS: Barnes M A (ne), Carter C C (ind ne, USA), Forman A (ind

Solvency Mgn% 1 335.30 356.59 309.83 308.08 264.35 ne), Mohale B (ne), Ntshingila H (Chair, ind ne), Savage C (CEO),

van Dyk G (CFO & COO)

PSV Holdings Ltd. MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2018 35.51%

Business Venture Investments No. 184

PSV JP Morgan Chase Bank Omnibus Clients Onshore 10.69%

ISIN: ZAE000078705 SHORT: PSV CODE: PSV Erasmus Family Trust 6.00%

REG NO: 1998/004365/06 FOUNDED: 1988 LISTED: 2006 POSTAL ADDRESS: PO Box 411449, Craighall, 2024

NATURE OF BUSINESS: PSV is an industrial engineering holding

company comprising two operating business segments: MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PPE

*Industrial Supplies (including steel, piping, industrial tools and COMPANY SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

consumable supplies); and TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

*Specialised Services (including comprehensive cryogenic and gas systems SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

and the supply and installation of geosynthetic linings). AUDITORS: BDO South Africa Inc.

SECTOR: AltX CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 59 PPE Ords 1c ea 1 200 000 000 935 476 518

DIRECTORS: Bernard O (ne), da Silva A J D, Mashabane B K (ld ind ne),

Ngubo M (ind ne), Mbalati A (Chair) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 02 Sep 2019 Ords 1c ea Ldt Pay Amt

Regis Holdings Ltd. 34.99% Share Premium No 5 15 Apr 16 25 Apr 16 0.65

DNG Energy (Pty) Ltd. 25.60% Share Premium No 4 20 Nov 15 30 Nov 15 1.25

A J D da Silva 13.10% LIQUIDITY: Jan20 Ave 831 163 shares p.w., R240 768.8(4.6% p.a.)

POSTAL ADDRESS: Postnet Suite 229, Private Bag X19, Gardenview,

2047 FINA 40 Week MA PURPLE

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PSV 91

COMPANY SECRETARY: Arbor Capital Company Secretarial (Pty) Ltd.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 77

DESIGNATED ADVISOR: Arbor Capital Sponsors (Pty) Ltd.

63

AUDITORS: HLB CMA (South Africa) Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 50

PSV Ords no par 1 000 000 000 408 982 990

36

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 22

Special No 1 20 Jul 12 30 Jul 12 3.60 2015 | 2016 | 2017 | 2018 | 2019

LIQUIDITY: Jan20 Ave 405 347 shares p.w., R76 523.5(5.2% p.a.) FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15

ALSH 40 Week MA PSV Final Final Final Final Final

Turnover 98 476 70 216 74 518 105 811 131 433

Op Inc - 5 423 - 27 591 - 21 580 1 326 45 080

45 NetIntPd(Rcvd) 3 650 4 316 3 456 2 176 1 043

Minority Int - 2 469 - 6 471 - - -

36

Att Inc - 9 544 - 26 447 - 57 862 - 3 190 29 438

TotCompIncLoss - 11 806 - 33 549 - 57 355 - 1 696 28 815

26

Fixed Ass 3 273 3 944 3 168 4 003 2 828

17 Inv & Loans 17 658 14 412 12 208 58 418 57 556

Tot Curr Ass 99 398 138 645 156 890 162 445 286 201

7 Ord SH Int 273 295 268 416 238 312 263 383 265 517

2015 | 2016 | 2017 | 2018 | 2019

Minority Int 23 604 26 073 - - -

FINANCIAL STATISTICS LT Liab 38 521 40 284 26 887 31 058 31 058

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final(rst) Final(rst) Final(rst) Tot Curr Liab 105 983 130 179 187 784 177 241 291 092

Turnover 84 379 237 532 175 703 186 988 243 429 PER SHARE STATISTICS (cents per share)

Op Inc - 4 568 - 3 284 660 4 413 - 25 311 HEPS-C (ZARc) - 1.06 - 3.00 - 6.42 - 0.37 3.51

NetIntPd(Rcvd) 560 1 821 879 2 759 303 NAV PS (ZARc) 29.10 29.90 25.54 29.88 30.86

Att Inc - 7 747 - 25 295 - 812 - 1 398 - 40 569 3 Yr Beta 0.06 0.61 0.31 0.31 - 0.63

TotCompIncLoss - 7 746 - 25 887 - 686 - 965 - 40 383 Price High 32 46 68 100 54

Fixed Ass - 5 436 11 794 11 940 9 785 Price Low 20 6 38 42 11

Inv & Loans - - - 2 503 - Price Prd End 30 29 45 62 48

RATIOS

Tot Curr Ass 81 297 60 025 88 727 70 975 78 338

Ord SH Int 19 310 27 056 28 528 29 225 30 190 Ret on SH Fnd - 4.05 - 11.18 - 24.28 - 1.21 11.09

- 28.96

- 39.29

1.25

34.30

Oper Pft Mgn

- 5.51

LT Liab 41 639 1 778 2 148 5 528 3 978 D:E 0.23 0.23 0.25 0.16 0.15

Tot Curr Liab 53 600 74 270 100 592 84 625 89 567

Current Ratio 0.94 1.07 0.84 0.92 0.98

206