Page 124 - SHB 2020 Issue 1

P. 124

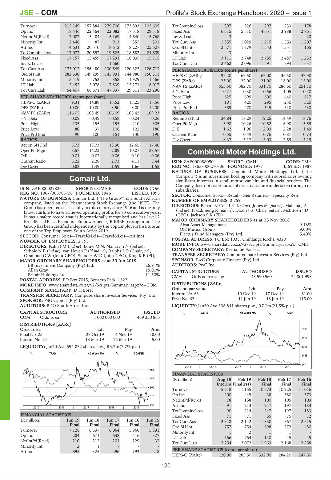

JSE – COM Profile’s Stock Exchange Handbook: 2020 – Issue 1

Turnover 215 149 157 884 279 700 173 893 102 605 TotCompIncLoss 897 326 297 233 178

Op Inc 18 446 22 464 22 082 17 518 29 318 Fixed Ass 6 315 5 510 4 631 3 988 2 761

NetIntPd(Rcvd) - 7 007 - 5 484 - 5 169 - 4 640 - 5 768 Inv & Loans 3 - - - 28

Minority Int 2 446 87 913 355 801 Tot Curr Ass 1 355 1 029 1 215 1 553 1 207

Att Inc 14 631 20 510 18 612 18 227 25 607 Ord SH Int 2 571 1 779 1 543 1 331 1 165

TotCompIncLoss 17 077 20 597 19 525 18 582 24 609 Minority Int 3 - - - 1 -

Fixed Ass 17 157 15 459 17 291 18 035 15 715 LT Liab 3 111 2 748 2 785 2 487 1 232

Inv & Loans - - 1 660 - - Tot Curr Liab 2 462 2 096 1 591 1 794 1 637

Tot Curr Ass 175 012 156 480 130 549 120 322 126 713 PER SHARE STATISTICS (cents per share)

Ord SH Int 282 530 149 299 145 991 144 980 150 311 HEPS-C (ZARc) 197.20 69.50 67.00 36.50 47.90

Minority Int 15 419 753 858 1 929 1 466 DPS (ZARc) 23.00 22.00 21.00 16.00 15.00

LT Liab 2 452 3 078 7 839 12 271 8 017 NAV PS (ZARc) 553.50 382.70 331.70 286.60 251.10

Tot Curr Liab 54 407 68 671 47 837 29 311 23 290 3 Yr Beta - 0.21 0.30 0.56 1.05 0.10

PER SHARE STATISTICS (cents per share) Price High 625 699 600 440 617

HEPS-C (ZARc) 9.31 14.88 13.52 13.25 18.56 Price Low 101 420 295 230 320

DPS (ZARc) 10.00 10.00 8.50 8.00 12.00 Price Prd End 389 470 515 310 430

NAV PS (ZARc) 116.05 108.49 106.09 105.42 109.23 RATIOS

3 Yr Beta 0.09 - 0.49 - 0.58 - 0.04 0.06 Ret on SH Fnd 34.84 18.29 19.25 14.49 18.76

Price High 135 155 155 210 305 Oper Pft Mgn 3.98 10.26 10.52 6.98 5.55

Price Low 80 37 106 122 180 D:E 1.62 1.96 2.03 2.28 1.49

Price Prd End 90 100 151 130 190 Current Ratio 0.55 0.49 0.76 0.87 0.74

RATIOS Div Cover 8.37 3.17 3.03 2.59 3.19

Ret on SH Fnd 5.73 13.73 13.30 12.65 17.40

Oper Pft Mgn 8.57 14.23 7.89 10.07 28.57 Combined Motor Holdings Ltd.

D:E 0.01 0.02 0.06 0.10 0.06

COM

Current Ratio 3.22 2.28 2.73 4.11 5.44 ISIN: ZAE000088050 SHORT: CMH CODE: CMH

Div Cover 0.82 1.49 1.59 1.66 1.55 REG NO: 1965/000270/06 FOUNDED: 1977 LISTED: 1987

NATURE OF BUSINESS: Combined Motor Holdings Ltd. (“the

Comair Ltd. Company”) is an investment holding company with subsidiaries owning

significant interests in retail motor, car hire and financial services. The

COM Company does not trade and all of its activities are undertaken through its

ISIN: ZAE000029823 SHORT: COMAIR CODE: COM subsidiaries.

REG NO: 1967/006783/06 FOUNDED: 1946 LISTED: 1998 SECTOR: Consumer Srvcs—Retail—Gen Retailers—Specialty Rets

NATURE OF BUSINESS: Comair Ltd. (“The Group”) is a South African NUMBER OF EMPLOYEES: 2 759

company, listed on the Johannesburg Stock Exchange (the “JSE”). The

Group has operated successfully in this country since 1946 and is the only DIRECTORS: Barritt B, Cele L C (ind ne), Jones M (ind ne), Mabena J A

known airline to have achieved operating profits for 73 consecutive years. (ind ne), Nkadimeng R (ind ne), Dixon J S (Chair, ind ne), McIntosh J D

It has a safety record that is internationally recognised and has level 2 (CEO), Jackson S K (FD)

BroadBased Black Economic Empowerment (“B-BBEE”) recognition. The MAJOR ORDINARY SHAREHOLDERS as at 15 Nov 2018

Group has been certified independently by the Top Employers Institute as Absa Asset Management 9.18%

one of the Top Employers South Africa 2019. Old Mutual Group 9.00%

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Airlines Electus Fund Managers (Pty) Ltd. 5.40%

NUMBER OF EMPLOYEES: 2 193 POSTAL ADDRESS: PO Box 1033, Umhlanga Rocks, 4320

DIRECTORS: Kahn J M (ind ne), Louw M N, Maharajh N (ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CMH

Sithole N B (ind ne), van Hoven P (ld ind ne), Ralphs L P (Chair, ne), COMPANY SECRETARY: Kerrianne Fonseca

Orsmond G W (Joint CEO), Stander W D (Joint CEO), King K E (FD) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 SPONSOR: PwC Corporate Finance (Pty) Ltd.

BB Investment Company (Pty) Ltd. 26.91% AUDITORS: PwC Inc.

Allan Gray 15.01% CAPITAL STRUCTURE AUTHORISED ISSUED

Britair Holdings Ltd. 11.50% CMH Ords no par value 143 590 560 74 801 998

POSTAL ADDRESS: PO Box 7015, Bonaero Park, 1622

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=COM DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: D H Borer Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 63 10 Dec 19 17 Dec 19 61.00

SPONSOR: PSG Capital (Pty) Ltd. Final No 62 11 Jun 19 18 Jun 19 115.00

AUDITORS: BDO South Africa Inc. LIQUIDITY: Jan20 Ave 308 841 shares p.w., R7.1m(21.5% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED GERE 40 Week MA CMH

COM Ords 1c ea 1 000 000 000 469 330 865

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt 2989

Final No 25 29 Oct 19 4 Nov 19 18.00

Interim No 24 18 Mar 19 25 Mar 19 5.00 2479

LIQUIDITY: Jan20 Ave 694 832 shares p.w., R3.2m(7.7% p.a.) 1968

TRAV 40 Week MA COMAIR

1458

947

2015 | 2016 | 2017 | 2018 | 2019

568

FINANCIAL STATISTICS

484 (R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final(rst) Final Final Final

399

Turnover 5 718 11 155 10 573 10 225 11 016

Op Inc 200 449 438 380 373

315

NetIntPd(Rcvd) 78 158 100 105 103

230 Att Inc 91 213 247 197 183

2015 | 2016 | 2017 | 2018 | 2019

TotCompIncLoss 90 214 247 197 183

FINANCIAL STATISTICS Fixed Ass 71 71 65 75 72

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Tot Curr Ass 2 318 2 142 1 850 1 867 2 615

Final Final Final Final Final Ord SH Int 757 754 698 572 480

Turnover 7 126 6 537 6 064 5 960 5 891 Minority Int 1 2 1 1 -

Op Inc 284 671 638 416 327 LT Liab 566 764 110 45 45

NetIntPd(Rcvd) 210 212 201 129 33 Tot Curr Liab 2 254 2 072 1 963 2 168 2 258

Minority Int 2 1 - - -

Att Inc 895 325 296 193 218 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 120.90 285.50 332.90 284.20 247.50

120