Page 131 - SHB 2020 Issue 1

P. 131

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – DIS

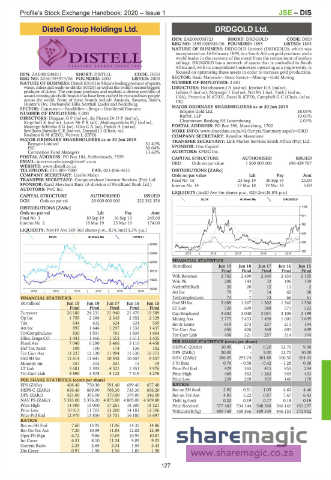

Distell Group Holdings Ltd. DRDGOLD Ltd.

DIS DRD

ISIN: ZAE000058723 SHORT: DRDGOLD CODE: DRD

REG NO: 1895/000926/06 FOUNDED: 1895 LISTED: 1895

NATURE OF BUSINESS: DRDGOLD Limited (DRDGOLD), which was

incorporated on 16 February 1895, is a South African gold producer and a

world leader in the recovery of the metal from the retreatment of surface

tailings. DRDGOLD has a network of assets that is unrivalled in South

Africa and, with its consolidated businesses operating as a single entity, is

focused on optimising these assets in order to increase gold production.

ISIN: ZAE000248811 SHORT: DISTELL CODE: DGH

REG NO: 2016/394974/06 FOUNDED: 2000 LISTED: 2000 SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

NATURE OF BUSINESS: Distell (DGH) is Africa’s leading producer of spirits, NUMBER OF EMPLOYEES: 2 601

wines, ciders and ready-to-drinks (RTDs) as well as the world’s second biggest DIRECTORS: Holtzhausen J A (ind ne), Jeneker E A (ind ne),

producer of ciders. The company produces and markets a diverse portfolio of Lebina P (ind ne), Mnyango T (ind ne), Nel Mr J (ne), Turk J (ind ne,

award-winning alcoholic brands that have been crafted by extraordinary people USA), Pretorius N (CEO), Davel R (CFO), Campbell G C (Chair, ind ne,

across the world. Some of these brands include Amarula, Savanna, Bain’s, UK)

Hunter’s Dry, Durbanville Hills, Scottish Leader and Nederburg.

SECTOR: Consumer—Food&Bev—Bevgs—Distillers&Vintners MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 38.05%

Sibanye Gold Ltd.

NUMBER OF EMPLOYEES: 5 000

DIRECTORS: Dingaan G P (ind ne), du Plessis Dr D P (ind ne), Ruffer, LLP 10.03%

Kruythoff K (ind ne), Louw Mr P R (alt), Madungandaba M J (ind ne), Clearstream Banking SA Luxembourg 2.03%

Matenge-Sebesho E G (ne), Otto C A (ne), Parker A (ind ne), POSTAL ADDRESS: PO Box 390, Maraisburg, 1700

Sevillano-Barredo C E (ind ne), Durand J J (Chair, ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=DRD

Rushton R M (CEO), Verwey L (CFO) COMPANY SECRETARY: Reneiloe Masemene

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Remgro Limited 31.41%

PIC 30.04% SPONSOR: One Capital

Coronation Fund Managers 13.60% AUDITORS: KPMG Inc.

POSTAL ADDRESS: PO Box 184, Stellenbosch, 7599 CAPITAL STRUCTURE AUTHORISED ISSUED

EMAIL: investor.relations@distell.co.za DRD Ords no par value 1 500 000 000 696 429 767

WEBSITE: www.distell.co.za

TELE PHONE: 021-809-7000 FAX: 021-886-4611 DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Lizelle Malan Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 15 23 Sep 19 30 Sep 19 20.00

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Interim No 14 13 Mar 18 19 Mar 18 5.00

AUDITORS: PwC Inc.

LIQUIDITY: Jan20 Ave 5m shares p.w., R29.2m(38.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

DGH Ords no par val 20 000 000 000 222 382 356 GLDX 40 Week MA DRDGOLD

DISTRIBUTIONS [ZARc] 1182

Ords no par val Ldt Pay Amt

971

Final No 3 10 Sep 19 16 Sep 19 249.00

Interim No 2 18 Mar 19 25 Mar 19 174.00

760

LIQUIDITY: Nov19 Ave 569 360 shares p.w., R74.3m(13.3% p.a.)

549

BEVR 40 Week MA DISTELL

339

29789

128

25899 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

22009

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

18119 Final Final Final Final Final

Wrk Revenue 2 762 2 490 2 340 2 433 2 105

14230

Wrk Pft 208 143 32 196 159

NetIntPd(Rcd) 20 20 12 11 - 2

10340

2014 | 2015 | 2016 | 2017 | 2018 | 2019 Att Inc 79 7 14 62 68

FINANCIAL STATISTICS TotCompIncLoss 73 7 13 66 61

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Ord SH Int 2 689 1 267 1 302 1 340 1 530

Final Final Final Final Final LT Liab 720 609 588 571 522

Turnover 26 180 24 231 21 940 21 470 19 589 Cap Employed 3 602 2 040 2 031 2 106 2 199

Op Inc 1 759 2 388 2 345 2 352 2 129 Mining Ass 2 775 1 453 1 498 1 601 1 699

Tax 644 632 624 624 569 Inv & Loans 619 273 237 211 194

Att Inc 897 1 646 1 297 1 532 1 437 Tot Curr Ass 656 626 548 601 609

TotCompIncLoss 830 1 931 761 1 839 1 664 Tot Curr Liab 458 321 257 314 304

Hline Erngs-CO 1 441 1 466 1 553 1 611 1 435

Fixed Ass 7 040 6 290 5 466 5 116 4 458 PER SHARE STATISTICS (cents per share)

Def Tax Asset 108 100 174 136 102 HEPS-C (ZARc) 10.90 1.70 0.20 12.70 9.90

Tot Curr Ass 13 227 12 120 11 994 11 630 10 373 DPS (ZARc) 20.00 - 5.00 12.70 10.00

Ord SH Int 11 614 11 641 10 542 10 657 9 537 NAV (ZARc) 386.05 293.74 301.88 310.50 354.43

Minority Int 357 315 301 15 19 3 Yr Beta 0.76 - 0.58 - 0.42 - 1.28 0.68

LT Liab 5 681 5 593 4 521 1 951 3 976 Price Prd End 429 365 415 853 234

Tot Curr Liab 5 890 4 578 5 122 7 319 4 276 Price High 465 552 1 262 949 403

PER SHARE STATISTICS (cents per share) Price Low 239 269 370 149 179

EPS (ZARc) 408.40 750.30 591.40 699.40 657.40 RATIOS

HEPS-C (ZARc) 656.40 669.90 708.30 735.30 656.20 Ret on SH fund 2.92 0.51 1.05 4.62 4.46

DPS (ZARc) 423.00 395.00 379.00 379.00 346.00 Ret on Tot Ass 4.83 5.22 0.87 7.67 6.43

NAV PS (ZARc) 5 383.00 5 376.20 4 875.90 4 805.00 4 309.80 Yield (g/ton) 0.20 0.19 0.17 0.18 0.19

Price High 14 900 15 000 17 261 18 300 18 521 Price Received 577 483 534 344 548 268 546 142 451 297

Price Low 10 013 11 703 13 200 14 181 12 306 WrkCost(R/kg) 499 749 458 866 489 549 446 153 372 932

Price Prd End 12 970 13 850 13 701 16 180 16 697

RATIOS

Ret on SH Fnd 7.60 13.95 11.96 14.35 14.86

Ret On Tot Ass 7.20 10.59 11.83 12.02 12.49

Oper Pft Mgn 6.72 9.86 10.69 10.95 10.87

Int Cover 6.51 8.10 11.24 9.05 9.03

Current Ratio 2.25 2.65 2.34 1.59 2.43

Div Cover 0.97 1.90 1.56 1.85 1.90

127