Page 60 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 60

CHAPTER 3

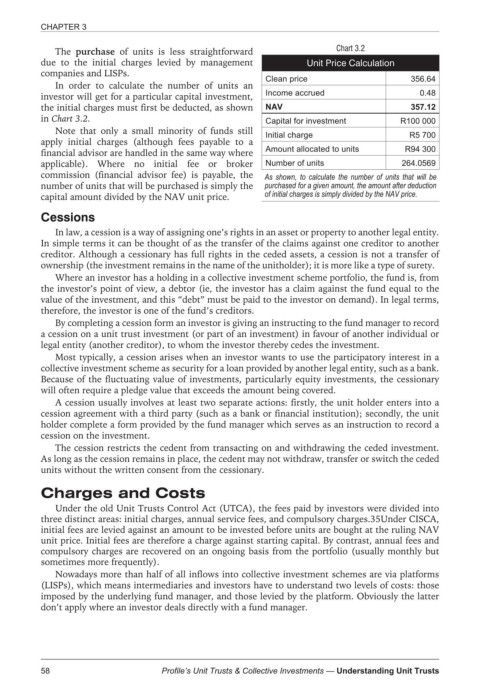

The purchase of units is less straightforward Chart 3.2

due to the initial charges levied by management Unit Price Calculation

companies and LISPs.

Clean price 356.64

In order to calculate the number of units an

investor will get for a particular capital investment, Income accrued 0.48

the initial charges must first be deducted, as shown NAV 357.12

in Chart 3.2. Capital for investment R100 000

Note that only a small minority of funds still Initial charge R5 700

apply initial charges (although fees payable to a

Amount allocated to units R94 300

financial advisor are handled in the same way where

applicable). Where no initial fee or broker Number of units 264.0569

commission (financial advisor fee) is payable, the As shown, to calculate the number of units that will be

number of units that will be purchased is simply the purchased for a given amount, the amount after deduction

capital amount divided by the NAV unit price. of initial charges is simply divided by the NAV price.

Cessions

In law, a cession is a way of assigning one’s rights in an asset or property to another legal entity.

In simple terms it can be thought of as the transfer of the claims against one creditor to another

creditor. Although a cessionary has full rights in the ceded assets, a cession is not a transfer of

ownership (the investment remains in the name of the unitholder); it is more like a type of surety.

Where an investor has a holding in a collective investment scheme portfolio, the fund is, from

the investor’s point of view, a debtor (ie, the investor has a claim against the fund equal to the

value of the investment, and this “debt” must be paid to the investor on demand). In legal terms,

therefore, the investor is one of the fund’s creditors.

By completing a cession form an investor is giving an instructing to the fund manager to record

a cession on a unit trust investment (or part of an investment) in favour of another individual or

legal entity (another creditor), to whom the investor thereby cedes the investment.

Most typically, a cession arises when an investor wants to use the participatory interest in a

collective investment scheme as security for a loan provided by another legal entity, such as a bank.

Because of the fluctuating value of investments, particularly equity investments, the cessionary

will often require a pledge value that exceeds the amount being covered.

A cession usually involves at least two separate actions: firstly, the unit holder enters into a

cession agreement with a third party (such as a bank or financial institution); secondly, the unit

holder complete a form provided by the fund manager which serves as an instruction to record a

cession on the investment.

The cession restricts the cedent from transacting on and withdrawing the ceded investment.

As long as the cession remains in place, the cedent may not withdraw, transfer or switch the ceded

units without the written consent from the cessionary.

Charges and Costs

Under the old Unit Trusts Control Act (UTCA), the fees paid by investors were divided into

three distinct areas: initial charges, annual service fees, and compulsory charges.35Under CISCA,

initial fees are levied against an amount to be invested before units are bought at the ruling NAV

unit price. Initial fees are therefore a charge against starting capital. By contrast, annual fees and

compulsory charges are recovered on an ongoing basis from the portfolio (usually monthly but

sometimes more frequently).

Nowadays more than half of all inflows into collective investment schemes are via platforms

(LISPs), which means intermediaries and investors have to understand two levels of costs: those

imposed by the underlying fund manager, and those levied by the platform. Obviously the latter

don’t apply where an investor deals directly with a fund manager.

58 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts