Page 207 - SHB 2020 Issue 1

P. 207

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – PIO

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs

Pioneer Food Group Ltd. NUMBER OF EMPLOYEES: 3 614

PIO DIRECTORS: Ball A C (ind ne), Claassen J T, Gobodo N (ind ne), Gumbi

ISIN: ZAE000118279 SHORT: PNR FOODS CODE: PFG Adv M F (ind ne), Mkhondo N (ind ne), Moyo T (ind ne), Naude C H (ind

REG NO: 1996/017676/06 FOUNDED: 1996 LISTED: 2008 ne), Thompson M R (ind ne), Moleketi P J (Chair, ind ne),

NATURE OF BUSINESS: Pioneer Foods is one of the largest South African van Wijnen R (CEO), van Dijk R (Acting CFO)

producers and distributors of a range of branded food and beverage MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

products. The Group operates mainly across South Africa, providing Government Employees Pension Fund 23.66%

wholesale, retail and informal trade customers with products of a Lazard Asset Management 5.84%

consistently high standard. Prudential Investment Managers 5.58%

SECTOR: Consumer—Food&Bev—Food Producers—Food POSTAL ADDRESS: PO Box 787416, Sandton, 2146

NUMBER OF EMPLOYEES: 9 655 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PPC

DIRECTORS: Botha C G (ind ne), Celliers N (ne), COMPANY SECRETARY: Kristell Holtzhausen

Karaan Prof A S M (ne), Mjoli-Mncube N S (ind ne), Mouton P J (ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mthimunye L E (ind ne), Ntsaluba S S (ind ne), Sangqu A H (ind ne),

Thomson N W (ld ind ne), Combi Z L (Chair, ind ne), Carstens T A SPONSOR: Merrill Lynch SA (Pty) Ltd.

(CEO), Lamprecht C (Acting CFO), Lombard F (CFO) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 16 Aug 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Zeder Investments Ltd. 25.00% PPC Ords no par value 10 000 000 000 1 593 114 301

GEPF 7.90%

The Good Carb Food Company Ltd. 7.70% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: Glacier Place, 1 Sportica Crescent, Tyger Valley, 7530 Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PFG Final No 224 31 Dec 15 11 Jan 16 33.00

COMPANY SECRETARY: Jay-Ann Jacobs Interim No 223 5 Jun 15 15 Jun 15 24.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan20 Ave 12m shares p.w., R58.6m(38.2% p.a.)

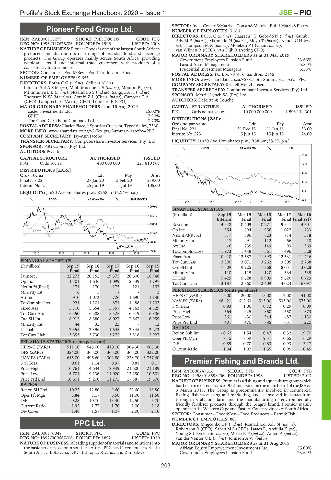

SPONSOR: PSG Capital (Pty) Ltd. CONM 40 Week MA PPC

AUDITORS: PwC Inc.

3012

CAPITAL STRUCTURE AUTHORISED ISSUED

PFG Ords 10c ea 400 000 000 221 810 907 2462

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt 1912

Final No 22 28 Jan 20 3 Feb 20 219.00 1362

Interim No 21 25 Jun 19 1 Jul 19 105.00

LIQUIDITY: Jan20 Ave 3m shares p.w., R258.1m(62.4% p.a.) 812

FOOD 40 Week MA PNR FOODS 262

2015 | 2016 | 2017 | 2018 | 2019

20799

FINANCIAL STATISTICS

18019 (R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final Final Final Final(rst)

15239 Revenue 4 948 10 409 10 271 9 641 4 501

Op Inc 354 894 956 1 027 733

12460

NetIntPd(Rcvd) 317 586 623 714 318

Minority Int - 17 - 91 - 112 - 66 - 18

9680

Att Inc - 6 235 149 93 369

6900 TotCompIncLoss - 1 973 1 448 - 561 - 496 528

2015 | 2016 | 2017 | 2018 | 2019

Fixed Ass 10 910 12 587 11 393 12 531 11 716

FINANCIAL STATISTICS Tot Curr Ass 3 300 3 071 3 262 3 805 2 768

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 Ord SH Int 7 309 9 225 7 768 8 051 3 028

Final Final Final Final Final Minority Int 110 115 120 334 535

Turnover 22 273 20 152 19 575 20 600 18 748 LT Liab 5 429 5 628 5 909 5 626 6 729

Op Inc 1 301 1 646 1 099 2 339 1 797 Tot Curr Liab 3 187 2 860 2 409 4 024 6 097

NetIntPd(Rcvd) 171 170 175 121 103

Minority Int 6 5 - - 2 PER SHARE STATISTICS (cents per share)

Att Inc 910 1 073 726 1 690 1 130 HEPS-C (ZARc) 6.00 20.00 15.00 7.00 41.00

TotCompIncLoss 924 1 101 871 1 488 1 202 NAV PS (ZARc) 484.21 612.63 513.00 533.00 573.00

Fixed Ass 5 710 5 654 5 357 4 763 4 329 3 Yr Beta 0.93 1.06 0.72 0.29 0.09

Tot Curr Ass 6 550 6 588 5 525 6 519 6 386 Price High 564 925 860 1 550 1 873

Ord SH Int 8 912 8 380 8 027 7 867 6 959 Price Low 361 430 344 487 1 130

Minority Int 44 35 25 - 12 Price Prd End 401 470 785 651 1 220

LT Liab 2 355 2 396 1 645 2 345 2 273 RATIOS

Tot Curr Liab 3 353 3 730 3 275 3 318 2 927 Ret on Shh Int - 0.62 1.54 0.47 0.32 19.70

Oper Pft Mgn 7.15 8.59 9.31 10.65 16.29

PER SHARE STATISTICS (cents per share) D:E 0.89 0.70 0.83 0.93 3.17

HEPS-C (ZARc) 511.10 545.00 410.10 904.30 665.30 Current Ratio 1.04 1.07 1.35 0.95 0.45

DPS (ZARc) 324.00 365.00 365.00 365.00 332.00

NAV PS (ZARc) 4 615.00 4 496.60 4 302.80 4 238.70 3 757.60

3 Yr Beta 0.61 1.14 0.97 0.81 0.17 Premier Fishing and Brands Ltd.

Price High 10 761 14 644 18 949 21 600 21 189 ISIN: ZAE000247516 SHORT: PFB CODE: PFB

PRE

Price Low 6 704 9 136 11 020 12 250 10 501 REG NO: 1998/018598/06 FOUNDED: 1998 LISTED: 2017

Price Prd End 10 601 9 200 11 275 17 387 19 576 NATURE OF BUSINESS: Premier is a fishing and aquaculture group which

RATIOS has been in existence since 1952 and listed on the main board of the JSE on

Ret on SH Fnd 10.22 12.80 9.60 22.60 18.80 3 March 2017. The Group is predominantly involved in commercial

Oper Pft Mgn 5.84 8.17 6.50 11.00 11.50 fishing, fish processing and marketing, and is involved in aquaculture

D:E 0.28 10.70 13.40 12.50 5.70 through its abalone farm and the manufacturing of environmentally

Current Ratio 1.95 1.77 1.70 2.00 2.18 friendly fertiliser products through the Seagro brand. Premier mainly

operates in the Western Cape and Eastern Cape provinces of South Africa.

Div Cover 1.48 1.57 1.07 2.00 2.10

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

NUMBER OF EMPLOYEES: 801

PPC Ltd. DIRECTORS: Mngconkola P (ind ne), Ramatlhodi Adv N (ind ne),

Robertson B (CFO), Saban M S (CEO), Isaacs R, Abdulla K (ne),

PPC

ISIN: ZAE000170049 SHORT: PPC CODE: PPC Young S (Dep Chair, ind ne), Mosia R P (ind ne), Amod A (ind ne),

REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910 van der Venter C L (ind ne), Johnson A W (ind ne)

NATURE OF BUSINESS: A leading supplier of materials and solutions into MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2018

the basic services sector in southern Africa, PPC has 11 cement factories in African Equity Empowerment Investments Ltd. 55.00%

South Africa, Botswana, DRC, Ethiopia, Rwanda and Zimbabwe. Government Employees Pension Fund 23.61%

203