Page 246 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 246

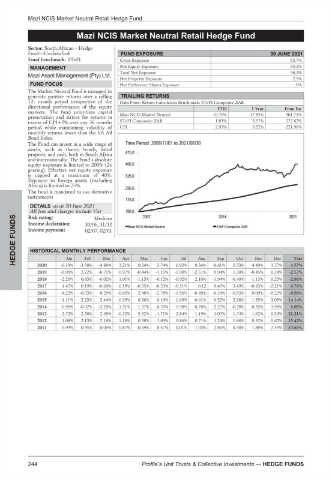

Mazi NCIS Market Neutral Retail Hedge Fund

Mazi NCIS Market Neutral Retail Hedge Fund

Mazi NCIS Market Neutral Retail Hedge Fund

Sector: South African—Hedge

Fund—Unclassified

FUND EXPOSURE 30 JUNE 2021

Fund benchmark: STeFI Gross Exposure 53.7%

Net Equity Exposure 33.2%

MANAGEMENT

Total Net Exposure 36.3%

Mazi Asset Management (Pty) Ltd.

Net Property Exposure 2.9%

Net Preference Shares Exposure 0%

FUND FOCUS

The Market Neutral Fund is managed to

generate positive returns over a rolling TRAILING RETURNS

12- month period irrespective of the Data Point: Return Calculation Benchmark: STeFI Composite ZAR

directional performance of the equity YTD 1 Year From Inc

markets. The fund prioritizes capital

preservation and strives for returns in Mazi NCIS Market Neutral 10.76% 17.85% 301.71%

excess of CPI+2% over any 36 months STeFI Composite ZAR 1.83% 3.57% 272.63%

period while maintaining volatility of CPI 2.93% 3.52% 221.96%

monthly returns lower than the SA All

Bond Index.

The Fund can invest in a wide range of

assets, such as shares, bonds, listed

property and cash, both in South Africa

and internationally. The Fund’s absolute

equity exposure is limited to 200% (2x

gearing). Effective net equity exposure

is capped at a maximum of 40%.

Exposure to foreign assets (excluding

Africa) is limited to 25%.

The fund is mandated to use derivative

instruments

DETAILS as at 30 June 2021

All fees and charges include Vat

FUNDS Income declaration: 30/06, 31/12

Risk rating:

Medium

Income payment:

02/07, 02/01

HEDGE HISTORICAL MONTHLY PERFORMANCE May Jun Jul Aug Sep Oct Nov Dec Year

Jan

Feb

Mar

Apr

2020

4.57%

4.49%

0.34%

0.24%

2.74%

0.92%

0.24%

0.94%

1.30%

2.22%

-0.99%

-0.71%

2019 -0.18% -3.50% -4.88% 3.21% -0.44% -1.15% -1.90% -2.51% -0.61% 0.33% -0.45% 1.77% -2.57%

0.97%

2018 -2.29% 0.83% -0.02% 1.01% -1.15% -0.12% -0.02% 2.10% -1.94% -0.40% -1.13% 0.23% -2.96%

2017 1.45% 0.19% -0.60% 0.19% -0.35% -0.53% -0.51% 0.12 0.45% 3.49% -0.83% -2.21% 0.76%

2016 -4.22% -0.93% 0.25% -0.65% 2.48% -2.78% -1.56% -0.49% -0.24% -0.93% 0.09% -0.22% -8.96%

2015 -1.11% 2.23% 2.44% 0.39% 0.36% 0.19% 1.69% -0.01% 0.52% 2.28% 1.35% 3.05% 14.14%

2014 0.90% -0.02% -3.20% 1.51% 1.37% 0.70% 1.90% 0.78% 2.22% -0.78% 0.55% 1.96% 8.05%

2013 2.72% 2.30% 2.45% -0.32% 5.32% -1.71% 2.84% 1.19% 1.07% 1.74% 1.62% 0.33% 21.21%

2012 1.08% 2.13% 2.18% 1.18% 0.38% 1.69% 0.86% 0.71% 1.24% 1.86% 0.52% 0.62% 15.42%

2011 0.99% 0.95% 0.05% 0.87% 0.69% 0.57% 0.01% 1.03% 2.86% 0.40% 1.88% 2.59% 13.64%

244 Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS