Page 123 - SHB 2020 Issue 1

P. 123

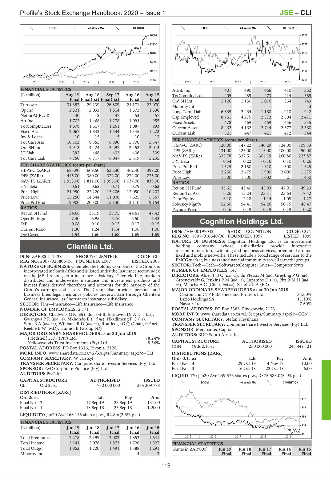

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – CLI

FOOR 40 Week MA CLICKS LIFE 40 Week MA CLIENTELE

26009 2257

22236 2057

18463 1856

14690 1656

10916 1455

7143 1255

2015 | 2016 | 2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS Attrib Inc 401 490 466 410 362

(R million) Aug 19 Aug 18 Sep 17 Aug 16 Aug 15 TotCompIncLoss 405 489 473 414 369

Final Final(rst) Final(rst) Final Final Ord SH Int 1 126 1 130 1 016 864 743

Turnover 31 352 29 239 26 809 24 171 22 070

Minority Int - - - 1 - 3

Op Inc 2 321 2 032 1 814 1 572 1 396 Long-Term Liab 6 865 2 464 1 160 910 942

NetIntPd(Rcvd) - 40 - 2 37 53 57 Cap Employed 8 731 4 275 2 872 2 504 2 411

Att Inc 1 703 1 468 1 278 1 094 955 Fixed Assets 478 469 469 456 335

TotCompIncLoss 1 678 1 517 1 261 1 087 993 Current Assets 8 462 4 162 2 744 2 377 2 360

Fixed Ass 2 067 1 843 1 534 1 345 1 222 Current Liab 521 447 421 412 344

Inv & Loans 10 15 5 10 13

Tot Curr Ass 10 103 8 355 6 890 5 870 5 547 PER SHARE STATISTICS (cents per share) 140.29 124.00 109.33

120.00

147.22

HEPS-C (ZARc)

Ord SH Int 4 913 4 424 3 297 2 452 2 013

LT Liab 392 448 402 406 309 DPS (ZARc) 131.00 125.00 115.00 100.00 90.00

Tot Curr Liab 7 750 6 717 6 047 5 519 5 235 NAV PS (ZARc) 335.78 337.51 304.19 260.86 223.87

3 Yr Beta 0.54 0.22 - 0.16 0.10 0.26

PER SHARE STATISTICS (cents per share) Price Prd End 1 525 2 150 1 610 1 500 1 625

HEPS-C (ZARc) 683.90 609.50 536.30 462.40 399.20 Price High 2 250 2 475 1 900 2 000 1 875

DPS (ZARc) 445.00 380.00 322.00 272.00 235.00 Price Low 1 300 1 500 1 002 21 1 450

NAV PS (ZARc) 1 953.00 1 811.00 1 395.00 1 037.00 839.00 RATIOS

3 Yr Beta 0.51 0.62 0.71 0.79 0.62 Ret on SH Fund 35.61 43.40 45.93 47.91 49.23

Price High 21 950 22 220 15 206 13 050 10 203 Ret on Tot Ass 6.26 15.24 23.41 23.64 17.42

Price Low 15 250 14 844 11 000 7 625 5 867 Debt:Equity 6.10 2.18 1.14 1.05 1.27

Price Prd End 19 900 20 300 15 130 12 110 9 154 Solvency Mgn% 52.60 54.41 54.26 50.15 48.47

RATIOS Payouts:Prem 0.16 0.19 0.19 0.19 0.20

Ret on SH Fnd 34.66 33.19 38.75 44.61 47.43

Oper Pft Mgn 7.40 6.95 6.76 6.50 6.33

D:E 0.08 0.10 0.12 0.17 0.15 Cognition Holdings Ltd.

Current Ratio 1.30 1.24 1.14 1.06 1.06 ISIN: ZAE000197042 SHORT: COG NI TION CODE: CGN

COG

Div Cover 1.54 1.60 1.68 1.69 1.69 REG NO: 1997/010640/06 FOUNDED: 1997 LISTED: 1999

NATURE OF BUSINESS: Cognition Holdings Ltd. is an investment

Clientèle Ltd. holding company whose subsidiaries provide interactive

telecommunication, switching and business services, orientated around

CLI

ISIN: ZAE000117438 SHORT: CLI EN TELE CODE: CLI fixed and mobile networks. These include a broad range of services to the

REG NO: 2007/023806/06 FOUNDED: 2007 LISTED: 2008 FMCG market, business and financial community as well as media groups.

NATURE OF BUSINESS: Clientèle, the holding Company of the Group, is SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

incorporated in South Africa and is listed under the Insurance sector index NUMBER OF EMPLOYEES: 147

on the JSE. Its Long-term insurance subsidiary, Clientèle Life, markets, DIRECTORS: Ahier T B C (ind ne), du Plessis M (ne), Greyling P G (ne),

distributes and underwrites insurance and investment products and Groenewaldt G, Jenkins P M (ind ne), Lupambo D (ne), Pitt R M H (ind

invests funds derived therefrom and accounts for the majority of the ne), Mancha A G (Chair, ind ne), Scholtz P A (FD)

Group’s earnings and assets. The Group also provides personal and MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

business lines legal insurance policies underwritten through Clientèle Caxton and CTP Publishers and Printers Ltd. 34.60%

General Insurance, its Short-term insurance subsidiary. Lazio Holdings SA 11.10%

SECTOR: Fins—Insurance—Life Insurance—Life Insurance Navsur Ltd. 7.60%

NUMBER OF EMPLOYEES: 2 171 POSTAL ADDRESS: PO Box 3386, Pinegowrie, 2123

DIRECTORS: Chadwick G K (alt), du Toit B, Enthoven Dr A D T (ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CGN

Gwangwa P R (ind ne), Mkhondo B (ind ne), Nkadimeng P G (ne), COMPANY SECRETARY: Stefan Kleynhans

Stott B A (ind ne), Williams R D (ind ne), Routledge G Q (Chair, ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Reekie B W (MD), Hume I B (Group FD) SPONSOR: Merchantec Capital

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 AUDITORS: BDO South Africa Inc.

Friedshelf 1577 (Pty) Ltd. 78.24%

Yellowwoods Trust Investments (Pty) Ltd. 8.56% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 1316, Rivonia, 2128 CGN Ords 0.1c ea 250 000 000 243 449 131

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CLI DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: W van Zyl Ords 0.1c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 14 29 Oct 19 4 Nov 19 10.00

SPONSOR: PwC Corporate Finance (Pty) Ltd. Final No 13 16 Oct 18 22 Oct 18 6.00

AUDITORS: PwC Inc.

LIQUIDITY: Jan20 Ave 239 576 shares p.w., R375 588.0(5.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

CLI Ord 2c ea 750 000 000 335 309 778 SCOM 40 Week MA COGNITION

DISTRIBUTIONS [ZARc]

Ord 2c ea Ldt Pay Amt 317

Final No 12 17 Sep 19 23 Sep 19 131.00

Final No 11 18 Sep 18 25 Sep 18 125.00 249

LIQUIDITY: Jan20 Ave 168 145 shares p.w., R2.8m(2.6% p.a.)

182

FINANCIAL STATISTICS

114

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final Final Final

47

Total Premiums 2 278 2 199 2 003 1 853 1 641 2015 | 2016 | 2017 | 2018 | 2019

Total Income 2 141 2 076 1 873 1 726 1 527 FINANCIAL STATISTICS

Total Outgo 1 852 1 720 1 491 1 388 1 291 (Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Minority Int - - - 4 3 Final Final Final Final Final

119