Page 208 - SHB 2020 Issue 1

P. 208

JSE – PRI Profile’s Stock Exchange Handbook: 2020 – Issue 1

POSTAL ADDRESS: PO Box 181, Victoria & Alfred Waterfront, Cape CAPITAL STRUCTURE AUTHORISED ISSUED

Town, 8000 PMV Ords 1c ea 500 000 000 132 062 743

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PFB DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Cornell Kannemeyer Ords 1c ea Ldt Pay Amt

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Interim No 21 14 Jan 20 20 Jan 20 1.50

SPONSOR: PSG Capital (Pty) Ltd. Final No 20 16 Jul 19 22 Jul 19 2.50

AUDITORS: BDO Cape Incorporated

LIQUIDITY: Jan20 Ave 67 892 shares p.w., R43 924.7(2.7% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

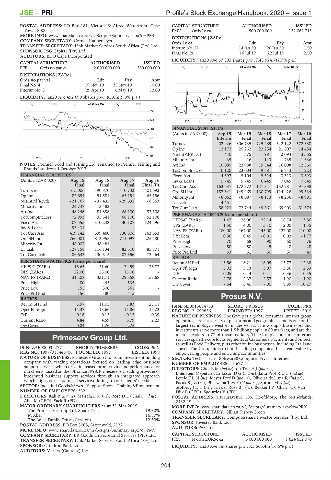

PFB Ords no par val 2 000 000 000 260 000 000 SUPS 40 Week MA PRIMESERV

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

76

Final No 4 19 Nov 19 25 Nov 19 10.00

Interim No 3 29 Apr 19 6 May 19 12.00

62

LIQUIDITY: Jan20 Ave 492 690 shares p.w., R1.0m(9.9% p.a.)

48

FOOD 40 Week MA PFB

34

533

20

447 2015 | 2016 | 2017 | 2018 | 2019

361 FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

275 Interim Final Final Final Final

Turnover 402 926 806 735 725 289 642 122 572 388

189

Op Inc 12 172 25 262 22 254 21 607 14 484

NetIntPd(Rcvd) 440 375 1 981 2 094 3 365

103

2017 | 2018 | 2019

Minority Int 35 16 143 735 - 1 636

NOTES: Premier Food and Fishing Ltd. renamed to Premier Fishing and Att Inc 10 085 22 988 19 544 16 008 12 860

Brands Ltd. from 4 October 2017.

TotCompIncLoss 10 120 23 004 19 687 16 743 11 224

FINANCIAL STATISTICS Fixed Ass 4 597 5 104 5 514 3 513 3 693

(Amts in ZAR’000) Aug 19 Aug 18 Aug 17 Aug 16 Inv & Loans 5 745 5 745 6 445 7 045 7 645

Final Final Final Final (P) Tot Curr Ass 163 637 172 372 127 311 132 781 97 398

Turnover 575 006 490 870 410 733 401 692 Ord SH Int 157 341 149 969 130 799 114 426 99 634

Op Inc 82 654 91 581 65 151 65 156 Minority Int - 8 062 - 8 097 - 8 113 - 8 256 - 8 991

NetIntPd(Rcvd) - 21 167 - 37 432 - 29 692 - 8 363 LT Liab 4 451 - - - -

Minority Int 24 747 13 483 - - Tot Curr Liab 58 923 72 744 49 561 69 903 51 374

Att Inc 48 246 81 858 68 100 52 108

TotCompIncLoss 72 993 95 341 68 100 52 108 PER SHARE STATISTICS (cents per share) 22.14 18.74 13.86

26.06

11.47

HEPS-C (ZARc)

Fixed Ass 407 555 310 242 130 107 124 596 DPS (ZARc) 1.50 4.00 3.10 2.00 1.35

Inv & Loans 93 434 - - -

Tot Curr Ass 419 142 599 460 730 806 163 553 NAV PS (ZARc) 180.00 167.00 145.00 127.00 110.00

0.56

0.02

- 1.77

0.45

3 Yr Beta

- 0.01

Ord SH Int 766 001 813 955 771 097 225 480

Minority Int 48 007 48 481 - - Price High 70 68 90 60 76

Price Low

45

50

28

50

40

LT Liab 127 158 116 134 82 310 85 871 Price Prd End 63 61 60 50 40

Tot Curr Liab 86 643 130 515 107 556 73 464

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 13.56 16.21 16.05 15.77 12.38

HEPS-C (ZARc) 16.65 31.60 34.59 36.73 Oper Pft Mgn 3.02 3.13 3.07 3.36 2.53

DPS (ZARc) 22.00 25.00 15.00 - D:E 0.05 0.14 0.11 0.36 0.35

NAV PS (ZARc) 313.08 331.71 296.58 157.68 Current Ratio 2.78 2.37 2.57 1.90 1.90

Price High 400 445 535 - Div Cover 7.64 6.40 7.00 8.89 10.27

Price Low 155 300 361 -

Price Prd End 156 380 415 -

RATIOS Prosus N.V.

PRO

Ret on SH Fnd 8.97 11.05 8.83 23.11 ISIN: NL0013654783 SHORT: PROSUS CODE: PRX

Oper Pft Mgn 14.37 18.66 15.86 16.22 REG NO: 34099856 FOUNDED: 1997 LISTED: 2019

D:E 0.16 0.13 0.13 0.39 NATURE OF BUSINESS: The Group is a global consumer internet group

Current Ratio 4.84 4.59 6.79 2.23 operating across a variety of platforms and geographies, and is one of the

Div Cover 0.84 1.26 2.25 - largest technology investors in the world. The Group’s businesses and

investments serve more than 1.5 billion people in 89 markets, and are the

market leaders in 77 of those markets. The Group’s consumer internet

Primeserv Group Ltd. services span the core focus segments of Classifieds, Payments and Fintech

as well as Food Delivery, plus other online businesses, including Etail and

PRI

ISIN: ZAE000039277 SHORT: PRIMESERV CODE: PMV Travel. The Group aims to build leading companies that create value by

REG NO: 1997/013448/06 FOUNDED: 1997 LISTED: 1998 empowering people and enriching communities.

NATURE OF BUSINESS: Primeserv Group Ltd. is an investment holding SECTOR: Tech—Tech—Software&Computer Srvcs—Internet

company with trading operations focused on leading edge business NUMBER OF EMPLOYEES: 15 677

support services which drive increased productivity and performance for DIRECTORS: Choi E M (ind ne), du Toit H J (ind ne),

our clients. Listed on the JSE since 1998, Primeserv is a leading provider of Enenstein C (ind ne), Eriksson D G (ind ne), Jafta Prof R C C (ind ne),

integrated business support services through an integrated approach Letele F L N (ne), Meyer Prof D (ind ne), Oliveira de Lima R (ind ne),

which aligns our customised service offerings to our clients’ needs. Pacak S J Z (ne), Phaswana T M F (ld ind ne), Sorour M R (ne),

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Training&Employment Stofberg J D T (ne), van der Ross B J (ne), Bekker J P (Chair, ne), Van

NUMBER OF EMPLOYEES: 332 Dijk B (CEO), Sgourdos V (FD)

DIRECTORS: Kali B (ind ne), Maisela L M (ne), Rose D L (Chair, ind ne), POSTAL ADDRESS: Taurusavenue 105, Hoofddorp, The Netherlands,

Abel M (CEO), Sack R (FD) 2132 LS

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PRX

The Primeserv Group Ltd. Share Trust 19.80% COMPANY SECRETARY: Gillian Kisbey-Green

M Abel 16.30% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

The Boles Family Trust (Cession) 12.30%

POSTAL ADDRESS: PO Box 3008, Saxonwold, 2132 SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PMV

COMPANY SECRETARY: ER Goodman Secretarial Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. PRX N ords EUR5c ea 5 000 000 000 1 624 652 070

SPONSOR: Grindrod Bank Ltd. LIQUIDITY: Jan20 Ave 5m shares p.w., R5 666.4m(16.6% p.a.)

AUDITORS: Mazars (Gauteng) Inc.

204