Page 75 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 75

Costs and Pricing

which the CIS manager must fully inform any prospective investor about the nature of the

investment and the associated risks.

Section 100 (4) of CISCA states that “there must be included in every price list, advertisement,

brochure or similar document published by a manager or by any of its authorised agents in which

participatory interests are commended to the public, a statement in clear and unambiguous terms, to

the effect that the value of participatory interests in a portfolio is subject to fluctuation from time to

time relative to the market value of the assets comprised in the portfolio…”

Media Reports

In addition to the (at least) annual report from the portfolio manager, investors and advisors will

also find considerable information available in the media. Various internet services and LISPs make

available fact sheets (similar to the ones in this handbook), and prices and performance statistics are

available in many daily and weekly newspapers and financial magazines.

Tables of performance figures in the press usually follow the classification system used by the

industry (see Chapter 8).

The grouping of funds for comparative purposes is important because of the difficulties of

comparing the performance of different asset classes. Fixed-interest funds, for example, are subject

to very different factors than equity funds. Fixed-interest funds are therefore grouped together in

their own sectors, as are the various equity fund categories.

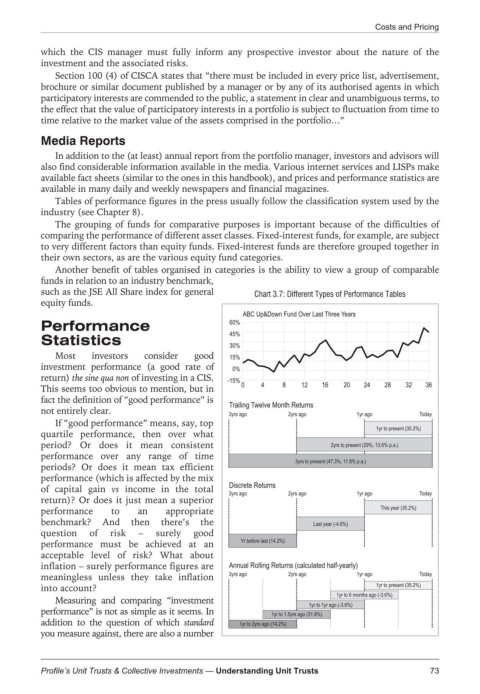

Another benefit of tables organised in categories is the ability to view a group of comparable

funds inrelationtoanindustrybenchmark,

such as the JSE All Share index for general Chart 3.7: Different Types of Performance Tables

equity funds.

ABC Up&Down Fund Over Last Three Years

Performance 60%

45%

Statistics

30%

Most investors consider good 15%

investment performance (a good rate of 0%

return) the sine qua non of investing in a CIS. -15%

This seems too obvious to mention, but in 0 4 8 12 16 20 24 28 32 36

fact the definition of “good performance” is

Trailing Twelve Month Returns

not entirely clear. 3yrs ago 2yrs ago 1yr ago Today

If “good performance” means, say, top

1yr to present (35.2%)

quartile performance, then over what

period? Or does it mean consistent 2yrs to present (29%, 13.6% p.a.)

performance over any range of time

3yrs to present (47.3%, 11.8% p.a.)

periods? Or does it mean tax efficient

performance (which is affected by the mix

Discrete Returns

of capital gain vs income in the total 3yrs ago 2yrs ago 1yr ago Today

return)? Or does it just mean a superior

performance to an appropriate This year (35.2%)

benchmark? And then there’s the Last year (-4.6%)

question of risk – surely good

performance must be achieved at an Yr before last (14.2%)

acceptable level of risk? What about

inflation – surely performance figures are Annual Rolling Returns (calculated half-yearly)

meaningless unless they take inflation 3yrs ago 2yrs ago 1yr ago Today

into account? 1yr to present (35.2%)

1yr to 6 months ago (-3.6%)

Measuring and comparing “investment

1yr to 1yr ago (-3.6%)

performance” is not as simple as it seems. In 1yr to 1.5yrs ago (31.9%)

addition to the question of which standard 1yr to 2yrs ago (14.2%)

you measure against, there are also a number

73

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts