Page 126 - SHB 2020 Issue 1

P. 126

JSE – CON Profile’s Stock Exchange Handbook: 2020 – Issue 1

Debt:Equity 0.18 0.03 0.03 0.05 0.07 also an active investment manager with a long-term valuation-driven

Solvency Mgn% 192.29 358.43 247.59 149.62 171.08 investment approach.

Payouts:Prem 0.41 0.63 0.60 0.50 0.50 SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

NUMBER OF EMPLOYEES: 335

DIRECTORS: Boyce L (ind ne), February J (ind ne), McKenzie J D (ind ne),

Consolidated Infrastructure Group Ltd. Nelson Dr H (ind ne), Nhlumayo M (ind ne), Watson Prof A (ld ind ne),

CON Pather S (Chair, ind ne), Pillay A (CEO), Musekiwa M (CFO)

ISIN: ZAE000153888 SHORT: CIL CODE: CIL MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2018

REG NO: 2007/004935/06 FOUNDED: 2007 LISTED: 2007 Government Employees Pension Fund 11.36%

NATURE OF BUSINESS: Consolidated Infrastructure Group Ltd. (”CIG”) Imvula Trust 8.14%

is an infrastructure-focused company listed on the JSE Main Board in the Louis Stassen 5.20%

‘Electrical Equipment’ sector. In the year under review the group operated POSTAL ADDRESS: PO Box 44684, Claremont, Cape Town, 7735

through four reportable divisions: Power, which supplies high voltage MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CML

infrastructure and metering to the energy sector; Building Materials,

which supplies heavy building materials to the construction industry; Oil COMPANY SECRETARY: Nazrana Hawa

& Gas, which provides waste management services for the industrial and TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

natural resources exploration sectors; and Rail, which provides SPONSOR: PSG Capital (Pty) Ltd.

maintenance solutions and railway electrification. AUDITORS: Ernst & Young

SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 820 CML Ords 0.01c ea 750 000 000 349 799 102

DIRECTORS: Beck J (ind ne), Bucknor K (ind ne), Hogarth R J (ld ind ne),

Hudson T (ne), Kariuki Dr K (ind ne), Mazar A (ne), McLean Q (ne), DISTRIBUTIONS [ZARc]

Melnick S A (ne, UK), Nwokedi J (ind ne), Wilkerson M (Chair, ne), Ords 0.01c ea Ldt Pay Amt

Gamsu R D (CEO), Teixeira C (CFO) Final No 32 3 Dec 19 9 Dec 19 176.00

MAJOR ORDINARY SHAREHOLDERS as at 02 Jan 2019 Interim No 31 4 Jun 19 10 Jun 19 165.00

Fairfax Africa Investments (Pty) Ltd. 49.66% LIQUIDITY: Jan20 Ave 5m shares p.w., R251.7m(78.6% p.a.)

Pinecourt International Ltd. 14.20%

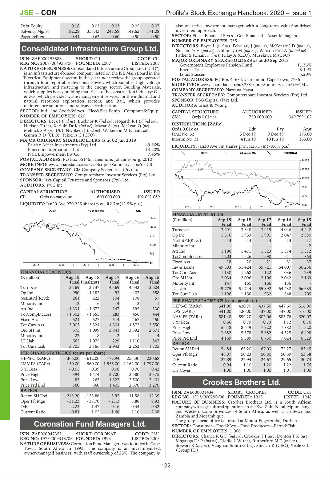

Nala Empowerment Inv Co. 7.45% GENF 40 Week MA CORONAT

POSTAL ADDRESS: PO Box 651455, Benmore, Johannesburg, 2010 14123

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CIL

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. 12086

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

10050

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

AUDITORS: PwC Inc.

8013

CAPITAL STRUCTURE AUTHORISED ISSUED

CIL Ords no par value 600 000 000 402 091 069 5977

LIQUIDITY: Jan20 Ave 970 225 shares p.w., R2.7m(12.5% p.a.) 3940

2015 | 2016 | 2017 | 2018 | 2019

ALSH 40 Week MA CIL

FINANCIAL STATISTICS

3594

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final Final Final Final

2893

Turnover 3 291 3 848 3 919 4 046 4 442

2191 Op Inc 1 516 1 933 1 991 2 047 2 380

NetIntPd(Rcvd) - 13 - 14 - 14 - 13 - 17

1490 Minority Int - - - - - 2

Att Inc 1 196 1 471 1 523 1 574 1 812

789

TotCompIncLoss 1 203 1 526 1 590 1 611 1 863

88 Fixed Ass 18 20 21 31 37

2015 | 2016 | 2017 | 2018 | 2019

Inv & Loans 49 603 51 424 55 721 64 007 66 256

FINANCIAL STATISTICS Tot Curr Ass 1 130 1 268 1 122 1 036 1 239

(R million) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15 Ord SH Int 2 034 2 096 2 106 2 042 2 169

Final Final(rst) Final Final Final Minority Int 147 160 166 136 -

Turnover 3 169 3 137 4 369 4 532 3 604 LT Liab 49 775 51 744 55 892 64 432 66 683

Op Inc - 990 - 1 183 - 93 402 358 Tot Curr Liab 1 196 1 156 932 848 705

NetIntPd(Rcvd) 261 222 104 108 57 PER SHARE STATISTICS (cents per share)

Minority Int - 12 - 6 - 4 - 2 1

HEPS-C (ZARc) 341.90 420.70 437.50 447.60 516.00

Att Inc - 1 331 - 1 672 - 147 395 330 DPS (ZARc) 341.00 420.00 437.00 447.00 516.00

TotCompIncLoss - 1 302 - 1 655 283 456 444 NAV PS (ZARc) 581.48 599.20 602.06 583.76 620.07

Fixed Ass 521 527 514 467 450 3 Yr Beta 0.56 0.79 0.73 1.12 0.76

Tot Curr Ass 3 003 3 324 4 304 4 872 3 550 Price High 5 648 8 649 7 922 7 882 11 520

Ord SH Int 575 1 099 3 841 3 392 2 671

Minority Int - 22 - 8 - 2 1 4 Price Low 3 882 5 378 5 882 4 525 6 498

4 169

Price Prd End

5 389

7 024

6 529

6 730

LT Liab 565 1 075 229 1 110 847 RATIOS

Tot Curr Liab 3 705 3 166 2 943 2 253 1 705

Ret on SH Fnd 54.84 65.20 67.03 72.27 83.45

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 46.07 50.23 50.80 50.59 53.58

HEPS-C (ZARc) - 366.00 - 612.00 - 77.94 255.30 220.68 D:E 22.89 22.94 24.67 29.65 30.74

NAV PS (ZARc) 150.00 560.00 1 956.00 2 162.00 1 797.00 Current Ratio 0.94 1.10 1.20 1.22 1.76

3 Yr Beta - 0.05 0.39 0.08 0.76 0.42 Div Cover 1.00 1.00 1.00 1.01 1.00

Price High 394 1 474 2 700 3 580 3 375

Price Low 85 265 1 322 2 500 2 401 Crookes Brothers Ltd.

Price Prd End 160 360 1 405 2 570 3 270

CRO

RATIOS ISIN: ZAE000001434 SHORT: CROOKES CODE: CKS

Ret on SH Fnd - 243.20 - 153.86 - 3.92 11.58 12.39 REG NO: 1913/000290/06 FOUNDED: 1913 LISTED: 1948

Oper Pft Mgn - 31.23 - 37.70 - 2.13 8.88 9.93 NATURE OF BUSINESS: Crookes Brothers Ltd. is a South African

D:E 2.23 1.47 0.16 0.34 0.32 company with agricultural operations in the KwaZulu-Natal, Mpumalanga

Current Ratio 0.81 1.05 1.46 2.16 2.08 and Western Cape provinces of South Africa, as well as in Swaziland,

Zambia and Mozambique.

The group’s head office is located at Mount Edgecombe, Durban.

Coronation Fund Managers Ltd. SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

COR NUMBER OF EMPLOYEES: 1 066

ISIN: ZAE000047353 SHORT: CORONAT CODE: CML DIRECTORS: Chance R G F (ind ne), Crookes T J (ne), Denton T K (ne),

REG NO: 1973/009318/06 FOUNDED: 1993 LISTED: 2003 Mnganga Dr P (ind ne), Riddle L W (ne), Rutherford M T (ind ne),

NATURE OF BUSINESS: Coronation Fund Managers was founded in Cape Stewart R (ind ne), Vaughan-Smith G (ne), Sinclair K (CEO), Veale G L

Town, South Africa in 1993. The company is an investment-led, (Group FD)

owner-managed business, with staff ownership of 25%. The company is

122