Page 209 - SHB 2020 Issue 1

P. 209

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – PSG

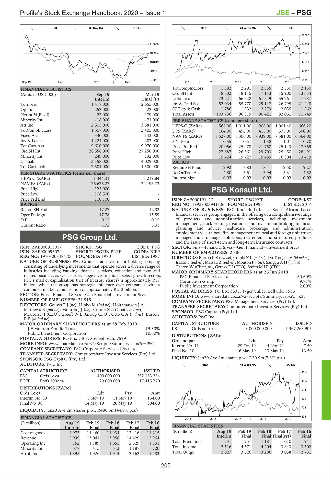

SCOM 80 Day MA PROSUS GENF 40 Week MA PSG

28797

113830 24934

108924 21072

104019 17209

99113 13347

94208 9484

Sep 19 | Oct | Nov | Dec | 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS TotCompIncLoss 1 882 2 291 2 335 2 830 2 130

(Amts in USD’000) Sep 19 Mar 19 Ord SH Int 18 602 18 115 17 143 15 900 13 634

Interim Final (P) Liabilities 73 221 66 928 61 549 55 261 47 987

Turnover 1 417 000 2 655 000 Inv & Trad Sec 52 034 55 770 29 147 26 795 21 448

Op Inc - 252 000 - 422 000 ST Dep & Cash 1 786 1 832 2 279 2 035 1 862

NetIntPd(Rcvd) - 22 000 - 179 000 Total Assets 103 736 96 819 90 421 82 061 71 749

Minority Int - 18 000 - 71 000 PER SHARE STATISTICS (cents per share)

Att Inc 2 505 000 3 581 000 HEPS-C (ZARc) 568.00 1 011.00 908.00 1 001.40 666.20

TotCompIncLoss 1 507 000 3 405 000 DPS (ZARc) 164.00 456.00 415.00 375.00 300.00

Fixed Ass 340 000 143 000 NAV PS (ZARc) 8 527.00 8 306.00 7 939.00 7 381.00 6 364.00

Inv & Loans 1 224 000 282 000 3 Yr Beta 0.55 0.51 1.38 1.07 0.70

Tot Curr Ass 9 610 000 9 970 000 Price Prd End 20 056 25 978 21 750 25 143 17 369

Ord SH Int 28 556 000 27 250 000 Price High 27 687 26 561 29 703 25 450 28 491

Minority Int 249 000 132 000 Price Low 19 424 19 727 19 489 16 804 13 419

LT Liab 3 158 000 4 029 000 RATIOS

Tot Curr Liab 2 581 000 1 580 000 Ret on SH Fund 12.92 7.83 8.41 12.50 9.27

PER SHARE STATISTICS (cents per share) RetOnTotalAss 4.80 3.61 3.94 5.31 4.52

HEPS-C (ZARc) 1 444.41 3 219.84 Interest Mgn 0.02 0.02 0.02 0.02 0.02

NAV PS (ZARc) 26 626.27 24 196.73

Price High 125 000 - PSG Konsult Ltd.

Price Low 108 500 -

PSG

Price Prd End 110 700 - ISIN: ZAE000191417 SHORT: PSG KST CODE: KST

RATIOS REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014

Ret on SH Fnd 17.27 12.82 NATURE OF BUSINESS: PSG Konsult Ltd. is a South African-based

Oper Pft Mgn - 17.78 - 15.89 financial services group engaged in the offering of a comprehensive range

D:E 0.15 0.15 of products and administration services, including investment

Current Ratio 3.72 6.31 management, stockbroking, insurance and investment broking, financial

planning and advice, healthcare brokerage and administration,

employment wealth benefits, management of local and foreign unit trusts,

PSG Group Ltd. managed multi-manager solutions, retirement and structured products

and the issue of short-term and long-term insurance contracts.

PSG

ISIN: ZAE000013017 SHORT: PSG CODE: PSG SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs

ISIN: ZAE000096079 SHORT: PSGFIN PREF CODE: PGFP NUMBER OF EMPLOYEES: 2 886

REG NO: 1970/008484/06 FOUNDED: 1970 LISTED: 1987 DIRECTORS: Burton P E (ind ne), Combi Z L (ind ne), Du Toit J de V (ld ind ne),

NATURE OF BUSINESS: PSG Group is an investment holding company Isaacs T (ind ne), Matsau Z (ind ne), Mouton P J (ne), Sangqu A H (ind ne),

consisting of underlying investments that operate across a diverse range of Theron W (Chair, ne), Gouws F J (CEO), Smith M I F (CFO)

industries including banking, financial services, education and food and MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2019

related business, as well as early-stage investments in select growth sectors. PSG Financial Services Ltd. 60.60%

PSG’s market capitalisation (net of treasury shares) is approximately R57 Coronation Group 9.81%

billion, while the group has strategic influence over companies with a Public Investment Corporation 2.00%

combined market capitalisation of approximately R212 billion. POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=KST

NUMBER OF EMPLOYEES: 21 915 COMPANY SECRETARY: PSG Management Services (Pty) Ltd.

DIRECTORS: Gouws F J (ne), Hlobo M (ind ne), Holtzhausen J A, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mathews B (ind ne), Mouton J J (ne), Combi Z L (Chair, ind ne), SPONSOR: PSG Capital (Pty) Ltd.

Mouton P J (CEO), Greeff W L (Group CFO), Otto C A (ind ne), Burton

P E (ld ind ne) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

J F Mouton Familie Trust 19.30% KST Ords no par 3 000 000 000 1 367 263 905

Public Investment Corporation 10.60%

POSTAL ADDRESS: PO Box 7403, Stellenbosch, 7599 DISTRIBUTIONS [ZARc] Ldt Pay Amt

Ords no par

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=PSG Interim No 11 29 Oct 19 4 Nov 19 7.50

COMPANY SECRETARY: PSG Corporate Services (Pty) Ltd. Final No 10 6 May 19 13 May 19 13.50

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. LIQUIDITY: Jan20 Ave 2m shares p.w., R20.9m(7.8% p.a.)

AUDITORS: PwC Inc. FINA 40 Week MA PSG KST

CAPITAL STRUCTURE AUTHORISED ISSUED 1100

PSG Ords 1c ea 400 000 000 232 163 254

PGFP Prefs 100c ea 20 000 000 17 415 770 1007

DISTRIBUTIONS [ZARc]

914

Ords 1c ea Ldt Pay Amt

Interim No 39 5 Nov 19 11 Nov 19 164.00 821

Final No 38 14 May 19 20 May 19 304.00

728

LIQUIDITY: Jan20 Ave 2m shares p.w., R486.5m(44.9% p.a.)

FINANCIAL STATISTICS 2015 | 2016 | 2017 | 2018 | 2019 635

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final FINANCIAL STATISTICS

Cost of goods 4 973 11 460 11 934 12 416 11 215 (R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Revenue 5 999 13 041 13 956 14 429 12 964 Interim Final Final Final(rst) Final

Operating Inc 752 1 789 1 655 2 529 1 331 Total Premiums 731 1 257 1 181 1 010 941

Minority Int 577 415 513 1 187 720 Total Income 2 516 4 571 4 204 3 843 3 502

Attrib Inc 1 395 1 926 1 914 2 162 1 483 Total Outgo 2 027 3 626 3 296 3 038 2 781

205