Page 215 - SHB 2020 Issue 1

P. 215

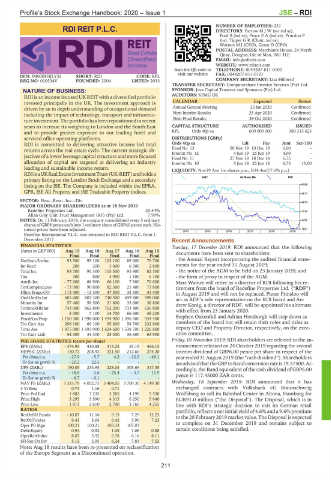

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – RDI

NUMBER OF EMPLOYEES: 231

RDI REIT P.L.C. DIRECTORS: Farrow M J W (snr ind ne),

RDI Ford S (ind ne), Peace E A (ind ne), Prinsloo P

(ne), Tipper G R (Chair, ind ne),

Watters M J (CEO), Grant D (CFO)

POSTAL ADDRESS: Merchants House, 24 North

Quay, Douglas, Isle of Man, IM1 4LE

EMAIL: info@rdireit.com

WEBSITE: www.rdireit.com

Scan the QR code to TELE PHONE: 0044207-811-0100

visit our website FAX: 0044207-811-0101

ISIN: IM00BH3JLY32 SHORT: RDI CODE: RPL

REG NO: 010534V FOUNDED: 2004 LISTED: 2013 COMPANY SECRETARY: Lisa Hibberd

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

RDI is an income focused UK REIT with a di ver si fied portfolio AUDITORS: KPMG UK

invested prin ci pally in the UK. The in vest ment approach is CALENDAR Expected Status

driven by an in depth un der stand ing of oc cu pa tional demand Annual General Meeting 23 Jan 2020 Con firmed

including the impact of tech nol ogy, transport and in fra struc - Next Interim Results 23 Apr 2020 Con firmed

ture in vest ment. The portfolio has been re po si tioned in recent Next Final Results 29 Oct 2020 Con firmed

years to increase its weighting to London and the South East CAPITAL STRUCTURE AUTHORISED ISSUED

and to provide greater exposure to our leading hotel and RPL Ords 40p ea 600 000 000 380 315 623

serviced office operating platforms. DISTRIBUTIONS [GBPp]

RDI is committed to de liv er ing at trac tive income led total Ords 40p ea Ldt Pay Amt Scr/100

returns across the real estate cycle. The current strategic ob - Final No 13 20 Nov 19 10 Dec 19 6.00 - -

4 Jun 19 25 Jun 19

4.00

Interim No 12

jec tives of a lower leverage capital structure and more focused Final No 11 27 Nov 18 18 Dec 18 6.75 -

allocation of capital are targeted at delivering an industry Interim No 10 5 Jun 18 25 Jun 18 6.75 15.00

leading and sus tain able income return. LIQUIDITY: Nov19 Ave 1m shares p.w., R34.4m(17.6% p.a.)

RDI is a UK Real Estate In vest ment Trust (UK-REIT) and holds a

J867 40 Week MA RDI

primary listing on the London Stock Exchange and a secondary

listing on the JSE. The Company is included within the EPRA, 6558

GPR, JSE All Property and JSE Tradeable Property indices.

5617

SECTOR: Fins—Rest—Inv—Div 4675

MAJOR ORDINARY SHAREHOLDERS as at 18 Nov 2019

Redefine Properties Ltd. 29.44% 3734

Allan Gray Unit Trust Management (RF) (Pty) Ltd. 7.99%

NOTES: On 11 February 2019, the company con sol i dated every 5 ordinary 2792

shares of GBP8 pence each into 1 ordinary share of GBP40 pence each. His -

tor i cal prices have been adjusted. 2014 | 2015 | 2016 | 2017 | 2018 | 2019 1851

Re de fine In ter na tional P.L.C. was re named to RDI REIT P.L.C. from 1

De cem ber 2017. Recent Announcements

FINANCIAL STATISTICS Tuesday, 17 December 2019: RDI announced that the following

(Amts in GBP’000) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15 documents have been sent to share hold ers:

Final Final Final Final Final

NetRent/InvInc 93 500 95 100 102 100 89 600 79 700 - the An nual Re port in cor po rat ing the au dited fi nan cial state -

Int Recd 200 200 3 400 6 300 2 800 ments for the year ended 31 Au gust 2019;

Total Inc 93 700 95 300 105 500 95 900 82 500 - the no tice of the AGM to be held on 23 Jan u ary 2020; and

Tax 300 800 3 900 1 100 6 100 - the form of proxy in re spect of the AGM.

Attrib Inc - 77 600 88 900 66 100 7 900 70 600 Marc Wainer will re tire as a di rec tor of RDI fol low ing his re -

TotCompIncLoss - 73 900 90 800 82 300 21 400 73 800 tire ment from the board of Re de fine Prop er ties Ltd. (“RDF”)

Hline Erngs-CO 113 400 - 12 300 47 300 32 600 41 400 in Au gust 2019 and will not be re placed. Pieter Prinsloo will

Ord UntHs Int 685 600 803 300 740 400 699 800 598 000 act as RDF’s sole rep re sen ta tive on the RDI board and An -

Minority Int 57 400 59 500 21 800 33 600 38 800 drew Konig, a di rec tor of RDF, will be ap pointed his al ter nate

TotStockHldInt 743 000 862 800 762 200 733 400 636 800 with ef fect from 23 Jan u ary 2020.

Investments 8 000 7 100 14 700 66 600 48 200 Ste phen Oakenfull and Adrian Horsburgh will step down as

FixedAss/Prop 1 150 300 1 598 000 1 494 900 1 396 400 934 400

Tot Curr Ass 298 100 66 100 95 600 58 700 232 800 mem bers of the board but will re tain their roles and ti tles as

Total Ass 1 475 000 1 693 900 1 624 600 1 538 700 1 226 800 dep uty CEO and Prop erty Di rec tor, re spec tively, on the ex ec -

Tot Curr Liab 54 300 34 300 25 300 36 600 63 900 u tive com mit tee.

PER SHARE STATISTICS (cents per share) Friday, 01 November 2019: RDI share hold ers are referred to the an -

EPS (ZARc) - 374.95 410.88 315.25 53.15 466.15 nounce ment released on 24 October 2019 regarding the second

HEPS-C (ZARc) 150.72 208.92 221.50 212.60 274.20 interim dividend of GBP6.00 pence per share in respect of the

Pct chng p.a. - 27.9 - 5.7 4.2 - 22.5 - 49.1 year ended 31 August 2019 (the “cash dividend”). Share hold ers

Tr 5yr av grwth % - 20.2 22.5 - - - are advised that the GBP to Rand con ver sion rate is 19.57500. Ac -

DPS (ZARc) 190.05 233.95 228.05 305.65 317.35 cord ingly, the Rand equiv a lent of the cash dividend of GBP6.00

Pct chng p.a. - 18.8 2.6 - 25.4 - 3.7 11.9 pence is 117.45000 ZAR cents.

Tr 5yr av grwth % - 6.7 - 0.1 - - -

NAV PS (ZARc) 3 333.79 4 052.73 3 404.05 3 709.30 4 149.30 Wednesday, 18 September 2019: RDI announced that it has

3 Yr Beta 0.74 1.16 0.71 - - exchanged contracts with Volksbank eG Braunschweig

Price Prd End 1 882 3 235 3 285 4 190 5 530 Wolfsburg to sell its Bahnhof Center in Altona, Hamburg for

Price High 3 295 3 590 4 315 6 250 5 640 EUR91.0 million (“the Disposal”). The Disposal, which is in

Price Low 1 813 2 610 2 700 3 760 4 255 line with RDI’s strategic decision to exit its German retail

RATIOS portfolio, reflects a net initial yield of 4.6% and a 9.6% premium

RetOnSH Funds - 10.07 11.16 9.13 7.29 12.23 to the 28 February 2019 market value. The Disposal is expected

RetOnTotAss 6.41 5.64 6.42 5.90 7.23

Oper Pft Mgn 100.21 100.21 103.33 107.03 - to complete on 31 December 2019 and remains subject to

Debt:Equity 0.94 0.92 1.08 1.06 0.88 certain con di tions being satisfied.

OperRetOnInv 8.07 5.92 6.78 6.16 8.11

SH Ret On Inv 5.12 5.95 6.24 7.83 7.52

Note: Aug 18 re sults have been re-pre sented on re clas si fi ca tion

of the Eu rope Seg ment as a Dis con tin ued operation.

211