Page 130 - SHB 2020 Issue 1

P. 130

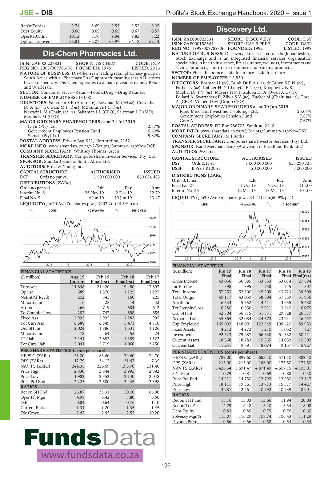

JSE – DIS Profile’s Stock Exchange Handbook: 2020 – Issue 1

RetOnTotAss 9.74 8.69 9.53 9.52 8.05

Debt:Equity 0.66 0.65 0.65 0.67 0.57 Discovery Ltd.

OperRetOnInv 10.12 8.76 9.94 9.82 8.22 DIS

OpInc:Turnover 66.81 66.07 63.97 64.18 62.14 ISIN: ZAE000022331 SHORT: DIS COV ERY CODE: DSY

ISIN: ZAE000158564 SHORT: DSY B PREF CODE: DSBP

REG NO: 1999/007789/06 FOUNDED: 1992 LISTED: 1999

Dis-Chem Pharmacies Ltd. NATURE OF BUSINESS: Discovery Ltd. is listed on the Johannesburg

Stock Exchange and is an integrated financial services organisation

DIS

ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP specialising in health insurance, life assurance, wellness, investments and

REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016 savings products, short-term insurance and banking products.

NATURE OF BUSINESS: Dis-Chem is a leading retail pharmacy group in SECTOR: Fins—Insurance—Life Insurance—Life Insurance

South Africa with a “Pharmacy First” approach meaning that ALL stores NUMBER OF EMPLOYEES: 12 950

have a dispensary. Dis-Chem operates two main divisions namely Retail DIRECTORS: Bosman H (ne), Brink Dr B A (ne), de Bruyn S E N (ne),

and Wholesale. Farber R (ne), Kallner H D, Khanyile F N (ne), Koopowitz N S,

SECTOR: Consumer Srvcs—Retail—Food&Drug—Drug Retailers Maphai Dr T V (ne), Mayers H P, Ntsaluba Dr A, Owen A L (ne),

NUMBER OF EMPLOYEES: 18 000 Pollard A, Swartzberg B, Zilwa S V (ne), Tucker M (Chair, ind ne), Gore

DIRECTORS: Saltzman S E (Alternate), Bowman M (ind ne), Coovadia A (CEO), Viljoen D M (Group CFO)

Dr A (ind ne), Gani M (ind ne), Mthimunye J (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Nestadt L M (Chair, ind ne), Saltzman I L (CEO), Saltzman L F (MD), Rand Merchant Investment Holdings Ltd. 25.04%

Morais R M (CFO) Government Employees Pension Fund 7.87%

MAJOR ORDINARY SHAREHOLDERS as at 24 Jul 2019 Gore A 7.67%

Ivlyn (Pty) Ltd. 52.67% POSTAL ADDRESS: PO Box 786722, Sandton, 2146

Government Employees Pension Fund 6.60% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=DSY

Stansh (Pty) Ltd. 5.82% COMPANY SECRETARY: M J Botha

POSTAL ADDRESS: Private Bag X21, Northriding, 2162 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=DCP SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: Whitney Thomas Green AUDITORS: PwC Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Standard Bank of South Africa Ltd. DSY Ords 0.1c ea 1 000 000 000 658 290 736

AUDITORS: Ernst & Young Inc. DSBP B Prefs R100 ea 20 000 000 8 000 000

CAPITAL STRUCTURE AUTHORISED ISSUED

DCP Ords no par val 1 500 000 000 860 084 483 DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 27 1 Oct 19 7 Oct 19 114.00

Ords no par val Ldt Pay Amt

Interim No 6 26 Nov 19 2 Dec 19 12.79 Interim No 26 12 Mar 19 18 Mar 19 101.00

Final No 5 4 Jun 19 10 Jun 19 13.47 LIQUIDITY: Jan20 Ave 8m shares p.w., R1 111.1m(60.9% p.a.)

LIQUIDITY: Jan20 Ave 7m shares p.w., R202.2m(44.3% p.a.) LIFE 40 Week MA DISCOVERY

CONS 40 Week MA DIS-CHEM

19000

3800

17286

3438

15572

3076

13858

2714

12143

2352

10429

2015 | 2016 | 2017 | 2018 | 2019

1990

2017 | 2018 | 2019 FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Final Final Final Final Final(rst)

Interim Final(rst) Final(rst) Final(rst) Gross Income 43 036 36 685 33 533 33 074 27 694

Turnover 11 848 21 420 19 480 17 897 Inc Fm Inv 398 895 758 745 507

Op Inc 589 1 376 1 125 1 127 Total Income 57 253 52 800 45 209 43 723 39 309

NetIntPd(Rcvd) 202 345 160 225 Total Outgo 49 117 43 059 38 894 37 539 31 956

Minority Int 16 28 14 43 Attrib Inc 6 533 5 652 4 411 3 655 5 480

Att Inc 266 719 684 612 TotCompIncLoss 6 280 6 656 2 911 3 640 6 075

TotCompIncLoss 282 747 698 655 Ord SH Int 42 304 36 815 31 511 29 828 26 577

Fixed Ass 2 992 2 995 1 182 995 Actuarial Liab 35 865 32 084 24 373 23 211 16 457

Tot Curr Ass 6 588 6 849 5 471 4 710 Cap Employed 169 002 148 091 122 849 109 420 89 953

Ord SH Int 2 024 1 886 1 631 1 106 Fixed Assets 4 212 4 272 1 210 1 052 727

Minority Int 78 64 55 24 Investments 92 523 79 287 66 638 61 332 50 411

LT Liab 3 141 2 852 1 389 1 522 Current Assets 18 868 18 783 15 865 14 032 10 502

Tot Curr Liab 5 041 5 719 4 060 3 250 Current Liab 11 231 9 891 8 074 9 157 5 927

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 31.00 83.60 79.60 74.70 HEPS-C (ZARc) 789.00 899.60 683.10 571.10 882.40

DPS (ZARc) 12.79 34.17 31.47 7.35 DPS (ZARc) 215.00 215.00 186.00 175.50 174.50

NAV PS (ZARc) 244.35 226.69 196.00 131.40 NAV PS (ZARc) 6 426.34 5 691.47 4 871.49 4 607.15 4 105.01

Price High 2 830 3 844 3 995 2 592 3 Yr Beta 0.79 0.81 0.69 0.88 0.30

Price Low 1 982 2 353 2 140 2 048 Price Prd End 14 911 14 750 12 792 12 250 12 647

Price Prd End 2 225 2 580 3 445 2 398 Price High 18 111 19 361 13 773 15 577 14 427

RATIOS Price Low 13 287 12 561 10 792 10 789 8 901

Ret on SH Fnd 26.87 38.31 50.00 66.90

Oper Pft Mgn 4.98 6.42 5.80 6.50 RATIOS

D:E 0.84 0.64 0.76 1.10 Ret on SH Fund 15.16 15.03 13.66 11.94 20.03

Current Ratio 1.31 1.20 1.35 1.45 Ret on Tot Ass 4.79 6.48 5.10 5.54 8.08

Div Cover 2.42 2.45 2.53 10.20 Debt:Equity 0.83 0.85 0.75 0.76 0.60

Solvency Mgn% 115.07 116.29 108.74 106.43 111.29

Payouts:Prem 0.56 0.56 0.58 0.54 0.54

126